Bitcoin and historical financial bubbles

Bitcoin and historical financial bubbles Quick Take

Bitcoin: A Critiqued Investment

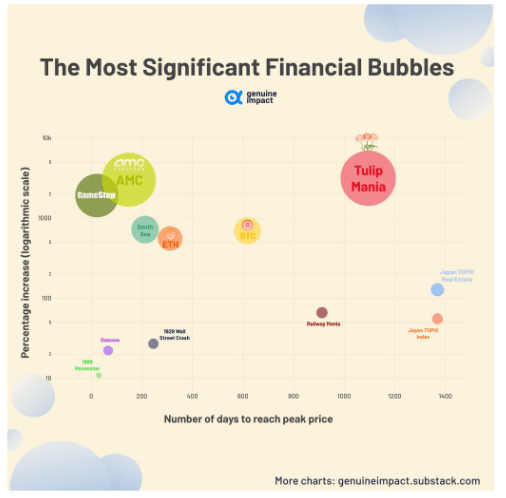

Since its inception in 2009, Bitcoin has often been disparaged as a financial bubble. Now, in 2023, Bitcoin is valued at over $30,000, offering a significant return for investors over the past fourteen years. The price of Bitcoin even surged by 1,000% in a mere 600-day timeframe. From an outsider’s perspective, this impressive growth may justify the skepticism surrounding its sustainability.

Historical Parallels

Throughout history, we’ve witnessed similar financial phenomena, such as the notorious “Tulip Mania,” which delivered over 1,000% return, albeit over a longer period than Bitcoin. More recently, the explosive price movements of AMC and GameStop stocks have been compared to these historical speculative bubbles.

Influence of Economic Policies

Historically, major financial crises and bubbles, like the Great Depression of 1929 and 1969 and the Tech Boom in 2000, have been fuelled by certain monetary policies such as low-interest rates and quantitative easing. With the ongoing trend of zero interest rate policy for over 15 years, one can’t help but speculate about the potential for upcoming bubbles in bonds, equities, or sovereign debt.

Future Prospects

As we look toward the future, it is crucial to consider these historical patterns and economic trends in our financial decision-making. The question remains – are we on the brink of witnessing the next major financial bubble?