Chicago Mercantile Exchange Bitcoin futures Open Interest falls as year-end approaches

Chicago Mercantile Exchange Bitcoin futures Open Interest falls as year-end approaches Chicago Mercantile Exchange Bitcoin futures Open Interest falls as year-end approaches

CME's Bitcoin futures contracts exhibit traditional year-end downturn, Open Interest/Market Cap ratio stabilizes.

Quick Take

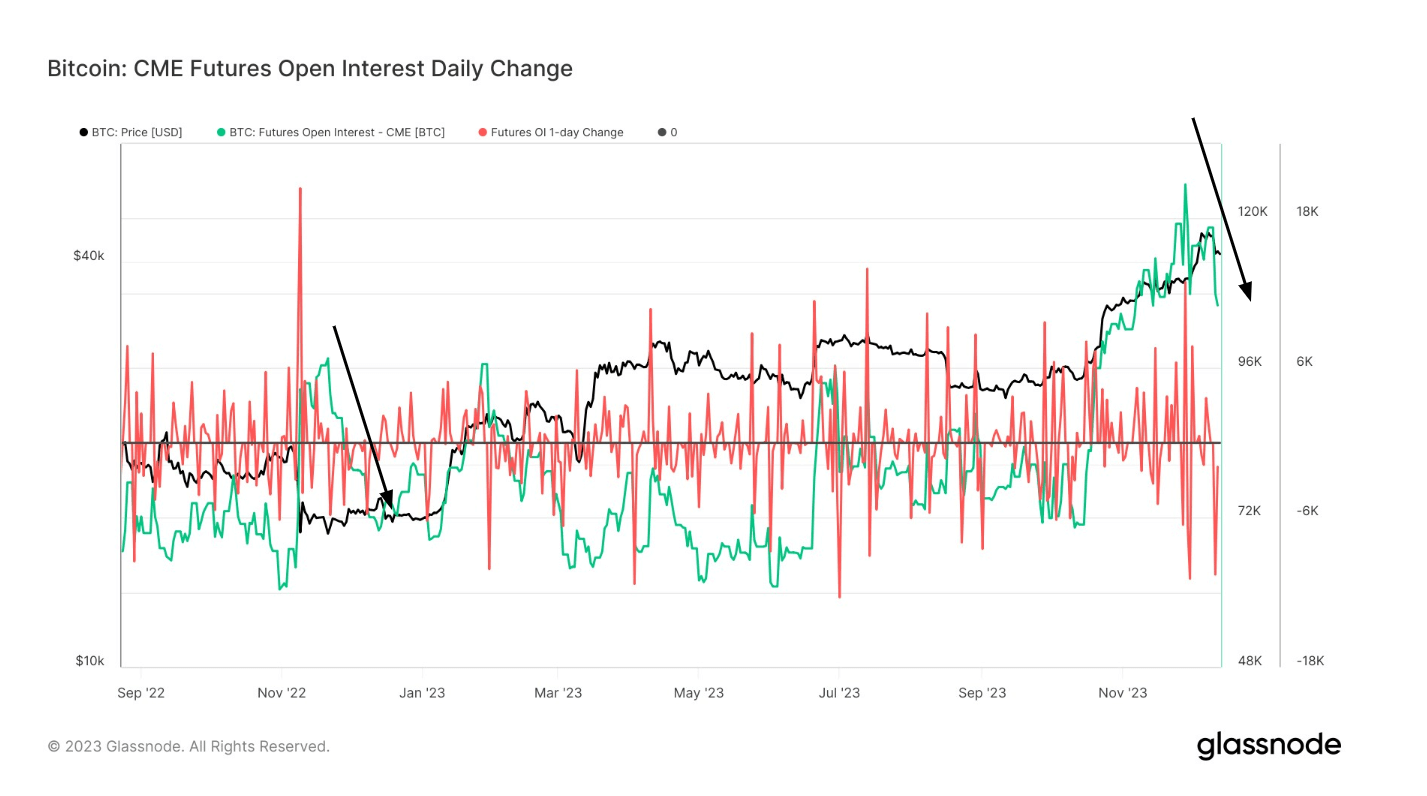

From mid-October, the Chicago Mercantile Exchange (CME) has maintained its position as the premier exchange for Bitcoin futures, augmenting its Open Interest by approximately 45,000 BTC through to the end of November.

However, this shift was marked by approximately 20,000 Bitcoin contracts being closed from CME since Nov. 28. In a notable downturn, Dec. 11 recorded one of the most significant one-day drops in futures Open Interest, with 10,500 Bitcoin contracts closed. This trend is not unprecedented, as year-end periods often witness contracts rolling over. With firms reluctant to hold significant exposure over the holiday period, such a trend could be considered a strategic de-risking move.

Historical analysis supports this, showing a similar pattern on CME last year in Nov. 2022, when Bitcoin futures peaked at 97,560 and subsequently dropped below 70,000.

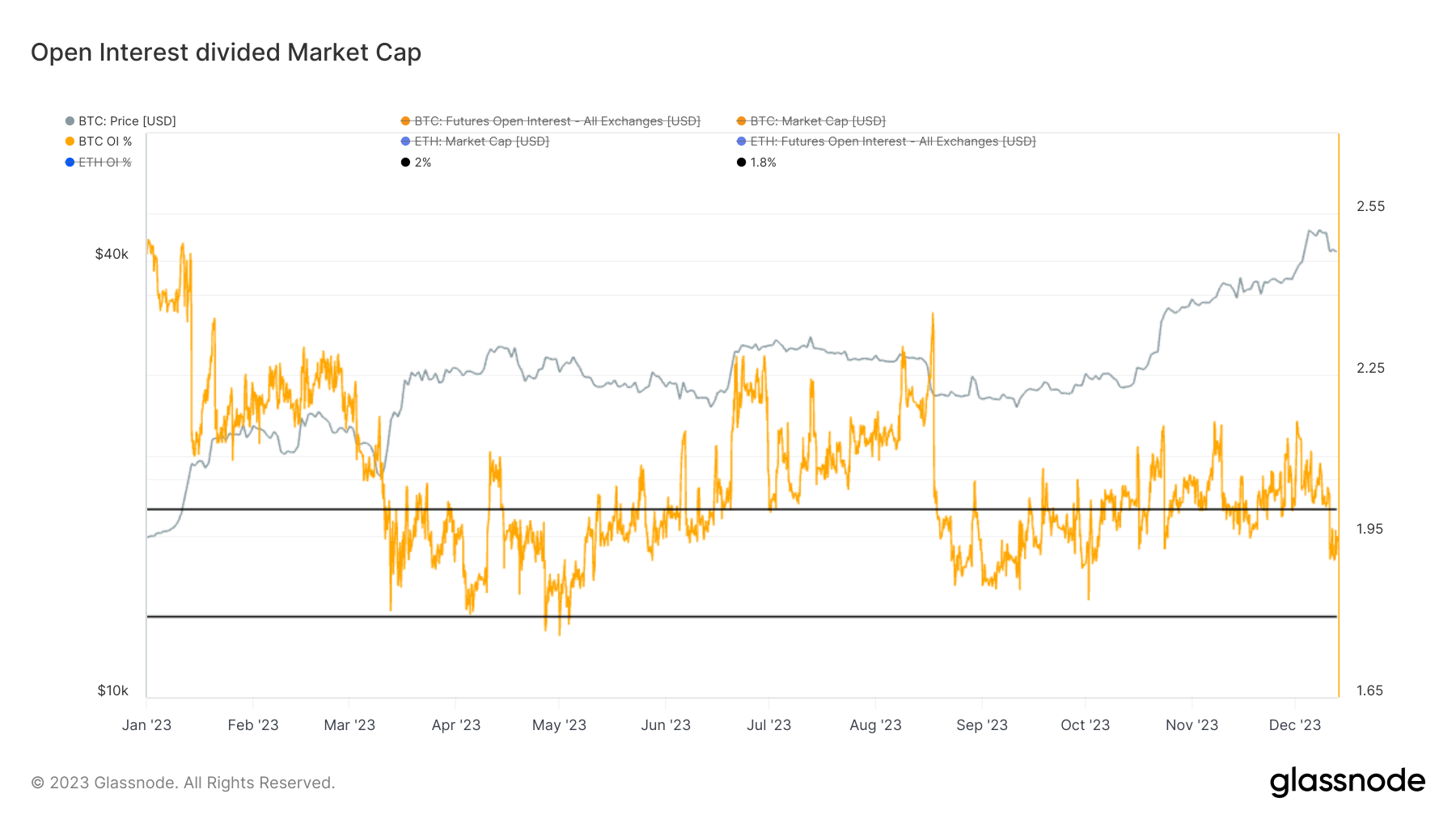

Amid the substantial liquidation cascade observed on Dec. 11, Open Interest saw a consequent decline. When examining Open Interest in relation to market cap—a measure used to gauge the overheating or over-leveraging of the derivatives market compared to the overall market—it is noteworthy that it has returned to below 2%, a sign of a balanced and healthy market. This contrasts with the period when Bitcoin soared to its Year-To-Date highs at $45,000, during which the Open Interest/Market Cap (OI/MC) ratio stood at 2.15%.