Bitcoin setup for imminent 2020 style rally, now 161 days post-halving

Bitcoin setup for imminent 2020 style rally, now 161 days post-halving Bitcoin has reached a critical milestone 161 days after its April halving, mirroring a pivotal moment from 2020 when the digital asset broke out from its reaccumulation range. Rekt Capital highlighted this temporal alignment, noting that in 2020, Bitcoin began a significant upward move exactly 161 days post-halving.

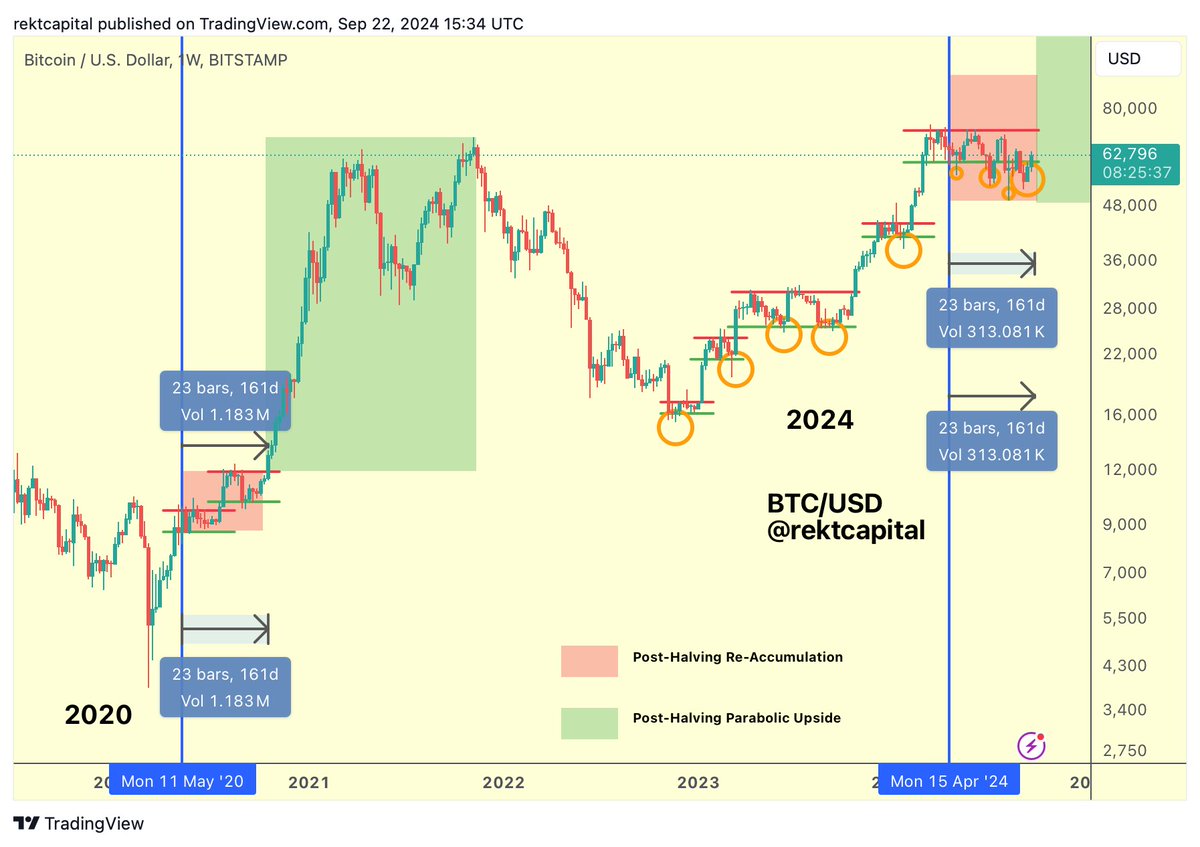

Rekt Capital’s chart below compares the post-halving periods of 2020 and 2024 and reveals striking similarities. Both times, Bitcoin entered a reaccumulation phase lasting approximately 161 days after the halving events. In 2020, this period culminated in a parabolic rally as Bitcoin broke through resistance levels it had repeatedly tested.

Support and resistance levels in both periods show consistent testing and retesting, forming a foundation for possible upward momentum. Rounded bottom patterns observed in the charts signal accumulation and may further support the breakout thesis.

While historical patterns indicate the potential for a significant move, differences in market conditions, such as volume, highlight that outcomes may not be identical.

A notable difference between the two periods is the trading volume on the chart, which uses Bitstamp. In 2020, Bitstamp’s volume during the 161-day post-halving period was 1.183 million, whereas in 2024, it stands at 313,081. This divergence suggests a change in market participation, which could impact the nature of any potential breakout.

Across all exchanges, CryptoSlate’s chart below shows 2.5 million in trading volume since this year’s halving, while there were 4 million in the 161 days after the 2020 halving. This confirms the reduction in volume since the comparative period last cycle. However, the drop in volume is not as drastic in relative terms.

Bitstamp saw a 73% decline, whereas TradingView’s combined index depicts a 37% decrease.

CryptoQuant

CryptoQuant

CoinGlass

CoinGlass