Bitcoin suffers fifth largest realized loss since FTX collapse amid Mt. Gox panic

Bitcoin suffers fifth largest realized loss since FTX collapse amid Mt. Gox panic Quick Take

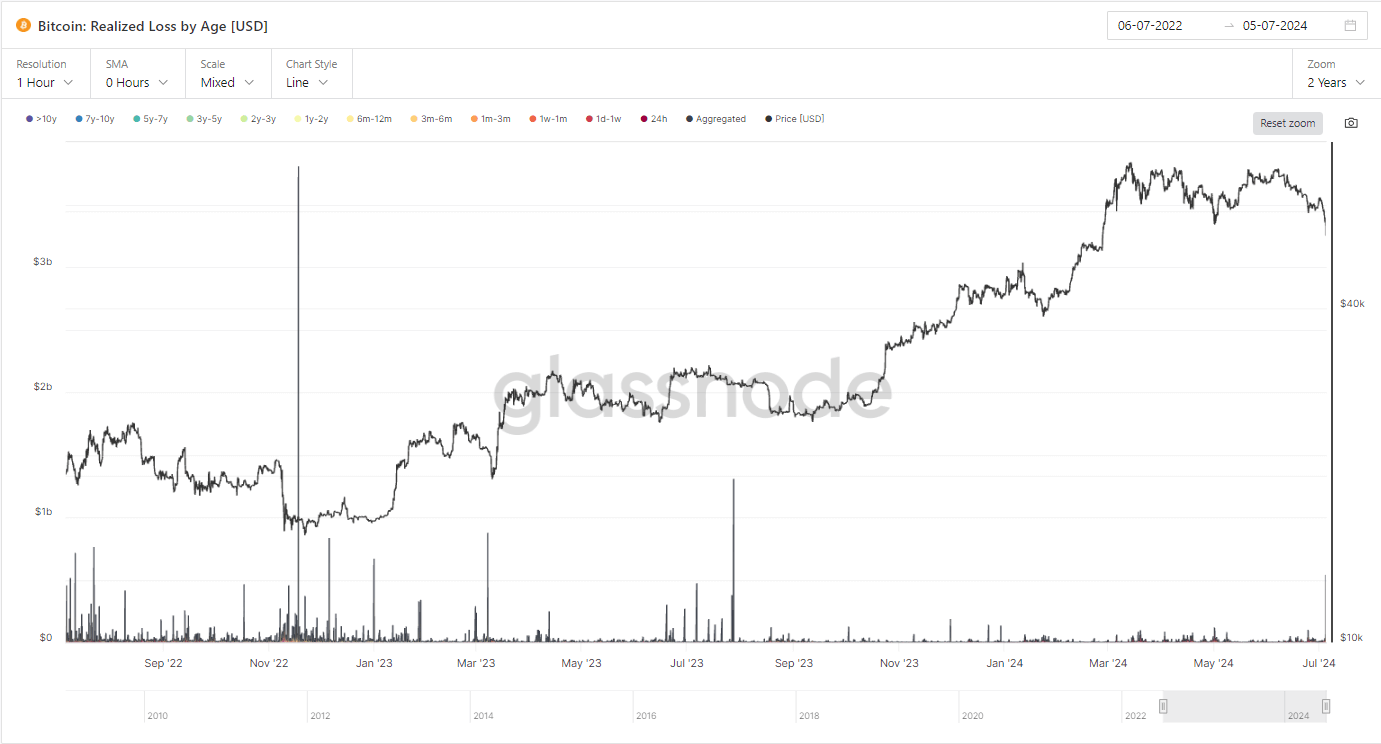

Bitcoin’s recent price dip to around $54,000 has triggered one of the largest realized losses since the FTX collapse, specifically the fifth biggest realized loss since. This significant sell-off is primarily attributed to panic selling spurred by news related to Mt. Gox.

On July 5, within a one-hour resolution, Bitcoin’s aggregated realized loss soared to $814 million. $587 million of these losses were incurred by short-term holders who had held Bitcoin for one to three months. This demographic’s reaction to market turbulence highlights the vulnerability of short-term holders compared to their long-term counterparts.

The sell-off highlights a pattern observed on July 4, where short-term holders were found to be holding 2.5 million BTC at a loss. This indicates that these holders pose a greater risk to a Bitcoin correction than the impact of Mt. Gox.

Despite the turmoil, long-term holders exhibited resilience, contributing minimally to the selling pressure. This stability from seasoned investors indicates confidence in Bitcoin’s long-term prospects, contrasting sharply with the short-term market fluctuations driven by newer entrants reacting to immediate news events.

| Cohorts | $ Values |

|---|---|

| aggregated | 813,775,780 |

| 1m_3m | 586,946,540 |

| 1d_1w | 102,135,624 |

| 24h | 60,121,075 |

| 1w_1m | 46,528,219 |

| 3m_6m | 17,918,197 |

| 2y_3y | 93,782 |

| 3y_5y | 31,089 |

| 6m_12m | 1,051 |

| 1y_2y | 202 |

Source: Glassnode

CryptoQuant

CryptoQuant