Bitcoin’s volatility in 2023 is at its lowest in over a decade

Bitcoin’s volatility in 2023 is at its lowest in over a decade Quick Take

According to Ecoinometrics, 2023 has marked a distinct shift in the volatility pattern typically associated with Bitcoin. Contrasting with the preceding decade, this year represents a period of unprecedented stability for the cryptocurrency, with volatility rates persistently ranging between 20 to 40%.

Despite this decreased volatility, Bitcoin’s performance has remained robust, delivering 100% returns year-to-date and soaring above the $35,000 mark.

| YEAR | JAN. | FEB. | MAR. | APR. | MAY | JUN. | JUL. | AUG. | SEP. | OCT. | NOV. | DEC. |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2023 | 29% | 41% | 53% | 41% | 32% | 37% | 28% | 23% | 31% | 27% | NA | NA |

| 2022 | 45% | 56% | 67% | 41% | 60% | 72% | 59% | 47% | 54% | 34% | 61% | 35% |

| 2021 | 74% | 86% | 70% | 49% | 81% | 90% | 63% | 53% | 58% | 62% | 48% | 55% |

| 2020 | 45% | 39% | 123% | 90% | 60% | 47% | 25% | 42% | 46% | 29% | 47% | 57% |

| 2019 | 59% | 35% | 33% | 52% | 57% | 67% | 99% | 63% | 43% | 48% | 54% | 41% |

| 2018 | 117% | 116% | 83% | 72% | 57% | 50% | 53% | 53% | 41% | 26% | 42% | 82% |

| 2017 | 79% | 43% | 57% | 57% | 45% | 74% | 76% | 85% | 85% | 74% | 69% | 110% |

| 2016 | 61% | 51% | 26% | 15% | 25% | 59% | 63% | 39% | 19% | 15% | 35% | 23% |

| 2015 | 95% | 89% | 55% | 44% | 33% | 23% | 38% | 53% | 49% | 22% | 73% | 54% |

| 2014 | 121% | 74% | 85% | 102% | 58% | 51% | 31% | 36% | 45% | 57% | 58% | 43% |

Source:@ecoinometrics

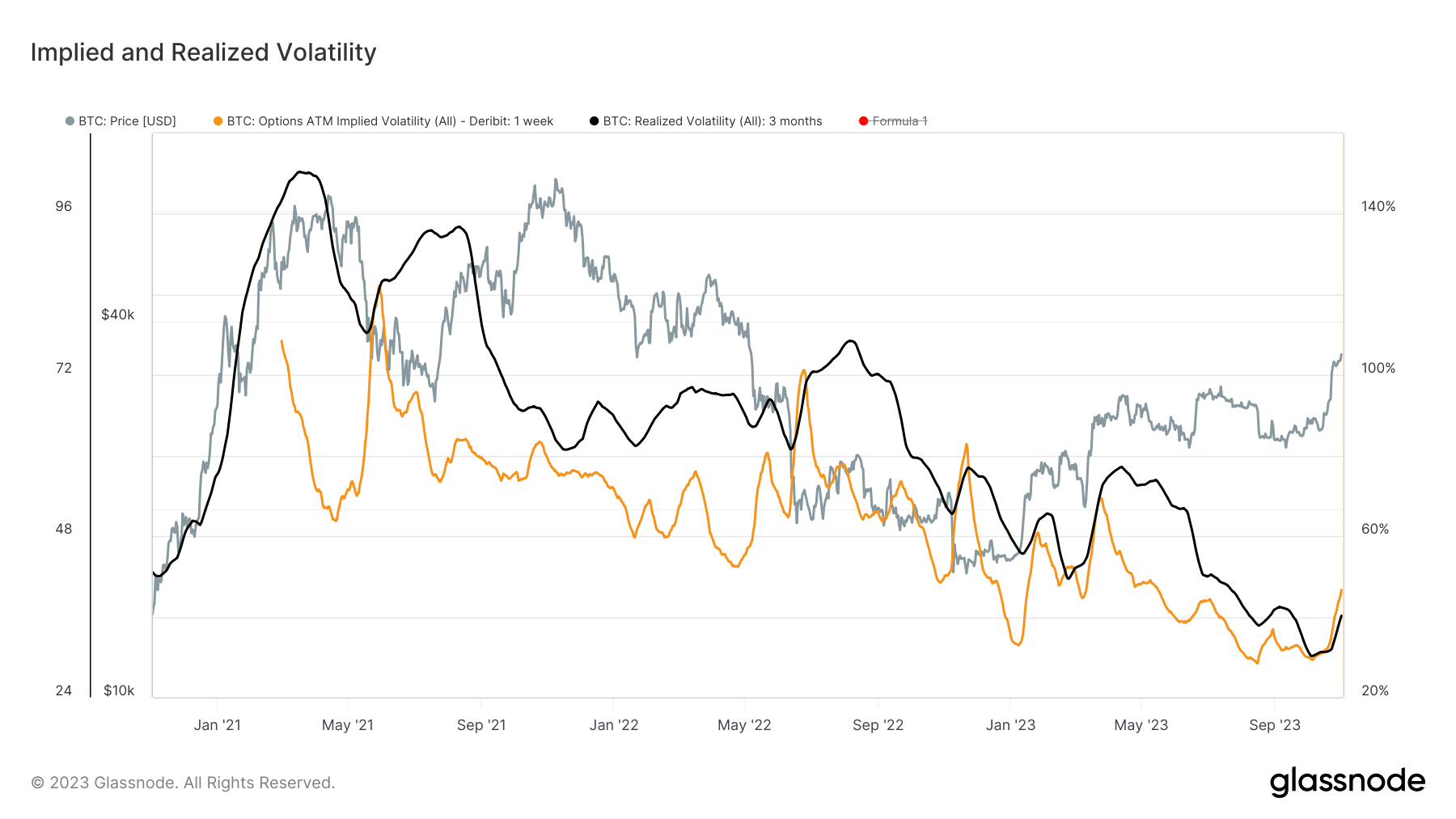

This reduction in volatility extends to both realized and implied volatility. Realized volatility, an indicator of actual price changes, has been on a consistent downward trend. Similarly, implied volatility, a predictive measure of future market unpredictability, has also dropped.

This exceptional stability, combined with solid performance, has resulted in a higher Sharpe Ratio for Bitcoin. As a measure of risk-adjusted performance, a higher Sharpe Ratio signals superior returns for each unit of risk investors endure. In essence, Bitcoin investors in 2023 are receiving more bang for their buck, reaping maximum returns from their investments while staying considerably less volatility compared to previous years.

Deribit

Deribit