Ethereum Founder Proposes Solution For Stabilizing Gas Prices

Photo by Markus Spiske on Unsplash

With current Ethereum transaction fees fluctuating daily, Ethereum co-founder Vitalik Buterin proposed a new way of implementing a maximum gas price.

Currently, cryptocurrencies like Ethereum and Bitcoin allow users to choose a gas price they are willing to pay and depending on how high the fee is compared to the others, the more likely it will be included.

The issue with this method is that users aren’t motivated to post fees significantly higher than the average rate, ensuring their transaction goes through.

“If you value a transaction getting included right now at $1, you would be willing to bid anything up to $1, but if everyone else is bidding $0.05, then you could keep more money by bidding $0.08 instead.”

– Vitalik Buterin

This system is what gives Ethereum its transaction fee volatility. Ethereum has thousands of dApps running on top of it, all requiring their transactions to be processed. Depending on the mean transaction fee, users can cause extreme fee volatility.

Buterin’s Proposal

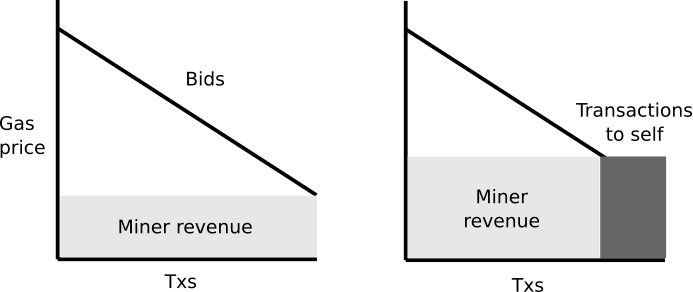

A common improvement to this fee model is a price auction. In this system, users bid a price they are willing to pay to have their transaction included. After this auction, the lowest fee the miner can accommodate will be applied to everyone.

One proposal for improving stability and user-friendliness of gas price markets: https://t.co/1AXsan7u9c

Not dependent on Casper, sharding or abstraction; if well reviewed and people agree it's a significant improvement, it could technically be implemented as a change to mainnet

— Vitalik "Not giving away ETH" Buterin (@VitalikButerin) July 2, 2018

For example, if a miner has space for 3 transactions and five bids are placed at [.03, .05, .07, .10 and .35], the 3rd to most expensive transaction fee will be applied to the highest three bidders.

The Ethereum network has more availability than 3 transactions, making this system effective at eliminating outliers.

Though this might be a better solution it is not without its flaws. Two issues Buterin brings to attention are:

- A miner can spam higher fee transactions, bringing up the price

- A miner can plot with transaction senders having them increase their bid, and then refund the difference.

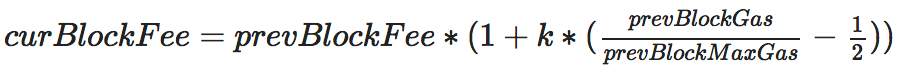

Expanding on the concept of fee auctions, Vitalk found a possible workaround to these issues with a formula:

With this solution, a minimum transaction fee is preserved, and miners can’t manipulate the price to increase their earnings. Instead of specifying a fee, users can state a minimum amount of blocks they want their transaction to occur in.

Users would be able to see the current price for Ethereum transactions, and if the fee is too high for a user, the transaction won’t occur. This method is incredibly effective at eliminating pointless transactions and removing unexpected transaction fee volatility.

While it might seem effective to have free and cheap transactions, it isn’t practical in Ethereum’s current system. Transaction fees are necessary to incentivize miners and protect against spam attacks.

If this recent proposal receives enough support from developers and the community, we may see it soon added to the Ethereum mainnet.

CryptoQuant

CryptoQuant

CoinGlass

CoinGlass