Ethereum daily transaction volume going “parabolic,” ETH price breaks $1400

Ethereum daily transaction volume going “parabolic,” ETH price breaks $1400 Ethereum daily transaction volume going “parabolic,” ETH price breaks $1400

The daily transaction volume of Ethereum is going “parabolic,” according to researchers. This trend buoys the short to medium-term bull case of ETH, which has been outpacing Bitcoin in the past few days.

Ryan Watkins, a researcher at Messari, said:

“Ethereum’s daily transaction volume is going parabolic. It now settles $12 billion in transactions daily – $3 billion more than Bitcoin. Imagine not being bullish $ETH.”

The fast growth of the Ethereum blockchain network can be attributed mainly to the exponential expansion of the DeFi market.

DeFi continues to uplift Ethereum

DeFi has many sub-sectors within the industry. There are lending protocols like Aave, automated market makers (AMMs) like SushiSwap, and decentralized derivatives exchanges, such as Perpetual Protocol.

DeFi protocols, especially decentralized exchanges, are beginning to see hundreds of millions of dollars in daily volume.

Even complex futures exchanges, like Perpetual Protocol, have begun to record around $30 million in volume per day.

The clear increase in the user activity of DeFi protocols directly buoys the sentiment around Ethereum because DeFi users utilize ETH to pay gas as fees.

Hence, as long as the fundamentals of Ethereum, such as the fees paid per day and the daily transaction volume continue to strengthen, the outlook of ETH remains bright.

What do traders think?

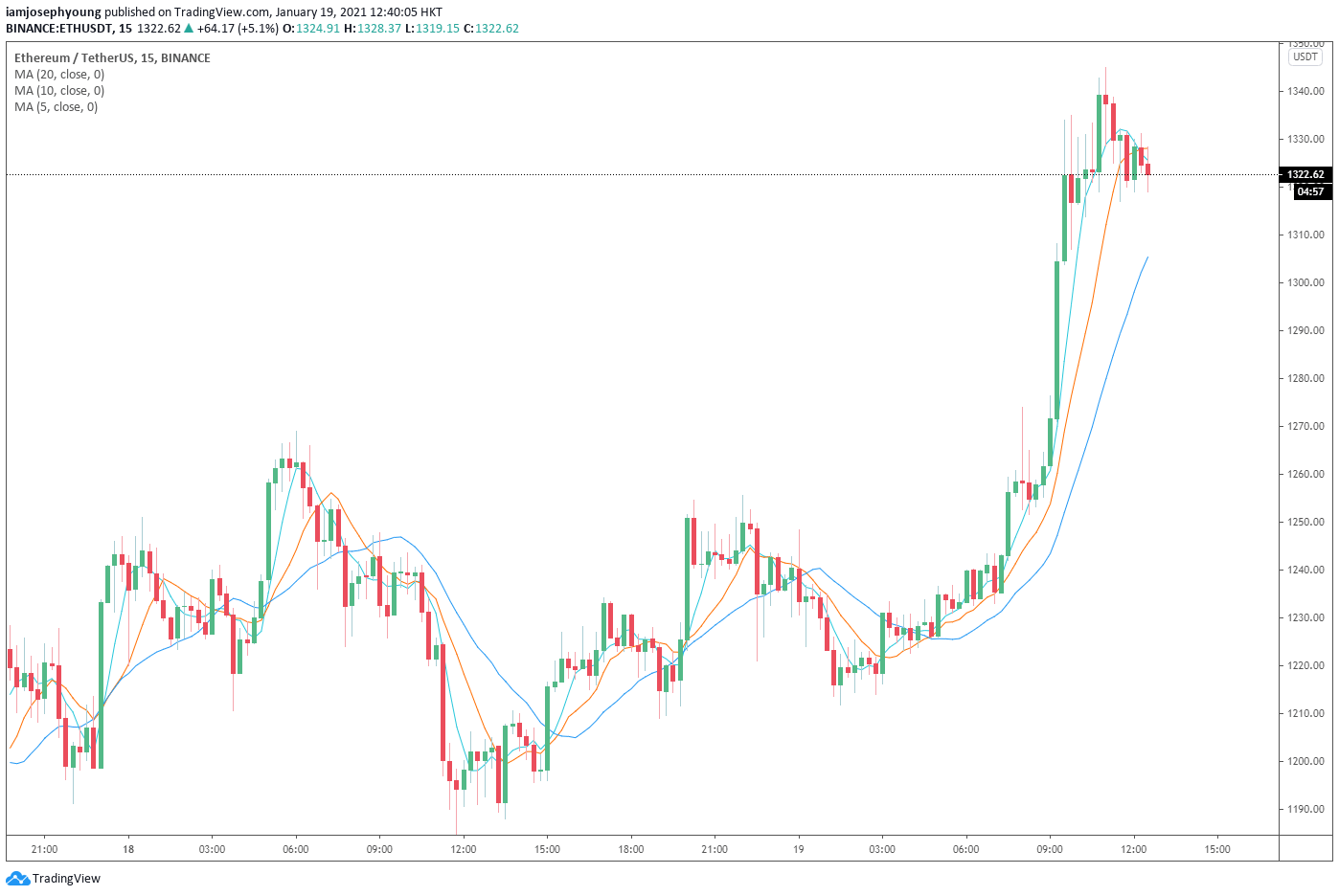

Traders are short-term cautious as ETH approaches $1400 because it remains as a major resistance level.

A pseudonymous trader known as “Loma” said that although an all-time high for ETH is becoming more likely, there is a high probability of a flush drop at $1,350. He said:

“Still think $ETH ATHs are a formality at this point, especially with the conditions in the market as we’re pushing up but… If there were ever an area for $ETH to scam mfers one more time, it’s here at the ~1350 area.”

But, once ETH surpasses its all-time high, industry executives say that it would further legitimize cryptocurrencies as an asset class.

Tyler Culler-Ward, the co-founder of BarnBridge, noted that ETH and BTC hitting an all-time high together would be a highly positive factor for the cryptocurrency sector in general. He wrote:

“I think ETH and BTC both hitting all time highs will legitimize crpto for a lot of people because they’ll start to realize it always comes back when it drops making it easier to ride out down markets if you truly believe in the technology.”

In the near term, the declining ETH reserves on exchanges is an optimistic sign as it shows there is lower selling pressure across trading platforms.

This trend explains why ETH has seen low volatility when BTC was falling steeply in the past week and saw a sharp uptrend when BTC rallied.

Ethereum Market Data

At the time of press 1:00 pm UTC on Jan. 19, 2021, Ethereum is ranked #2 by market cap and the price is up 13.45% over the past 24 hours. Ethereum has a market capitalization of $158.94 billion with a 24-hour trading volume of $41.05 billion. Learn more about Ethereum ›

Crypto Market Summary

At the time of press 1:00 pm UTC on Jan. 19, 2021, the total crypto market is valued at at $1.05 trillion with a 24-hour volume of $133.86 billion. Bitcoin dominance is currently at 65.22%. Learn more about the crypto market ›