CME sees Bitcoin open interest grow by over 5k

CME sees Bitcoin open interest grow by over 5k Quick Take

Bitcoin’s Open Interest Reaches a Four-Month High

Open interest in Bitcoin has escalated to a four-month peak as approximately 418,000 Bitcoin are held in open interest contracts, marking a significant upturn in investor engagement.

CME Emerges as a Key Player

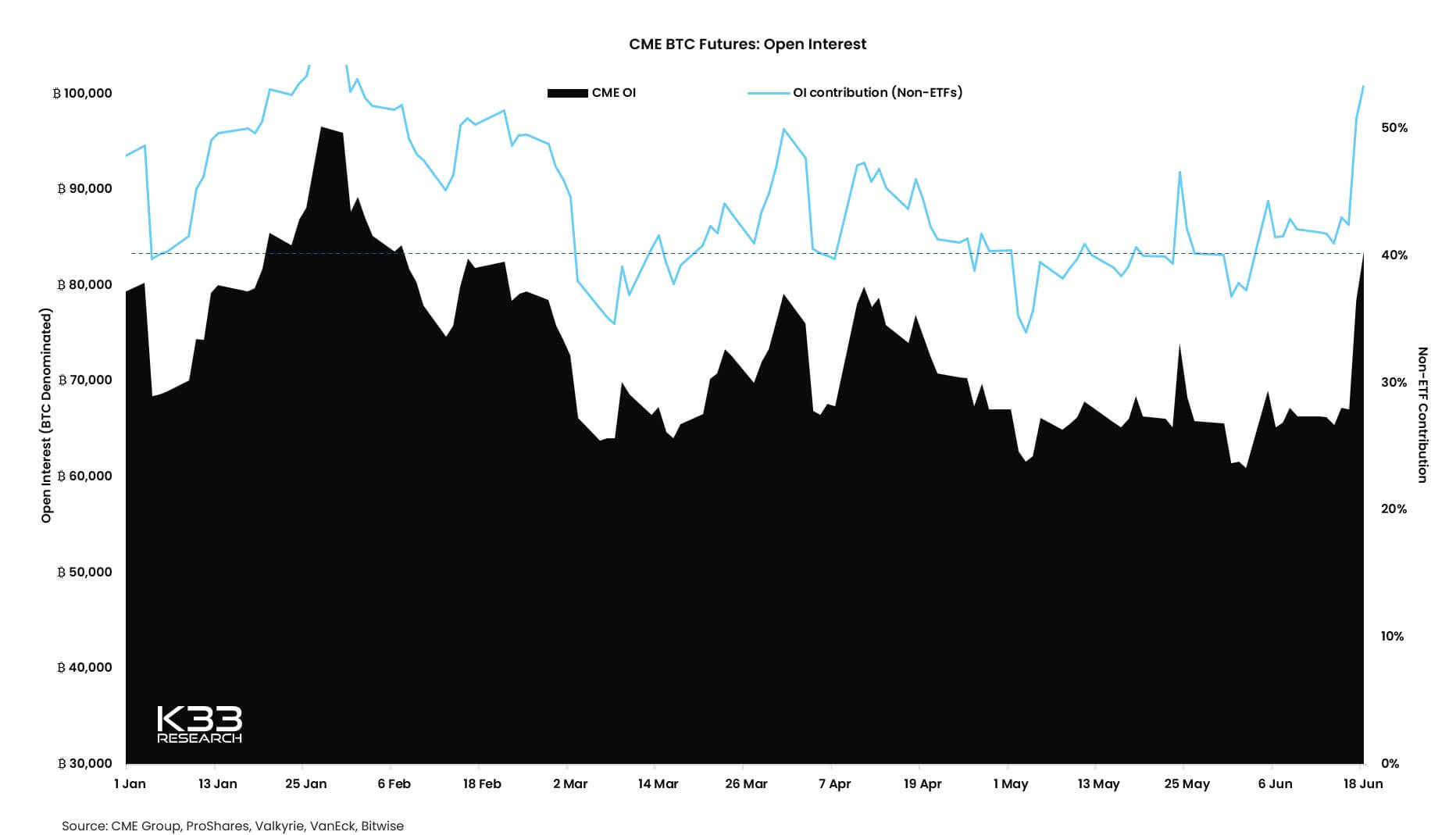

An important catalyst behind this growth appears to be the Chicago Mercantile Exchange (CME). Currently, CME holds 83,560 Bitcoin in futures open interest contracts. This level of engagement is an all-time high since January and indicates a significant return of investor interest in Bitcoin futures.

Analyst Insights on the Current Market Situation

Vetle Lunde, a research analyst at K33, supports this viewpoint, highlighting that despite the recent growth on an annualized basis, trailing returns remain comfortably above 10%.

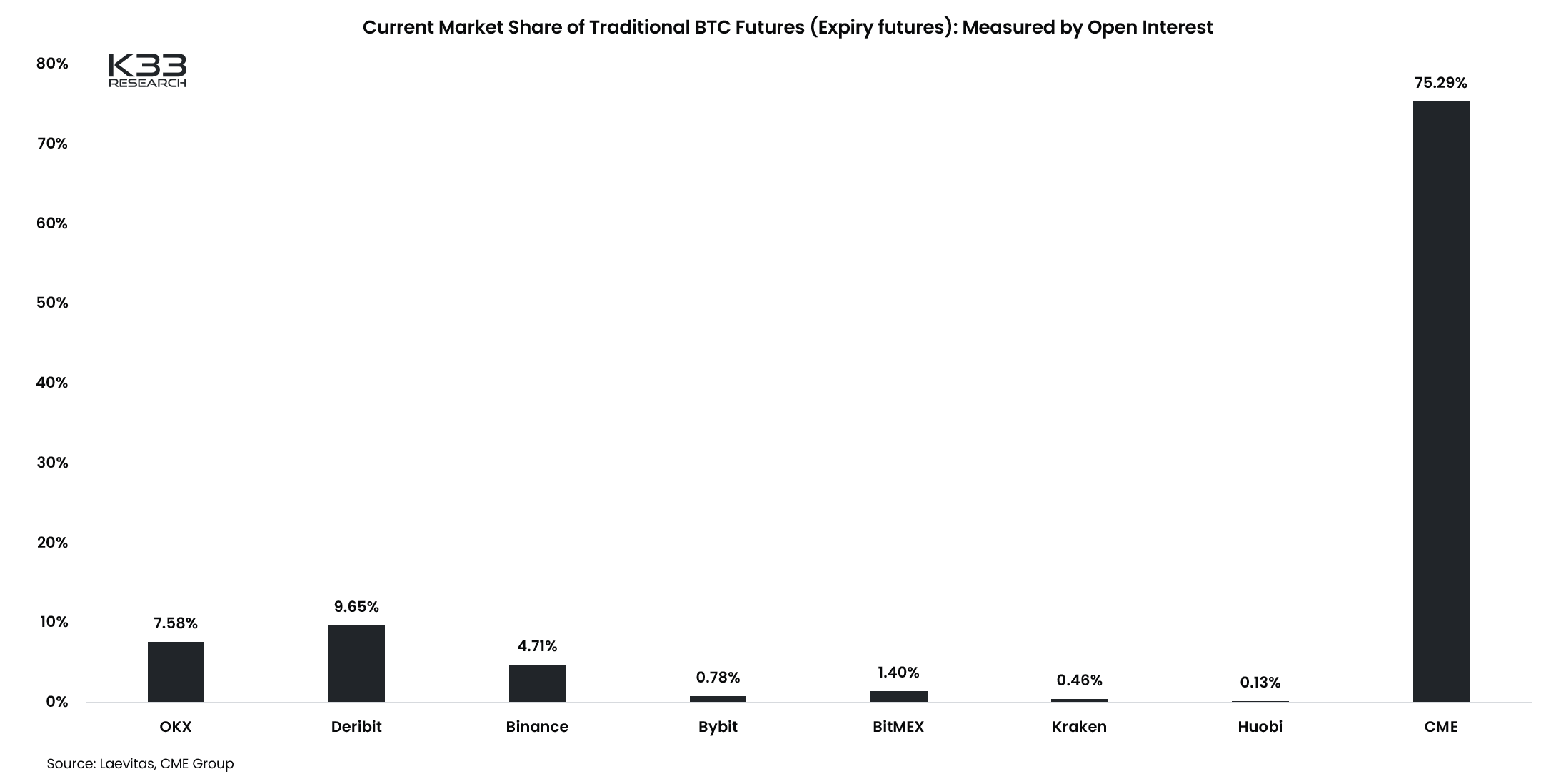

Expanding further on this topic, Lunde pointed out that among all derivatives exchanges, CME experienced the most significant daily growth in Bitcoin’s open interest. In terms of overall open interest, Binance remains the largest exchange, followed by Bybit and then CME.

However, when considering expiring futures, the landscape is quite different. CME dominates with a market share of 75%, rendering offshore futures relatively insignificant.

Implications for the Market

Given that CME is one of the world’s largest derivatives exchanges and is primarily used by institutional investors, this surge of activity indicates a noteworthy entry of large players into the Bitcoin market.

The implications of this could be significant, suggesting a possible stabilization and increased acceptance of Bitcoin among traditional financial institutions.