The impact of Ordinals on Bitcoin mempools & transaction size

The impact of Ordinals on Bitcoin mempools & transaction size The impact of Ordinals on Bitcoin mempools & transaction size

New Glassnode data show NFTs on Bitcoin have caused mempool changes and increased transaction size by 100%.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

The introduction of the Ordinals Protocol, which enables the development of Bitcoin-based NFTs, has coincided with significant changes to mempool activity and transaction size, new data by CryptoSlate and Glassnode show.

What are Bitcoin Ordinals?

The ability to mint non-fungible tokens directly onto Bitcoin’s blockchain with all associated content, such as images and videos, is made possible by Ordinal NFTs, also known as digital artifacts or inscriptions.

Launched in January 2023, the Ordinals protocol allows users to interact with and exchange individual satoshis that may contain unique inscribed data. This new approach to creating NFTs on Bitcoin takes advantage of changes included in the Bitcoin Taproot upgrade. It involves placing the complete content of the NFT directly on-chain, providing a novel way to explore, transfer, and receive such tokens.

When combined with the SEC’s decision to exempt Bitcoin from the “security” classification, some experts say a bullish outlook for Bitcoin begins to emerge, which could positively impact the entire cryptocurrency ecosystem.

Quantitative analysis

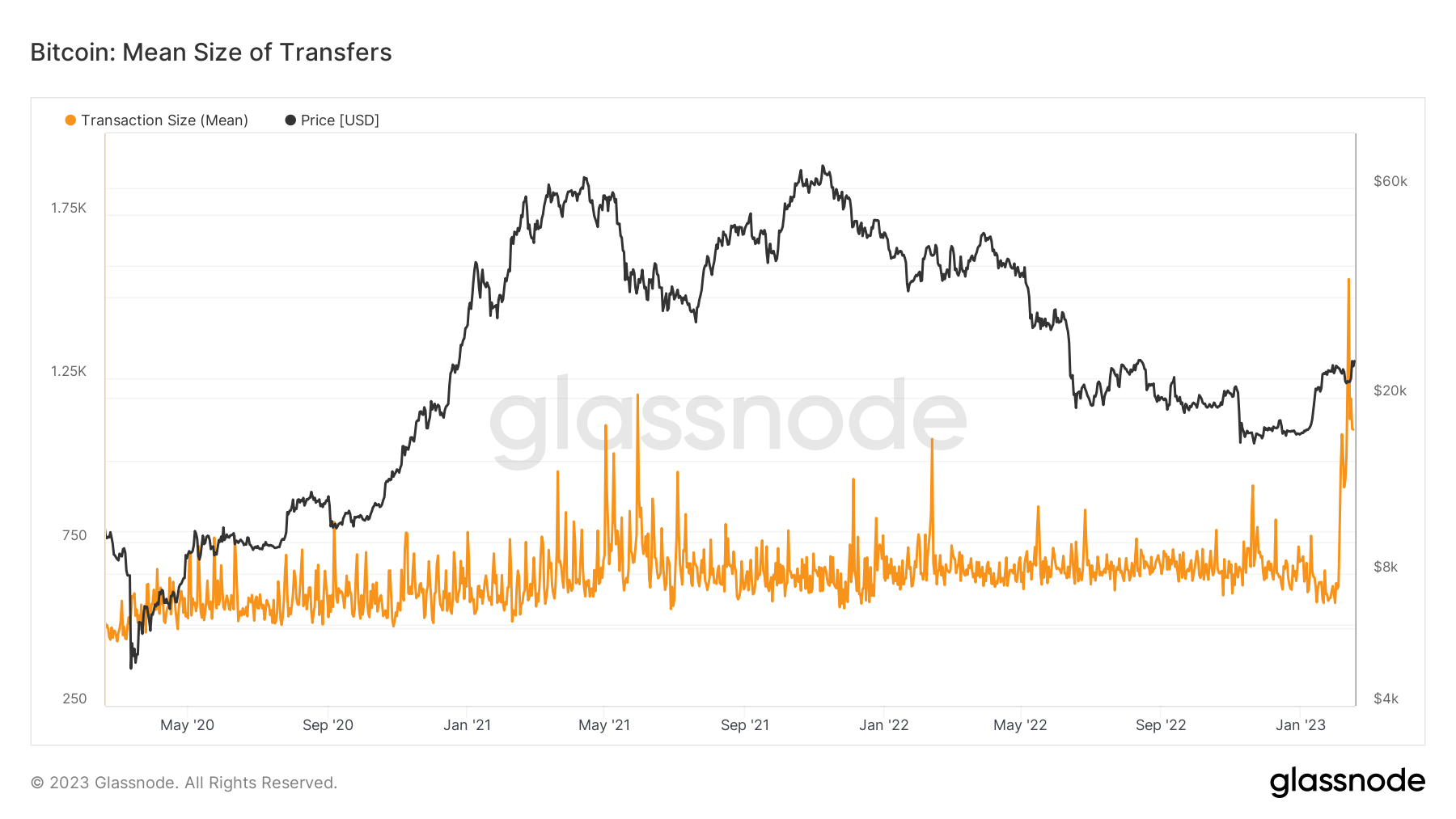

According to recent Glassnode data sourced in conjunction with CryptoSlate, the aftermath of Ordinals has positively impacted Bitcoin. However, the data suggests there are factors to consider in relation to the ‘health’ of the Bitcoin network. For example, the mean size of transactions increased by over 100%, from 600 B (bytes) to 1100 B.

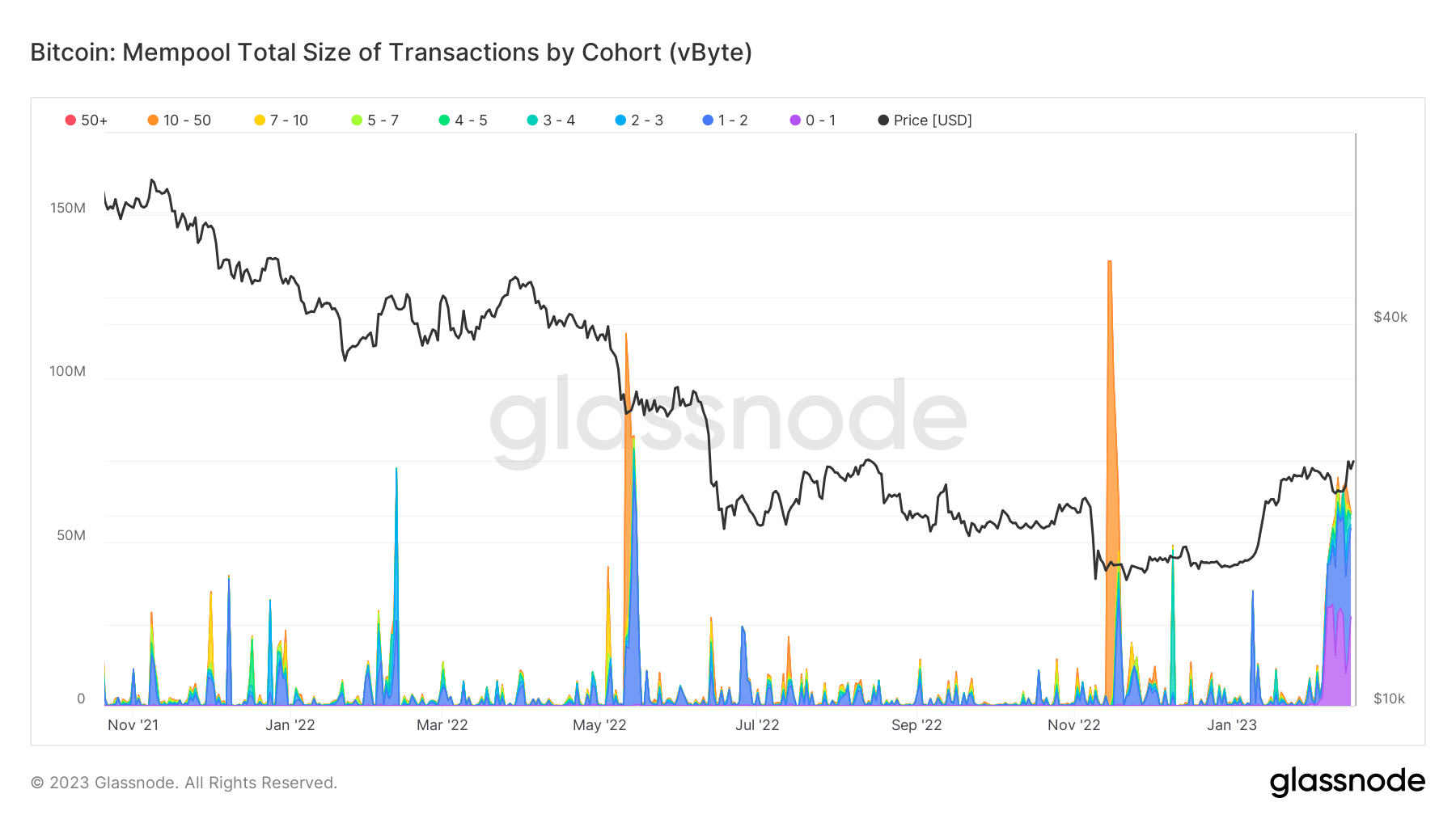

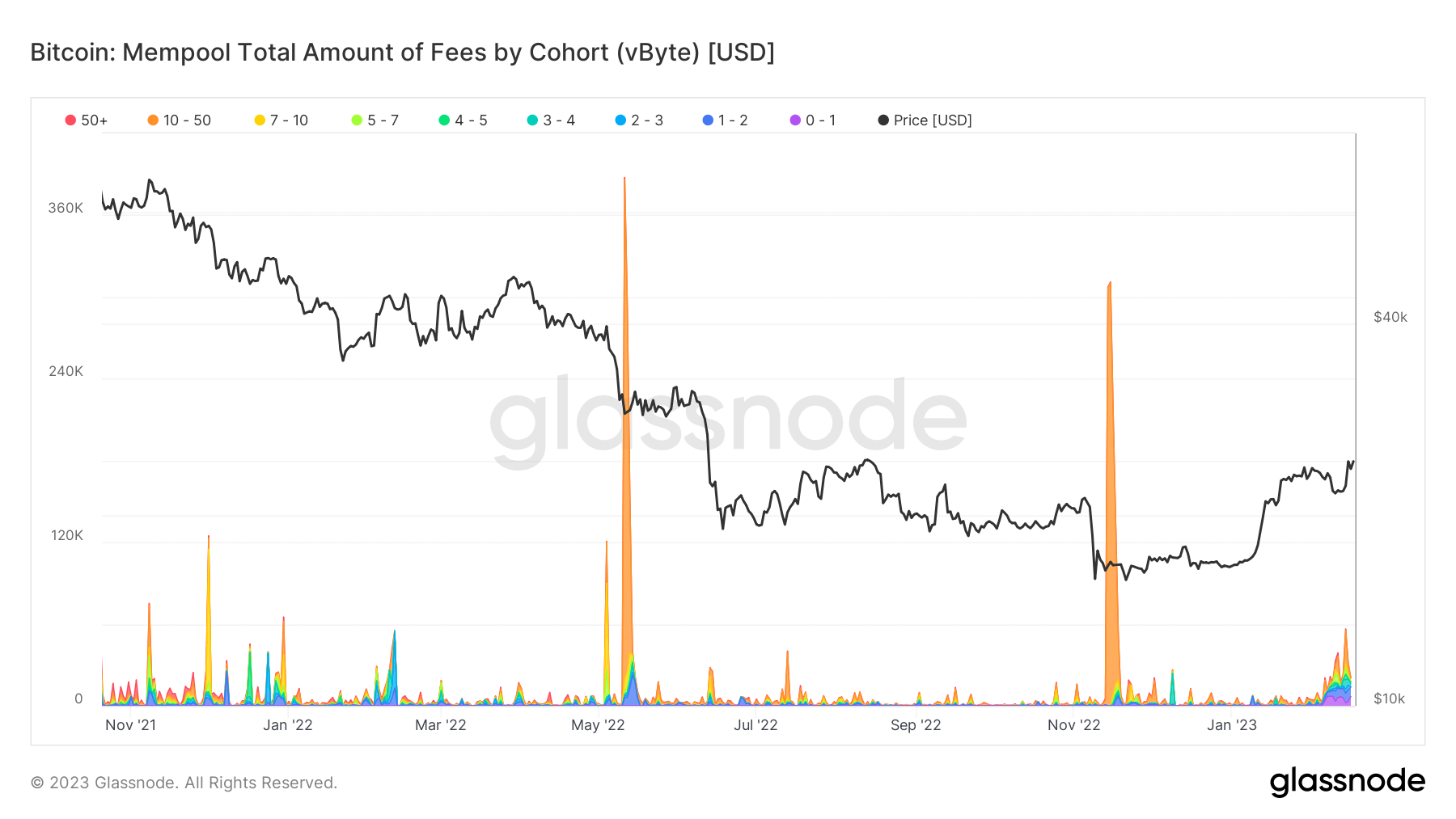

However, the below chart illustrates that Ordinal transactions have low satoshi fees (purple color dominant).

The total fees (USD Value) of transactions waiting in the mempool in different size (vByte) cohorts have increased since FTX collapsed, and inscriptions have lifted the baseline fee from 1 – 4 satoshis. The congestion within the mempools was raised partly due to an increase in space needed to store Ordinals inscriptions compared to standard transaction data. In addition, a surge in Bitcoin usage during the FTX saga, as investors led an exodus in exchange-held crypto, played a role in the November spike.

Glassnode data shows that Bitcoin’s mean block size upper range has increased significantly since the launch of Ordinals, rising from 1.5-2.0 MB to 3.0-3.5 MB within a few weeks. The increase correlates with not only images but larger files such as audio and video starting to be stored as Ordinals.

Notably, on Feb. 1, Inscription 652, the first piece in the Taproot Wizards collection, set a new record as the largest block and transaction in the history of Bitcoin, reaching 4 MB in size. Additionally, on Feb. 17., CryptoSlate reported on a fart that had been uploaded to the Ordinal network, inscription 2042.

Qualitative analysis

Glassnode shows that while the Ordinal network has had a significant impact on Bitcoin transaction hash size and cost, qualitatively, this may be connected to a broader crackdown on proof-of-stake mechanisms.

The majority of other layer-1 crypto protocols, which refer to base-layer blockchains having their own native tokens, are built on a proof-of-stake consensus mechanism, including Ethereum.

However, with the SEC’s crackdown on Kraken’s staking service in the United States, which suggests that only highly sophisticated retail investors can partake in validating networks of such blockchains, it appears that investing in ETH and similar tokens could become the exclusive domain of institutional players, leading to improvements to the Ordinal network.

As a result, the Ordinals Protocol is being hailed as a game-changer for the Bitcoin blockchain. By enabling the creation of Bitcoin-based NFTs, it has given the world’s most famous cryptocurrency a new purpose beyond just facilitating peer-to-peer transactions. This is particularly significant, given that the mainstream appeal of Bitcoin has arguably been hindered by factors like banking system regulations and its volatile price swings.

As evidenced by data from Glassnode, intense bullish activity appears to be forming around the Ordinal network.