EU regulators criticize stablecoins to promote Euro CBDC

EU regulators criticize stablecoins to promote Euro CBDC EU regulators criticize stablecoins to promote Euro CBDC

EU regulators are using the attack on UST and USDT stumbling as proof that Europe needs a CBDC

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

EU regulators are using the recent Terra Luna situation to push forward with a Digital Euro CBDC.

Many will see the volatility created by the attack on the algorithmically backed stablecoin, UST, as a reason to increase the regulation of stablecoins. With $16 billion worth of UST evaporating within days, it is hard to argue with the calls for more protection for investors.

The identity of the UST attacker is currently unknown. There are many theories but no hard evidence to suggest government or institutional involvement at this time. However, a common thread among the theories is that the goal was to create instability within the stablecoin market to fast-track the adoption of CBDCs.

Janet Yellen spoke in front of the US Treasury committee during the crisis, the UK Treasury reaffirmed its desire to regulate stablecoins, and now the EU is putting its hat in the ring. Fabio Panetta of the European Central Bank (ECB) and the person in charge of developing a CBDC for Europe said,

“Recent developments in the market for crypto assets illustrate that it is an illusion to believe that private instruments can act as money when they cannot be converted at par into public money at all times… There is no guarantee that they [stablecoins] can be redeemed at par at any time — just last week the world’s biggest stablecoin temporarily lost its peg to the dollar.”

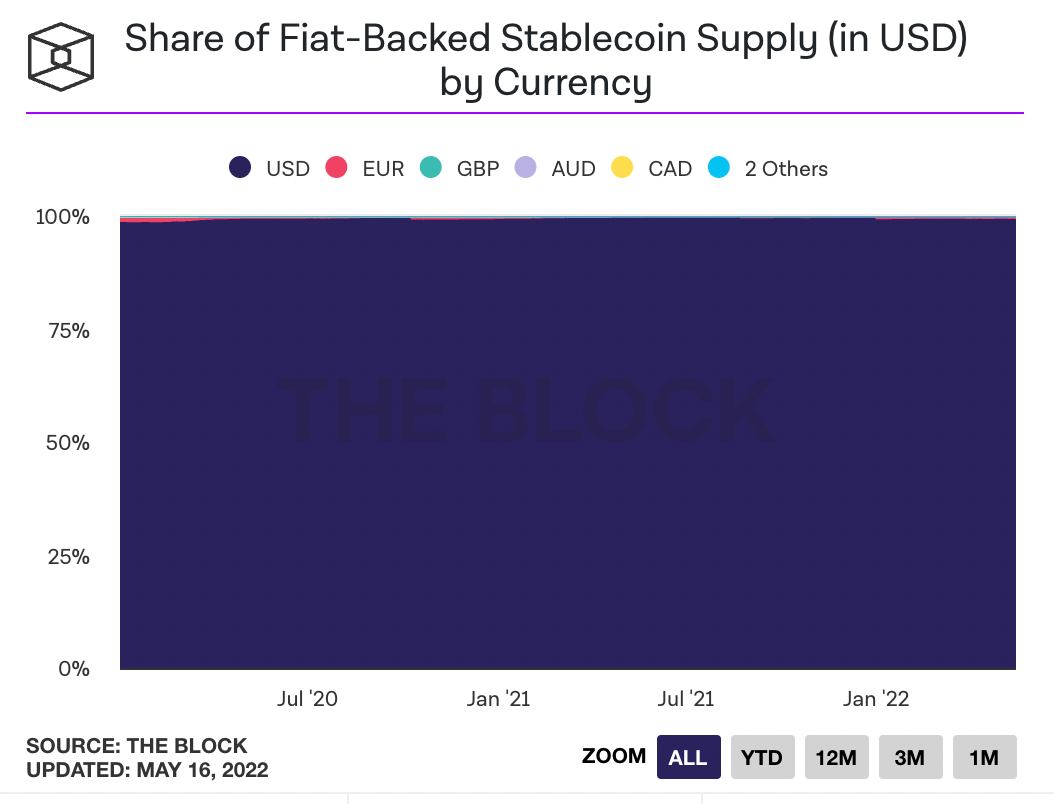

A clear rationale for a frosty approach to crypto-backed stablecoins is that no other currency has made any real headway into the space. Over 99% of all stablecoins in circulation are backed by USD rather than GBP, EUR, or countless other fiat currencies.

The chart below shows the market share of cryptocurrencies made up by the top fiat system.

The ongoing news from traditional media focuses on the environmental impact of Bitcoin and the benefits of proof of stake instead of proof of work.

Any CBDC report that has been released focuses on a proof of stake model with minimal energy usage. Panetta added “that a digital euro “can only be successful if potential users find that it adds value to current payment options.”

CryptoQuant

CryptoQuant