Bitcoin faces crucial resistance as submerged cohorts of hodlers affect market sentiment

Bitcoin faces crucial resistance as submerged cohorts of hodlers affect market sentiment Quick Take

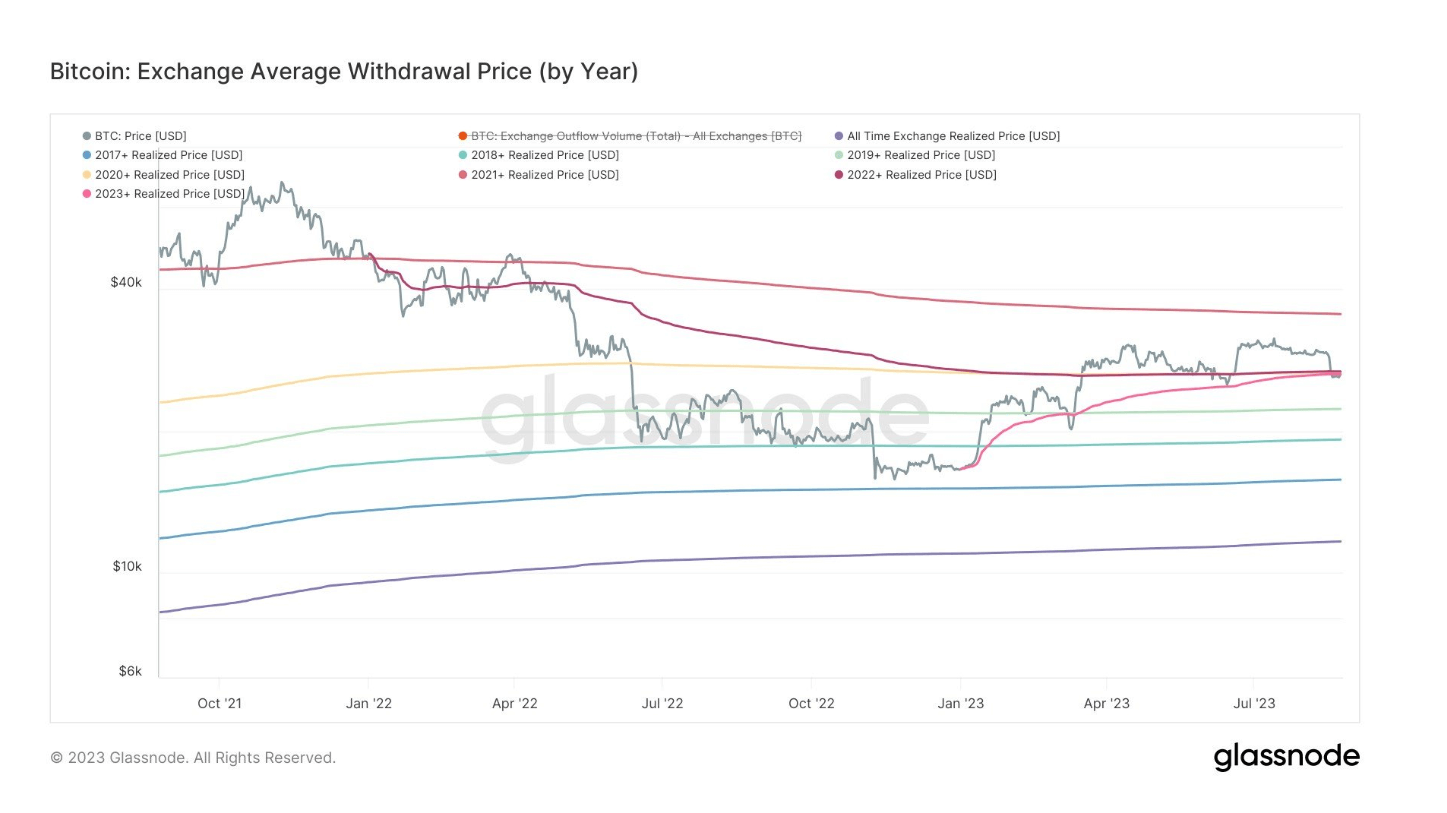

Information drawn from recent data analysis underscores the significant resistance that Bitcoin is encountering, with a price range from $26,419 up to $26,773. This resistance is critical because three different cohorts of average withdrawal prices are currently tagged as underwater, meaning that the current price is below the average price at which the bitcoins were withdrawn.

Specifically, the 2023+ cohort experienced an average withdrawal price of $26,419, the 2022 cohort at $26,773, and the 2020 cohort at $26,588. This implies that Bitcoin holders from these periods are currently in a loss position, which could potentially curb their enthusiasm to sell and thus create upward pressure on the price.

This resistance pattern aligns with a confluence of average withdrawal prices, signaling a noteworthy hurdle for Bitcoin’s price ascent. The submerged cohorts could impact market sentiment, either inducing a sell-off if prices dive deeper or holding the fort, causing a potential price rebound if the market anticipates a recovery.