Despite record sales, Black Friday underscores Americans’ reliance on debt and credit

Despite record sales, Black Friday underscores Americans’ reliance on debt and credit Quick Take

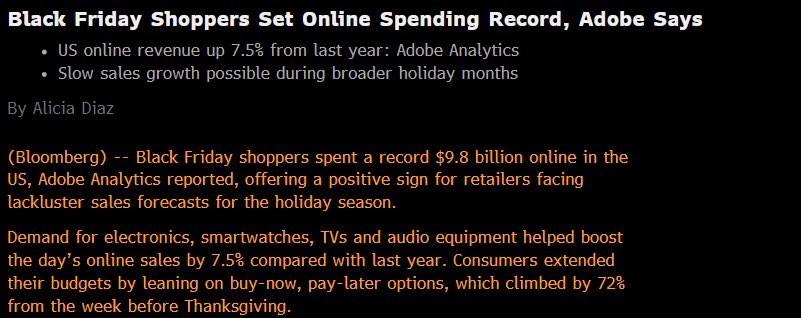

According to CNBC analyst Carl Quintanilla, a staggering $9.8 billion was spent on Black Friday, reflecting a 7.5% increment from the previous year, suggesting robust consumer behavior.

However, a source of concern lies in a parallel trend: many of these purchases appear to be financed through personal debt.

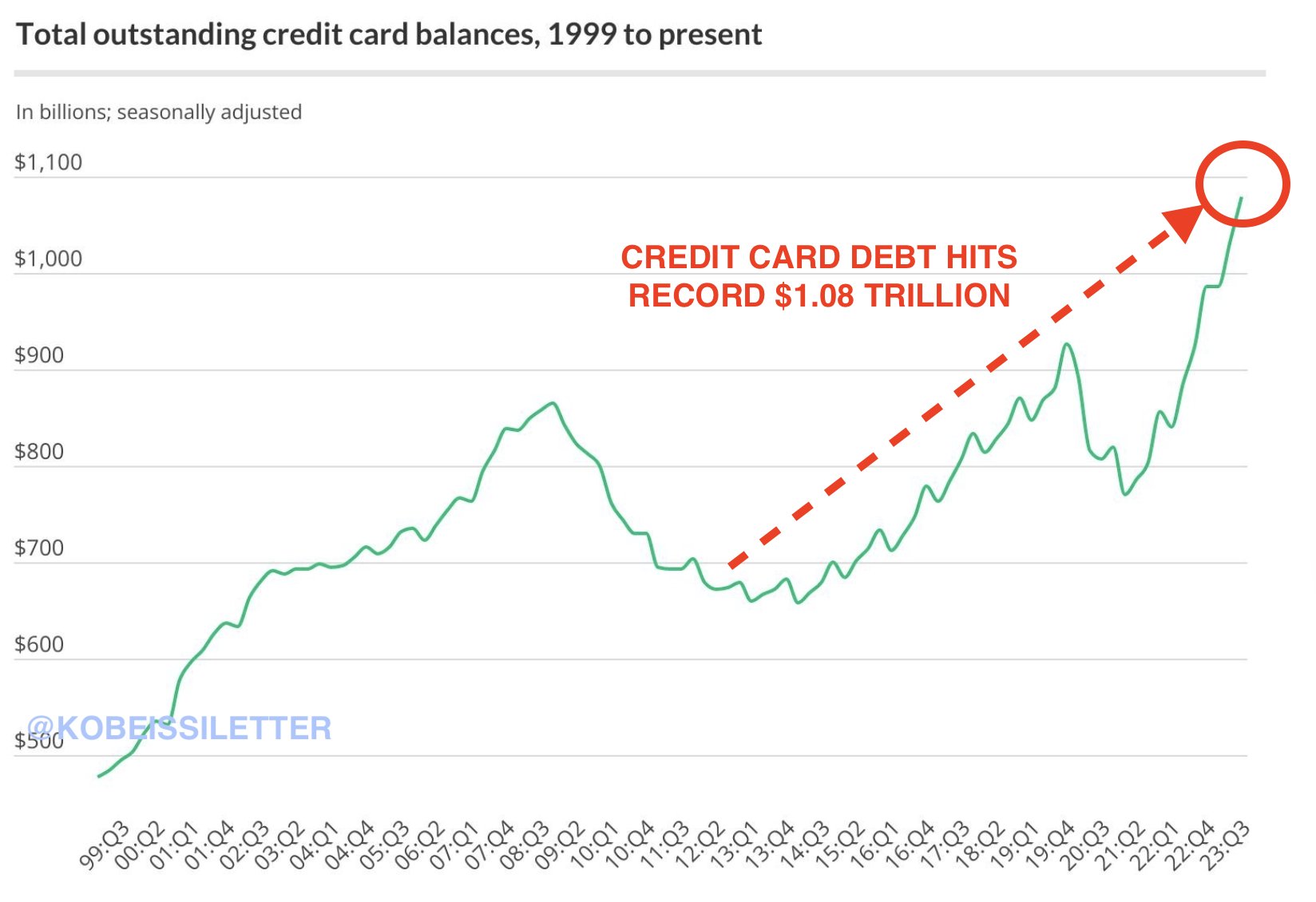

Experian reports that the average American household possesses 3.84 credit cards. In addition, as per the Kobeissi Letter, the ‘Buy Now Pay Later’ segment has observed a 20% growth year over year while credit card debt has hit an unprecedented $1 trillion.

This data places a question mark on the perceived consumer strength. Are we witnessing actual financial strength, or does the escalating debt merely underline a culture of deferring payments facilitated by easy access to credit?

Arkham Intelligence

Arkham Intelligence

Farside Investors

Farside Investors

CryptoQuant

CryptoQuant

CoinGlass

CoinGlass