Central banks globally roll back balance sheets – quantitative tightening pace heightened

Central banks globally roll back balance sheets – quantitative tightening pace heightened Quick Take

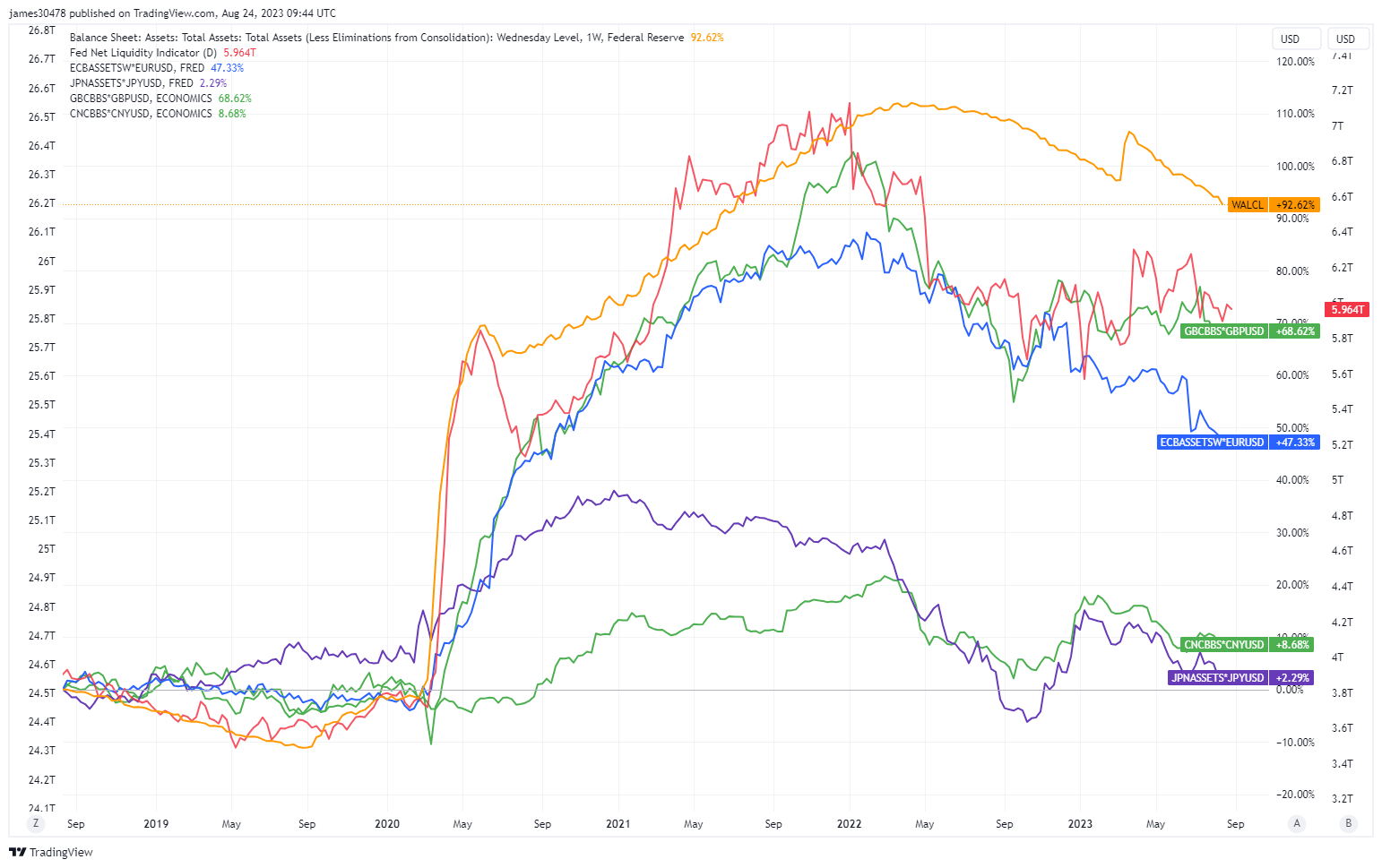

Global central banks are decidedly rolling back on their respective balance sheets, indicating an aggressive stride in quantitative tightening for 2023.

The Bank of England’s (BOE) balance sheet downsized by 3%, while the Federal Reserve reported a 4% reduction. Notably, the People’s Bank of China charts a 5% decline in its balance sheet.

The European Central Bank (ECB) and the Bank of Japan are leading the pack with a decline of 8.5% and 9%, respectively.

Analyst Holger Zschaepitz highlighted that the ECB’s balance sheet has hit its lowest point since March 2021. Zschaepitz goes on further to say the total assets of these banks are significant fractions of their corresponding GDPs.

The ECB’s assets account for 53% of the EU’s GDP, with the Federal Reserve and BOE representing 30% and 33% of the US and UK GDPs, respectively. The Bank of Japan stands out, with its assets equating to 126% of Japan’s GDP.

This trend is indicative of the central banks’ persistent efforts to alleviate the inflationary pressures and stabilize their economies following the pandemic-induced financial upheaval.