Ethereum deposits exceeds previous record high; are whales cashing out?

Ethereum deposits exceeds previous record high; are whales cashing out? Ethereum deposits exceeds previous record high; are whales cashing out?

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

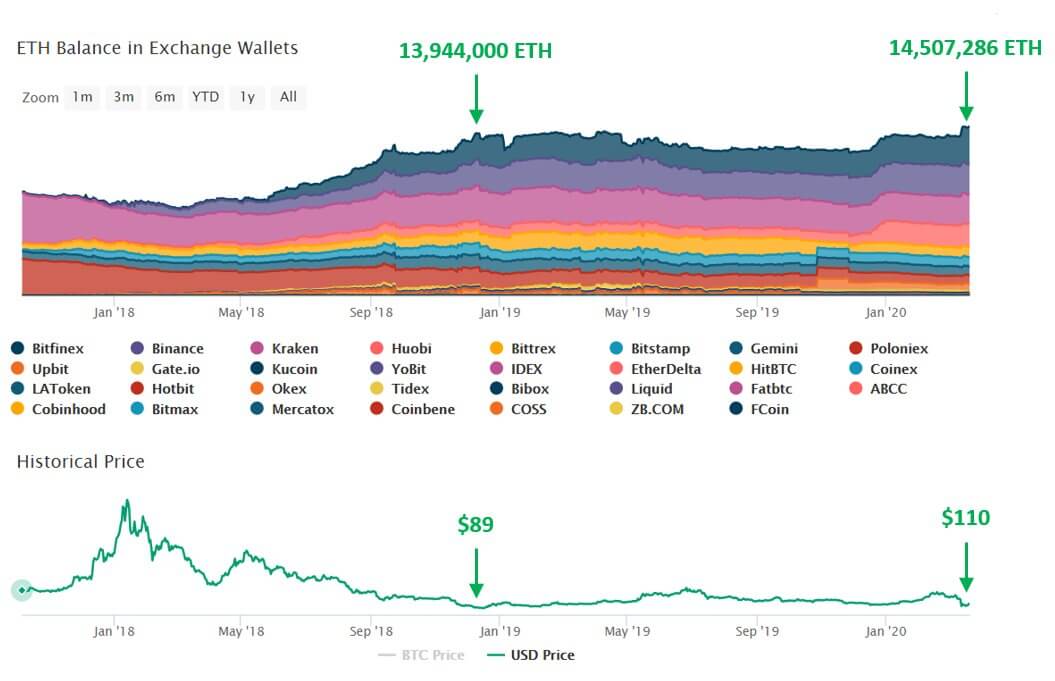

Ethereum deposits on exchanges have exceeded its previous high in December 2018, when the price of ETH fell to as low as $89.

Total exchange deposits of Ethereum increased to 14.5 million across all major cryptocurrency platforms, indicating that ETH is likely being sent to trading platforms to be sold.

Exchange deposits typically show that investors are moving to sell their assets, and exchange withdrawals or outflow indicate investors holding onto crypto assets over a long period of time.

A surge in exchange deposits demonstrates that amidst heightened levels of fear towards the coronavirus pandemic, investors are hedging their portfolio in the case of a further downtrend.

Uncertainty surrounds Ethereum and the crypto market

Since the second week of March, the price of Ethereum and other major crypto assets such as Bitcoin have been largely correlated with the U.S. stock market.

The drop-off in the equities market, primarily triggered by declining appetite towards high-risk assets, has led to a steep sell-off in the crypto market as well.

Analysts like Placeholder VC Chris Burniske have said that the Bitcoin price is unlikely to have seen its bottom just yet, due to various technical reasons. Until equities see a bottom, the demand for crypto assets, especially from institutions, is expected to dwindle.

1/ Lots of people asking where $BTC bottoms. The short of it is I wouldn’t be surprised to see a retest of our 2018 lows near $3000. To explain:

— Chris Burniske (@cburniske) March 16, 2020

Despite the exponential growth of the decentralized finance (DeFi) market and the rapid expansion of firms like BlockFi and Dharma, the Ethereum price has seen a significant correction in the past month.

As the price of Ethereum fell to sub-$200, it triggered a large number of liquidations across DeFi platforms, causing the total amount of ETH used as collateral on DeFi platforms to nearly halve.

Because DeFi platforms use ETH as collateral for loans, when the price of Ethereum drops substantially, borrowers are required to put up more ETH to maintain their loans.

At this time, for the crypto market, technical factors seem to take precedent over fundamentals; while Ethereum’s ecosystem has seen consistent growth since early 2019, the ETH has not been able to outperform the crypto market.

With analysts anticipating the crypto market to establish a new bottom in the near-future, exchange data suggests that a large number of investors are selling Ethereum out of fear towards uncertainty in the market.

Why record high deposits often coincide with the bottom

The crypto market, similar to the traditional financial market, tends to bottom when the market sees a peak level of fear amongst investors.

In December 2018, Ethereum bottomed when the number of deposits to exchanges reached 14 million ETH. After large amounts of ETH were sold and the price declined to nearly $80, ETH started to recover.

Similarly, when the Bitcoin price dropped to as low as $3,150 two years ago, it saw a sudden spike in buying demand and volume across major spot exchanges, causing a massive reaction and recovery.

Ethereum Market Data

At the time of press 8:08 am UTC on Mar. 23, 2020, Ethereum is ranked #2 by market cap and the price is down 6.65% over the past 24 hours. Ethereum has a market capitalization of $13.85 billion with a 24-hour trading volume of $12.72 billion. Learn more about Ethereum ›

Crypto Market Summary

At the time of press 8:08 am UTC on Mar. 23, 2020, the total crypto market is valued at at $166.28 billion with a 24-hour volume of $132.57 billion. Bitcoin dominance is currently at 64.95%. Learn more about the crypto market ›