Ethereum was $11 during the last Presidential election—now it’s $355

Ethereum was $11 during the last Presidential election—now it’s $355 Ethereum was $11 during the last Presidential election—now it’s $355

Photo by David Beale on Unsplash

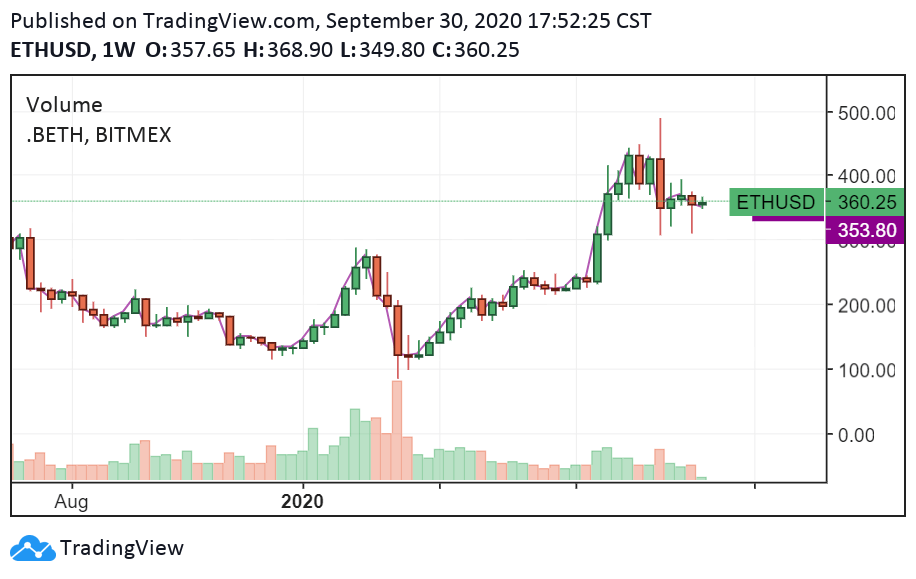

Four years ago, during the last presidential election, the price of Ethereum was hovering at $11. Today, fast forward four years, ETH is valued at $355. Within four years, ETH recorded a 3127% increase against the U.S. dollar.

Evan Van Ness, an Ethereum researcher, said:

“Four years ago during the #PresidentialDebate, the price of Ether was $11.”

Three major catalysts catapulted Ethereum by more than 30-fold in four years. The factors are the resurgence of decentralized finance (DeFi), surging user activity, and the anticipation of ETH 2.0.

The resurgence of DeFi

Since mid-2020, the demand for Ethereum noticeably increased at an unprecedented pace. Most of the newfound demand for ETH came from the DeFi market.

For DeFi users to transfer tokens to stake or earn a yield on DeFi protocols, they need to spend gas. The term gas refers to transaction fees on the Ethereum blockchain paid using ETH.

In the wake of the DeFi craze, gas costs surged to previously unseen levels. In some periods, average gas costs rose to 600 to 1,000 GWEI, costing users $50 to $200 per transaction.

Since users have to purchase ETH to pay for gas, naturally, that caused the demand for ETH to rise. Many users have also been staking ETH to earn governance tokens on newly-emerging DeFi protocols.

The confluence of the two factors exacerbated the recovery of ETH from the March 13 crash.

Since March 13, the price of Ethereum increased from sub-$100 to above $355. At its peak, ETH neared $500, topping at $488.84.

User activity on Ethereum is surging

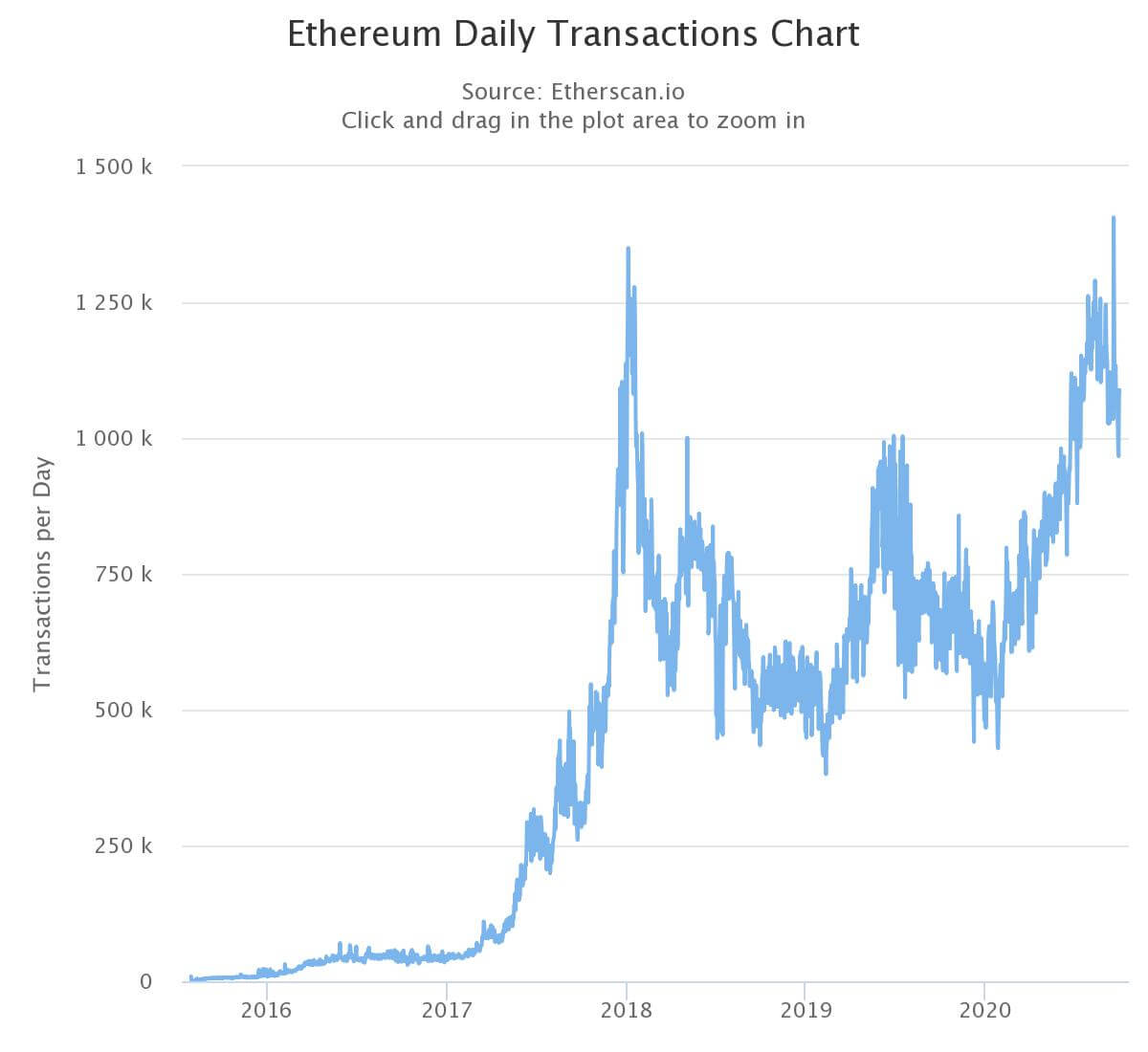

Data from the blockchain explorer Etherscan shows that the user activity on Ethereum has hit an all-time high. On September 17, the number of daily transactions on Ethereum achieved 1.4 million, to a new record high.

The surging user activity like came from the DeFi market, as users began to utilize decentralized exchanges like Uniswap over centralized platforms.

At its peak, the daily volume of Uniswap surpassed Coinbase Pro, processing $426 million in trades on a single day.

ETH 2.0 anticipation is building

Ethereum users expect ETH 2.0 to shortly arrive because the ecosystem needs it more than ever before.

The high gas costs and the frequently-clogged blockchain network has caused the user experience in DeFi to degrade. For the first time, legitimate user activity is overwhelming the blockchain to the point it cannot handle the capacity.

For the long-term growth trajectory of Ethereum, such a trend is highly optimistic. In previous bull cycles, the price of ETH soared, but there were lackluster fundamental factors and user demand to supplement it.

This time around, the price of ETH is rising in tandem with user activity and overall investor demand. Throughout the next four years, if backed with adequate developer activity and progress with ETH 2.0, the trajectory of Ethereum remains positive.

Ethereum Market Data

At the time of press 11:00 am UTC on Sep. 30, 2020, Ethereum is ranked #2 by market cap and the price is down 2.32% over the past 24 hours. Ethereum has a market capitalization of $40.14 billion with a 24-hour trading volume of $10.42 billion. Learn more about Ethereum ›

Crypto Market Summary

At the time of press 11:00 am UTC on Sep. 30, 2020, the total crypto market is valued at at $341.58 billion with a 24-hour volume of $83.76 billion. Bitcoin dominance is currently at 58.20%. Learn more about the crypto market ›