Bitcoin’s net realized profit/loss stabilizes post $70k surge, signaling market maturity

Bitcoin’s net realized profit/loss stabilizes post $70k surge, signaling market maturity Onchain Highlights

DEFINITION: Net Realized Profit/Loss is the net profit or loss of all moved coins and is defined by the difference between Realized Profit and realized Loss.

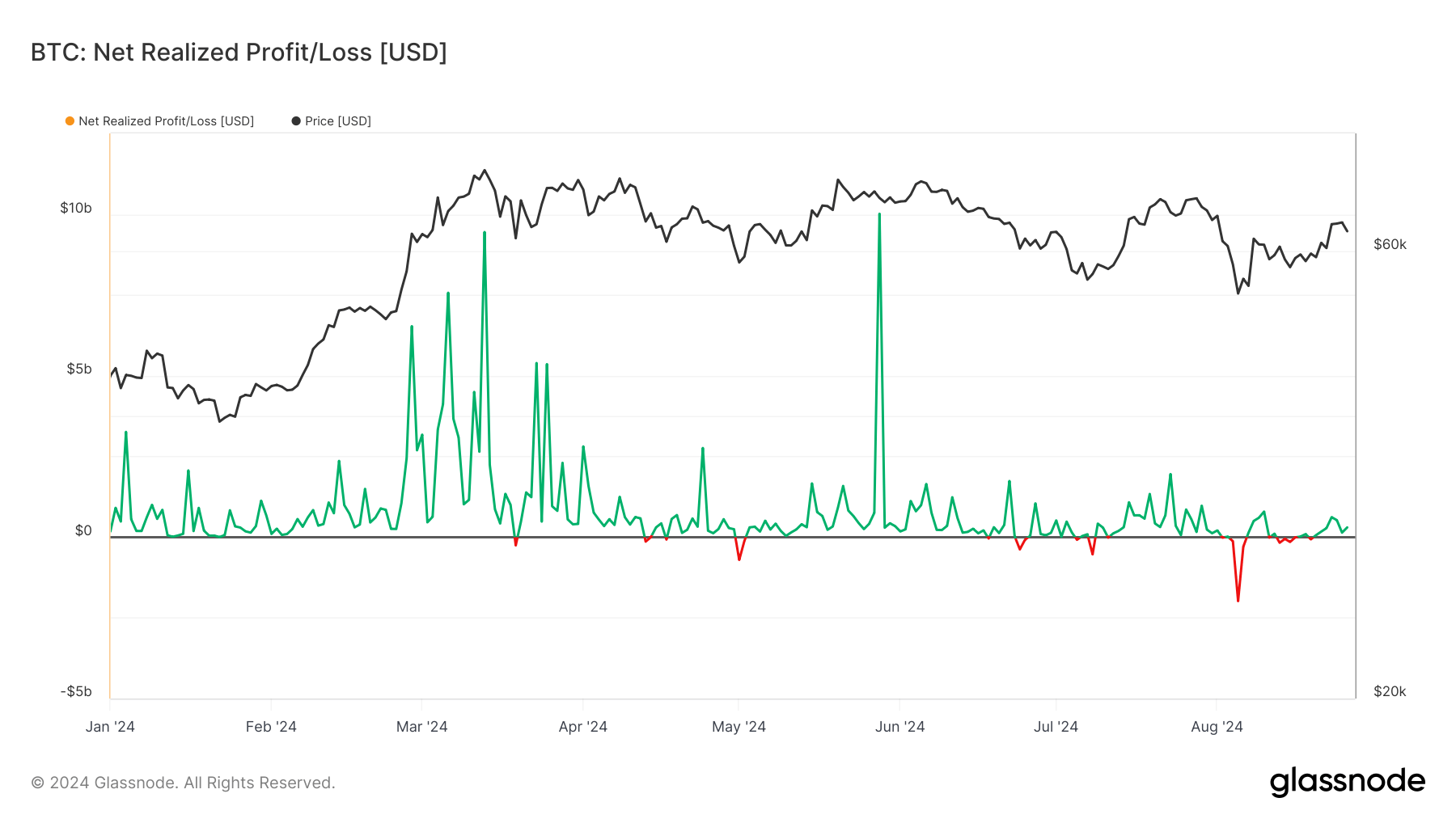

Bitcoin’s net realized profit/loss reflects the aggregate profitability of on-chain transactions. The metric has shown heightened volatility year-to-date, peaking in the first quarter as Bitcoin surged past $70,000.

Despite this rally, the latter half of 2024 saw the metric stabilize, indicating a balance between profits and losses as the market matured post-halving.

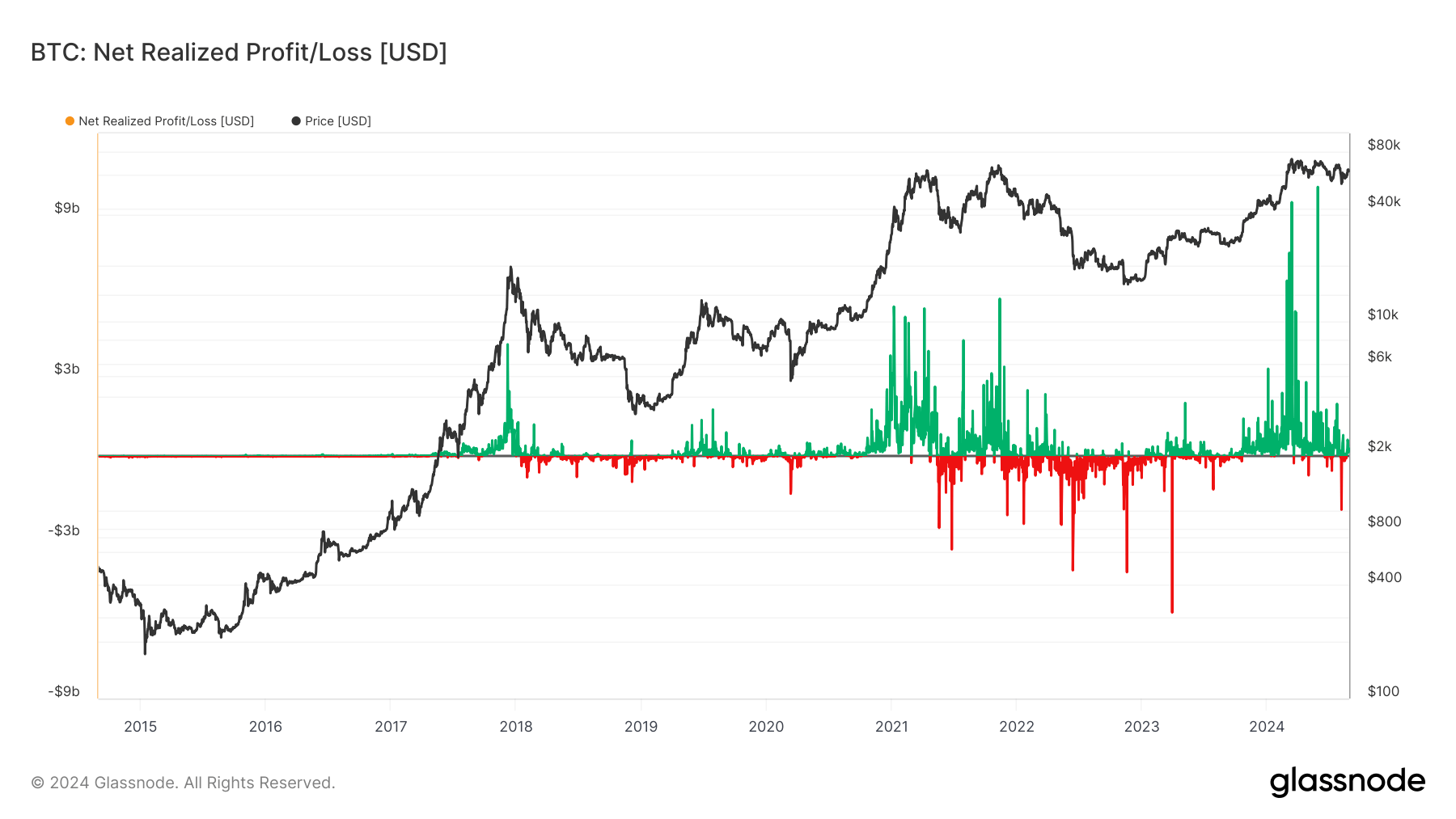

Historically, Bitcoin’s net realized profit/loss has mirrored market cycles. In 2021, peaks corresponded with Bitcoin’s all-time highs, while 2022 saw significant losses during the market downturn. The current trend of more minor fluctuations compared to previous years suggests that while the market remains active, it is entering a period of consolidation.

CoinGlass

CoinGlass  Arkham Intelligence

Arkham Intelligence