December sees Bitcoin whales selling off despite market rally

December sees Bitcoin whales selling off despite market rally Quick Take

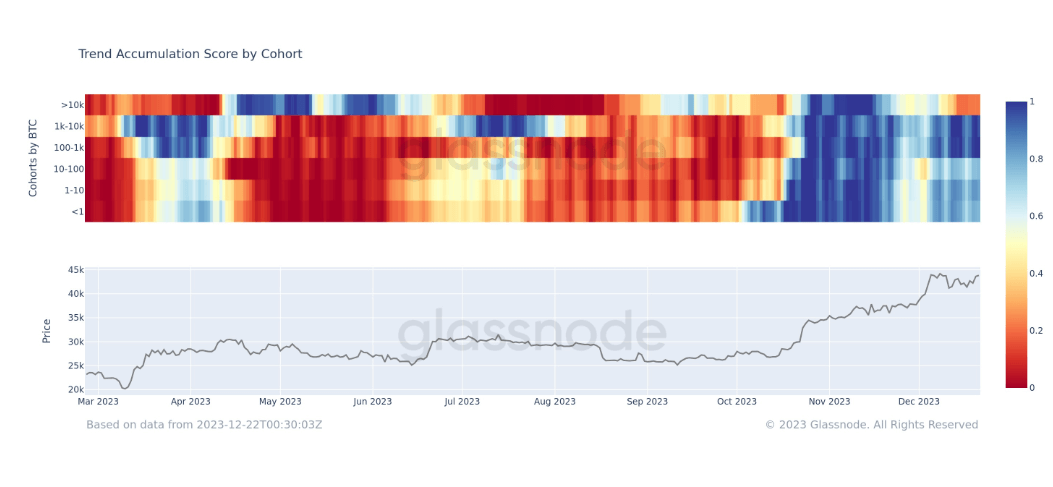

Analyzing the Accumulation Trend Score provides an overview of the current Bitcoin market dynamics. This metric, which measures the relative strength of accumulation based on the size of entity wallets and their recent coin acquisitions, reveals distinct behaviors among different cohort tiers. Exchanges and miners are omitted from this calculation.

Bitcoin whales, addresses holding over 10,000 BTC, have been distributing their holdings throughout December. This distribution activity contrasts Bitcoin’s performance, as it posted a 16% price increase, making December its fourth-best-performing month of the year. This suggests that large entities took Bitcoin’s rally as an opportunity to realize profits. The accumulation trend score shows an exceptionally high distribution score in mid-November when Bitcoin rallied from $26,000 to around $35,000.

Meanwhile, all cohorts with fewer than 10,000 BTC continued their aggressive accumulation trend, observed from mid-October to mid-November. As previously reported by CryptoSlate, retail investors with less than 1 BTC have been accumulating at a rapid pace, most likely in anticipation of a potential ETF approval, indicating a bullish sentiment among this group.