Bitcoin ETFs see explosive inflows as price tops $50,000

Bitcoin ETFs see explosive inflows as price tops $50,000 Quick Take

The recent surge in Bitcoin’s price, passing the $50,000 mark on Feb. 12, the highest level since December 2021, has been mirrored by substantial net inflows into Bitcoin exchange-traded funds (ETFs).

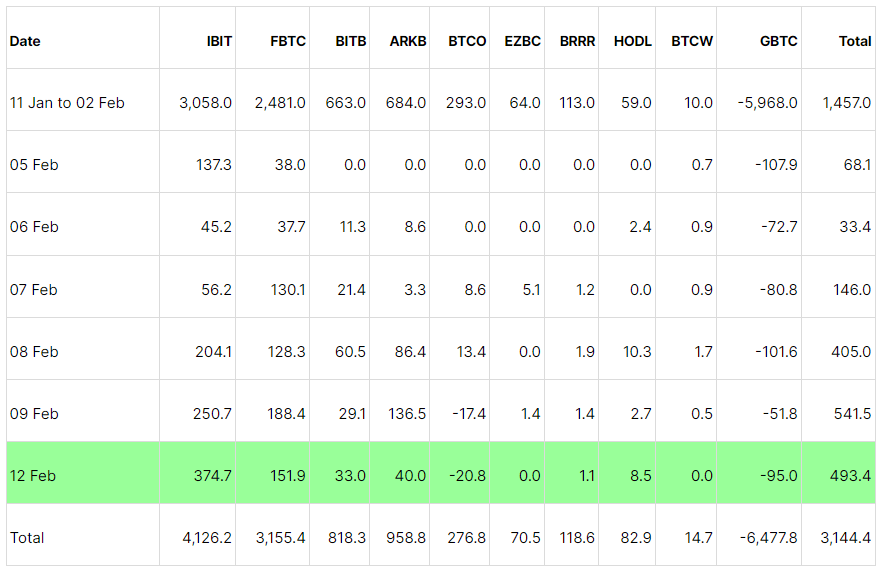

Provisional data by Farside Investors shows that BlackRock’s IBIT witnessed a net inflow of $375 million on Feb. 12, raising its total holdings to a remarkable $4.1 billion. Furthermore, Fidelity’s FBTC also experienced a significant net inflow of $152 million, resulting in an overall total of $3.2 billion.

Data shows Invesco Galaxy Bitcoin ETF (BTCO) saw consecutive days of net outflows totaling $38 million, the first of the Newborn Nine to do so. Grayscale Bitcoin Trust (GBTC) also exhibited net outflows slightly below $100 million, placing the total net outflows at $6.5 billion. Consequently, the overall net inflows for Bitcoin currently stand at $3.1 billion.

CoinGlass

CoinGlass

Farside Investors

Farside Investors