Ethereum long contracts just hit a record high: how it can trigger a big correction

Ethereum long contracts just hit a record high: how it can trigger a big correction Ethereum long contracts just hit a record high: how it can trigger a big correction

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

The Ethereum price is quickly pulling back with technical analysts seeing sub-$200 in the short-term. Despite being one of the top-performing cryptocurrencies in the past two months, it is rapidly losing momentum.

Mostly due to record high Ethereum longs

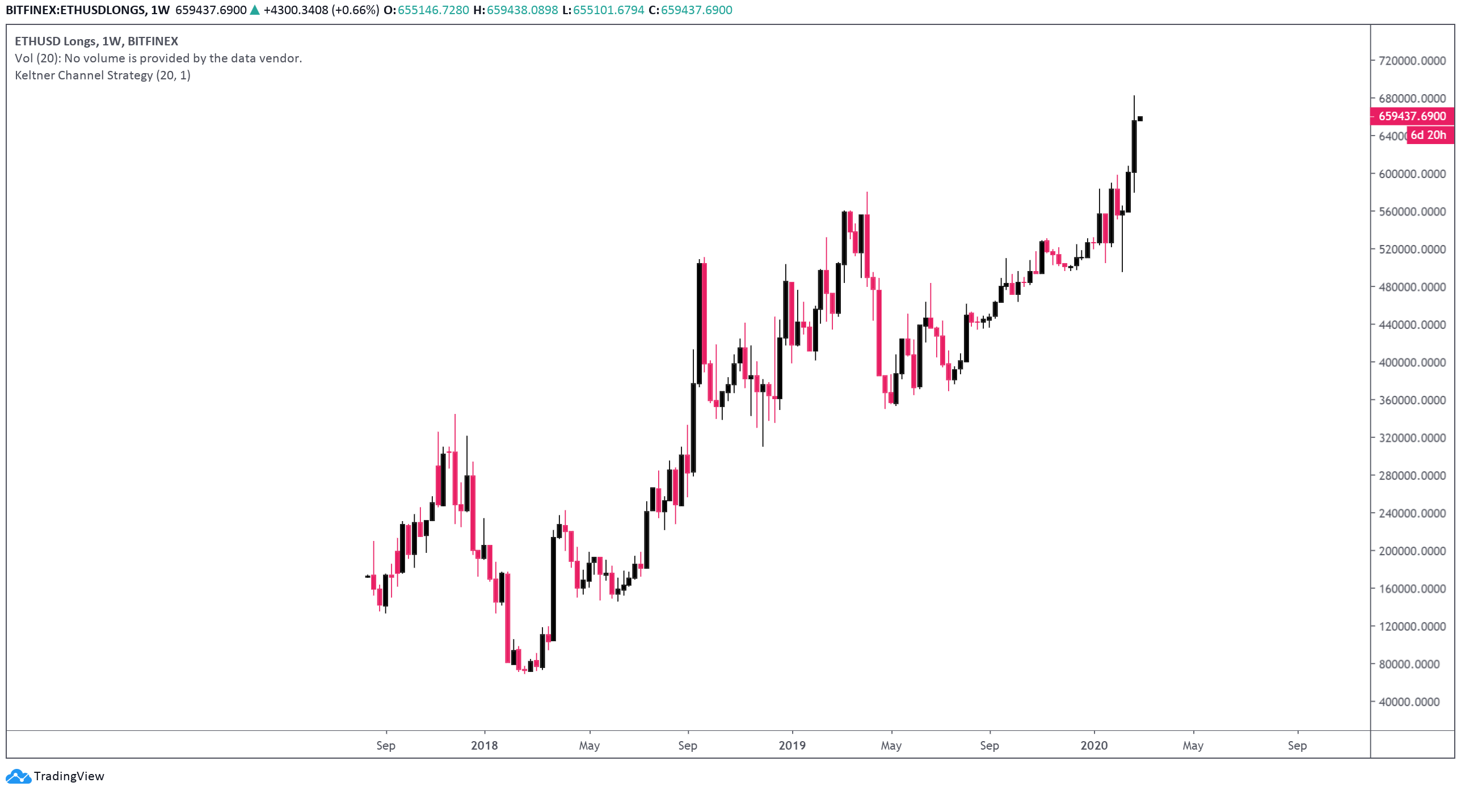

On Bitfinex, ETHUSD longs just hit a record high at 659,247, surpassing its previous high 579,785 contracts.

The absurdly high amount of ETH long contracts have led the funding rate of the Ethereum perpetual contract to spike.

On BitMEX, the funding for the Ethereum perpetual swap contract still hovers at 0.098 percent. That means, if a trader has a $100,000 long contract open, the trader is paying $98 per funding session.

Since funding occurs every 8 hours, the trader would be paying almost $300 per day just to have a long contract open.

The problem occurs when the price starts to drop while long contracts hit a fresh high and the funding rate is still extremely high.

If the price of Ethereum begins to decline and traders are still paying high funding rates to keep their longs open, it forces long contract holders to adjust their positions.

When long positions are market closed, they turn into market sells, which then turn into selling pressure.

The price of Ethereum has dropped by 20 percent from $280 to $220 within a two-week span, and technical analysts like Luke Martin expect the price of Ethereum to fall to the $180 support level in the near-term.

The continuation of a downtrend amidst high funding rates and an increase in long contracts could cause a cascade of longs to be liquidated or market closed over time.

Considering that short-term price movements in the cryptocurrency market are primarily swayed by margin trading platforms like BitMEX and Bitfinex, analysts fear that Ethereum would underperform against bitcoin as the market pulls back.

Martin said:

As we move into March, I am expecting ETH underperformance. Altcoins had a killer start to 2020 but majors are all turned over with momentum lower. Betting on lower prices for ETH.

As reported by CryptoSlate, the dominance of Bitcoin has started to increase as investors shift their focus from high-risk altcoins to more stable alternatives.

How deep will be the correction?

The price of Ethereum rose by 120 percent year-to-date at its peak, within less than two months, possibly as a response to oversold conditions in 2019.

The vertical rally of Ethereum has left a few strong support levels the cryptocurrency can fall back to amidst pullbacks.

Throughout the past several years, the cryptocurrency market has seen rallies that occur in a short period of time pullback shortly thereafter due to a lack of demand and support levels to sustain the momentum.

Technical analysts foresee the $140 to $180 range as a likely support area for ETH heading into the second quarter of 2020.

Ethereum Market Data

At the time of press 9:11 am UTC on Mar. 3, 2020, Ethereum is ranked #2 by market cap and the price is up 2.49% over the past 24 hours. Ethereum has a market capitalization of $25.04 billion with a 24-hour trading volume of $20.15 billion. Learn more about Ethereum ›

Crypto Market Summary

At the time of press 9:11 am UTC on Mar. 3, 2020, the total crypto market is valued at at $251.89 billion with a 24-hour volume of $176.78 billion. Bitcoin dominance is currently at 63.76%. Learn more about the crypto market ›