Bitcoin edges closer to gold with market cap nearing 10%

Bitcoin edges closer to gold with market cap nearing 10% Quick Take

Bitcoin, often referred to as ‘digital gold,’ is nearing a notable juncture, as its market capitalization approaches 10% of gold’s massive $14.55 trillion market cap, currently at 9.5%, according to data from the Clarkmoody dashboard.

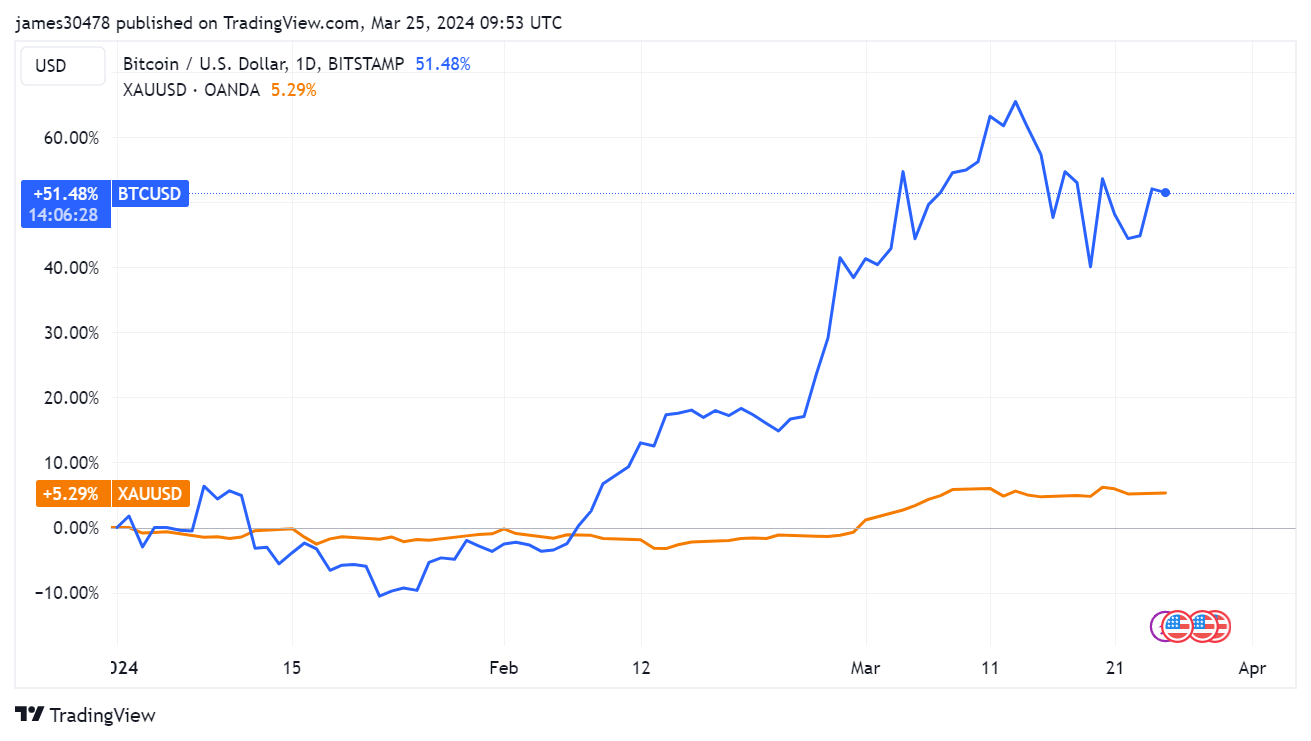

As Bitcoin hovers at approximately $67,000, its market capitalization stands at an estimated $1.314 trillion. This comes amidst a year of impressive growth for Bitcoin, with its value increasing by 58% compared to gold’s 5%.

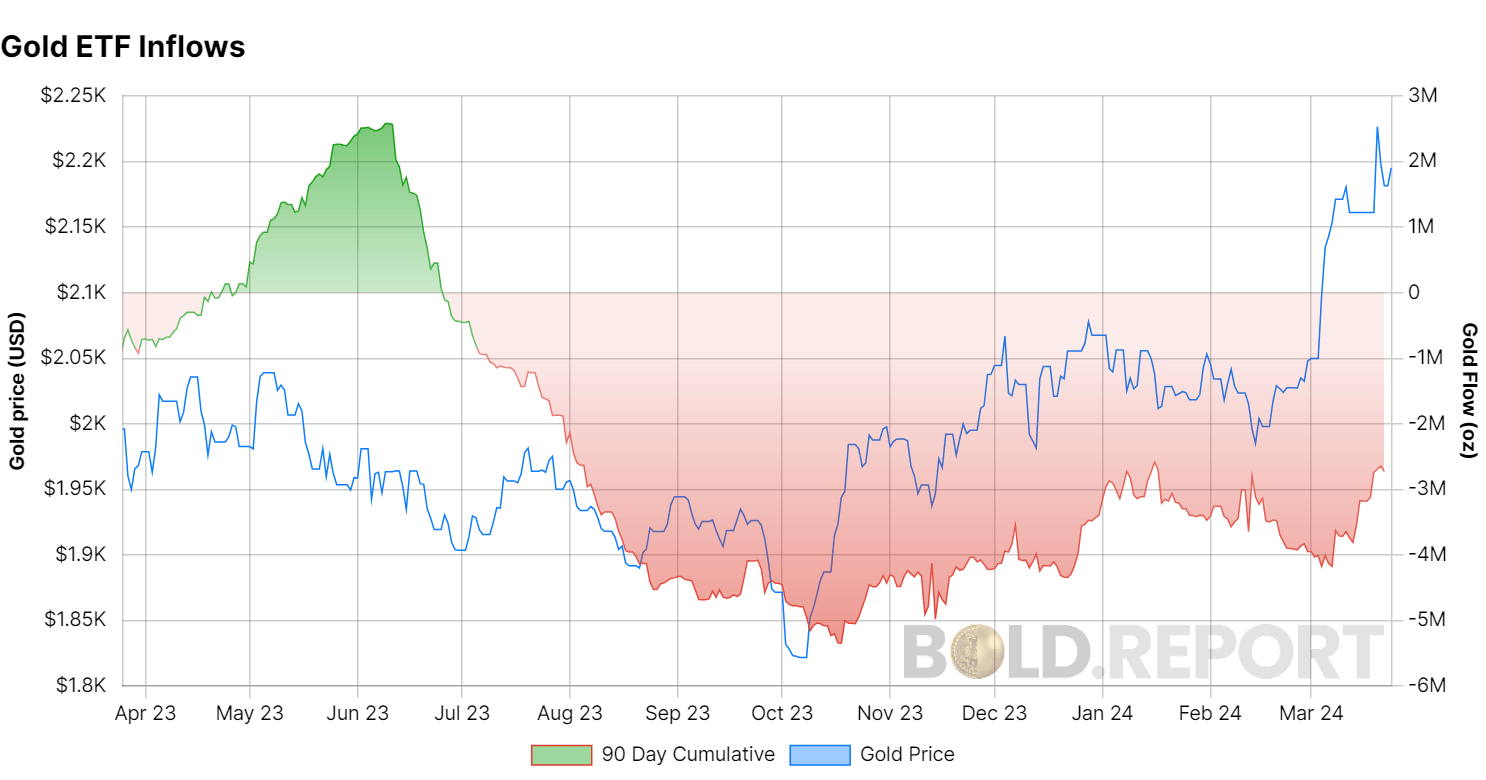

This shift isn’t limited to capitalization alone. Exchange Traded Funds (ETFs) revolving around the two assets are seeing divergent trends. Gold ETFs are experiencing significant outflows, with the Bold Report noting 2.7 million ounces of gold flowing out over a 90-day period. At its peak in March, gold outflows hit over 4.1 million ounces.

However, it is worth noting that in the past week, Gold ETFs have experienced substantial inflows of approximately 530,537 ounces, mainly coming from SPDR Gold Shares, according to the Bold Report.

Bitcoin ETFs, as reported by BitMEX, witnessed inflows amounting to roughly $11.269 billion.