Dogecoin, Shiba Inu coin lead losses as crypto volume dumped 43% in June

Dogecoin, Shiba Inu coin lead losses as crypto volume dumped 43% in June Dogecoin, Shiba Inu coin lead losses as crypto volume dumped 43% in June

Meme dog-themed tokens take a hit in the latest market dip.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Data on crypto exchange trading volumes show a fall of more than 40% in June. Some attribute this to the regulatory crackdown by Chinese authorities.

As a hangover from this, the past few weeks have seen markets ranging. But a dip yesterday has set off more bearish sentiment, as the Fear and Greed Index slid further into extreme fear, falling from a rating of 25 to 20 today.

Meme tokens Dogecoin and Shiba Inu felt the brunt of the sell-off. The question on everyone’s mind is, is more to come?

Crypto volumes tell a story of depression

According to data analyst firm CryptoCompare, spot trading volume fell 42.7% to $2.7 trillion in June. Crypto derivatives also took a tumble, with volume dropping 40.7% to $3.2 trillion over the same period.

The firm said falling prices, decreasing volatility and trading volume were due to China’s crackdown on Bitcoin mining.

“Headwinds continued as China persisted with its crackdown on bitcoin mining. As a result of both lower prices and volatility, spot volumes decreased.”

Since mid-May, a series of notices from Chinese authorities have injected major FUD into crypto markets. First, three industry bodies operating under the People’s Bank of China sounded the alarm on crypto trading speculation. The notice stated financial institutions must strengthen their “social responsibilities” in not conducting business related to virtual currencies.

This was closely followed by local authorities putting a stop to Bitcoin mining operations, even cutting electricity supply to miners in some cases.

The net result has been plummeting hash rates and a mining exodus. Several countries have come forward, advertising themselves as friendly jurisdictions for Chinese miners to set up shop. However, it may be many months before we see the effect of relocation on these metrics.

Dogecoin and Shiba Inu post big losses today

Unfortunately, as the “God market,” goings-on in Bitcoin have consequences for the rest of the crypto markets. For the past three weeks, Bitcoin has been trading sideways with tight daily closes of between $31,600 and $36,000.

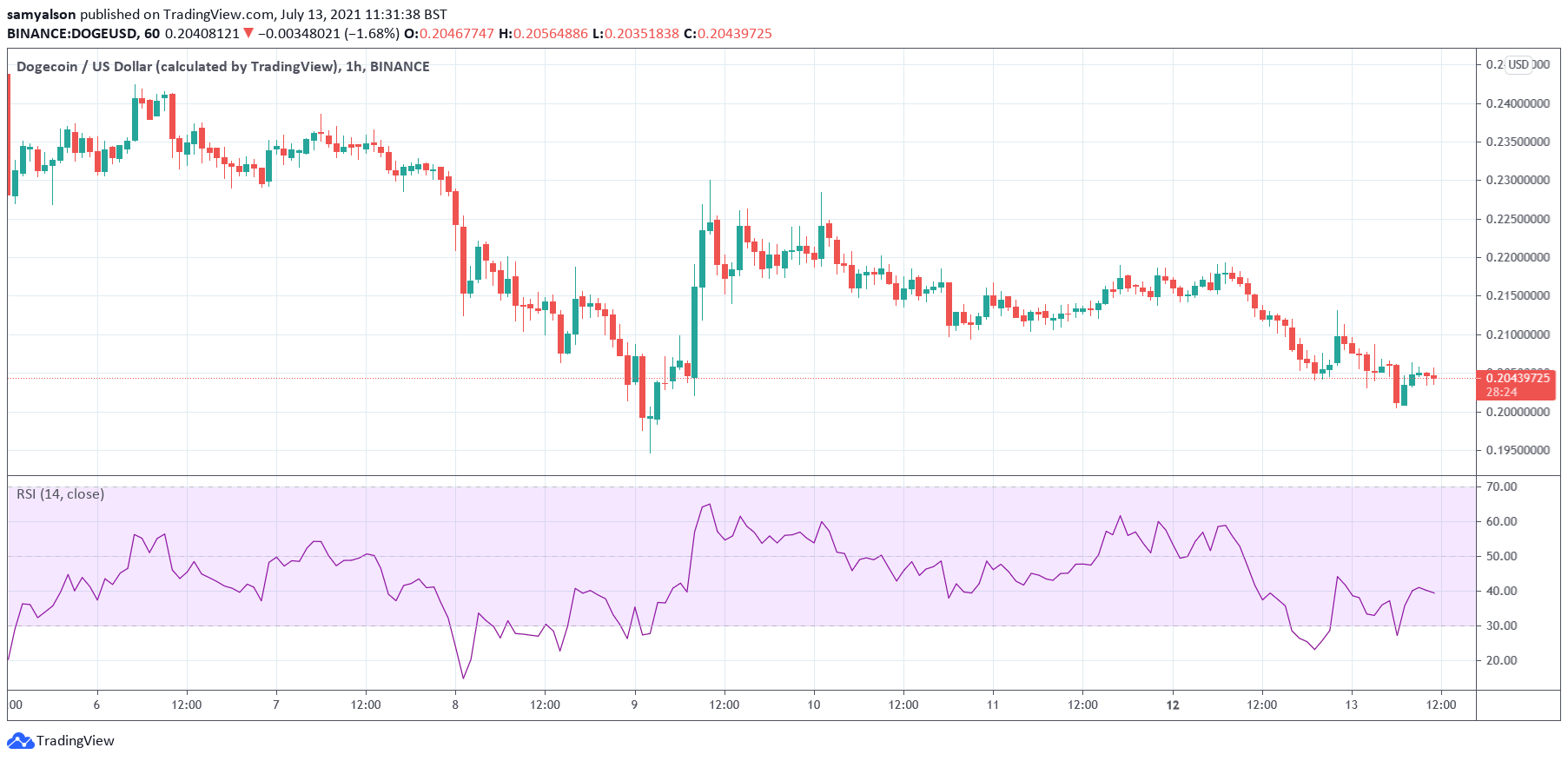

Late yesterday evening, Dogecoin began sliding in price, falling from $0.2179 to bottom at $0.2008 in the early hours of today – that’s an 8% fall.

Bulls have since stepped up leading to a fightback of sorts. However, RSI is starting to curl back down to oversold levels suggesting the bulls are losing steam.

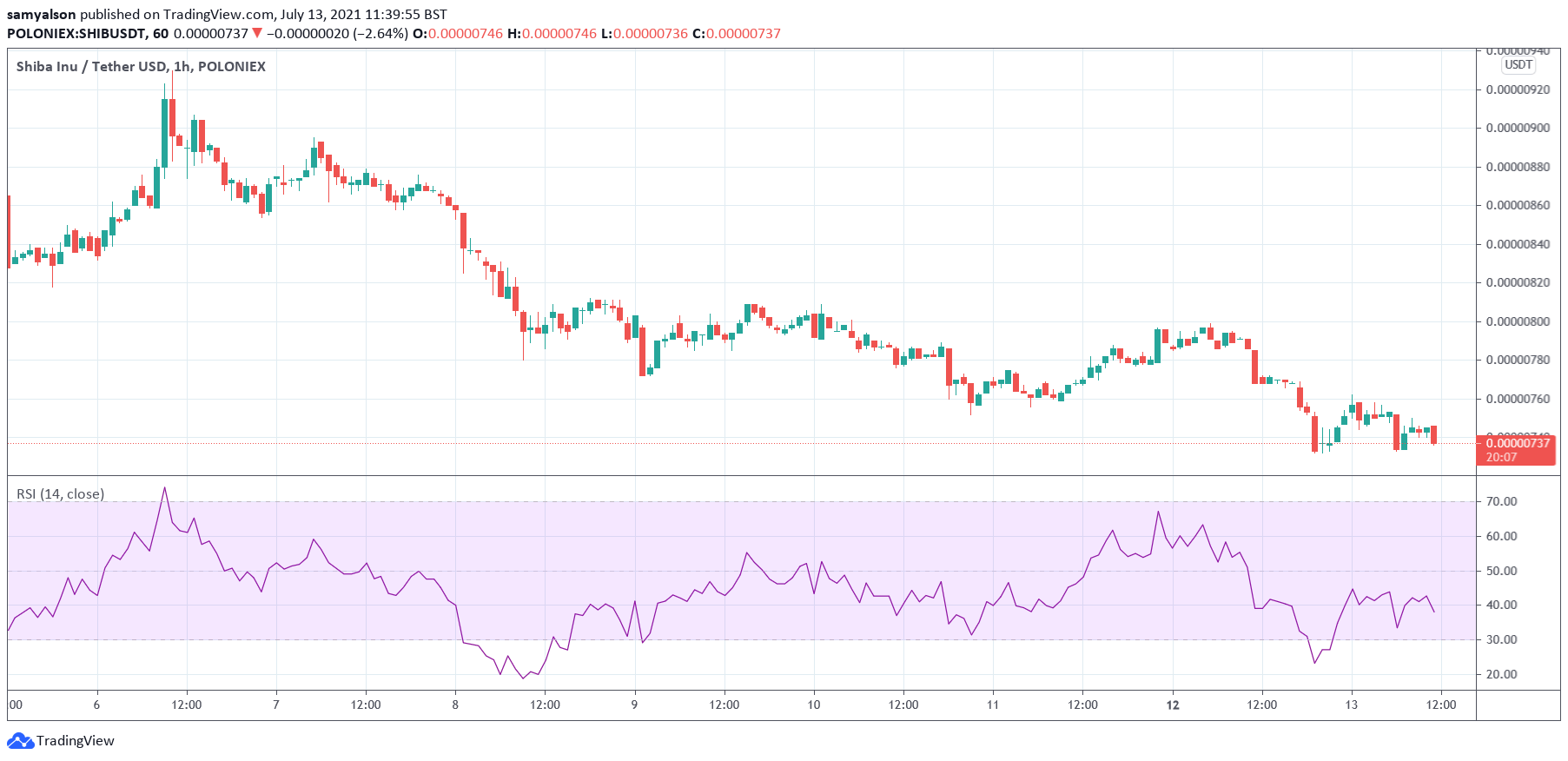

It’s a similar story for Shiba Inu. SHIB’s dip in price occurred around the same time as Dogecoin. But with SHIB there are two distinct drops followed by three, so far, bounces at the $0.00000733 support level.

Since the downturn, SHIB has lost 7%. While RSI shows a more aggressive downturn towards oversold levels.

The above can be interpreted as meme tokens continuing to fall out of favor with the market. But until trading volumes return to pre-FUD levels, if they do at all, this remains conjecture.