Unemployment Rate

Source: FRED, Federal Reserve Bank of St. Louis

U.S. Bureau of Labor Statistics, Unemployment Rate [UNRATE], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/UNRATE, November 16, 2024.

What is Unemployment Rate?

The unemployment rate is a critical economic indicator that reflects the health of a country’s labor market. It measures the percentage of the total labor force that is unemployed but actively seeking employment. Central banks, policymakers, economists, and investors keep a close eye on this figure because it serves as a barometer for broader economic conditions, influencing decisions related to fiscal policies, investment strategies, and even consumer sentiment.

This explainer will provide a comprehensive overview of the unemployment rate, its history, and its relationship to broader economic conditions, including how it has historically correlated with the price of Bitcoin and the broader crypto market.

History of the Unemployment Rate

The concept of tracking unemployment dates back to the early 20th century. Prior to that, governments did not systematically collect data on employment or unemployment. The Great Depression of the 1930s in the United States was a pivotal moment in labor economics, as unemployment skyrocketed to unprecedented levels—reaching around 25% in 1933.

This economic catastrophe spurred governments worldwide to create mechanisms for tracking and understanding the labor market. In the U.S., for example, the Bureau of Labor Statistics (BLS) began releasing regular unemployment data in the 1940s as part of its broader efforts to measure economic activity.

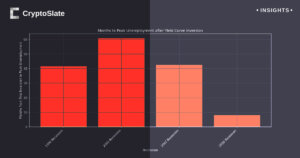

Unemployment has often fluctuated in response to global economic cycles. High unemployment rates are typically associated with economic recessions, while lower rates often indicate periods of economic growth. For example, during the 2008 global financial crisis, the U.S. unemployment rate reached 10%, a peak that sparked massive government intervention, such as the Federal Reserve’s quantitative easing (QE) programs.

Post-crisis, as economic conditions improved, unemployment gradually decreased. By 2019, it had reached historically low levels in many countries—around 3.5% in the United States. However, the COVID-19 pandemic in 2020 caused a sudden, sharp spike in unemployment worldwide, with some countries reporting unemployment rates as high as 20%.

How Is the Unemployment Rate Calculated?

The unemployment rate is calculated as a percentage of the labor force. Specifically, it is determined by dividing the number of unemployed people actively seeking work by the total labor force, which includes both employed and unemployed individuals. It is important to note that people who are not actively looking for work—such as retirees, students, or discouraged workers who have stopped looking—are not included in the labor force, and thus do not count toward the unemployment rate.

Governments often publish unemployment data on a monthly basis. In the United States, for instance, the BLS conducts surveys, including the Current Population Survey (CPS), to gather employment statistics. The data is categorized into different groups, such as the U-3 unemployment rate (the standard figure reported in the media) and the U-6 rate, which includes underemployed and discouraged workers, offering a broader view of labor market distress.

Types of Unemployment

Economists typically break down unemployment into several categories:

- Frictional Unemployment: This occurs when workers are temporarily unemployed as they transition from one job to another. It’s a normal and healthy part of a dynamic labor market.

- Structural Unemployment: This happens when there’s a mismatch between the skills workers possess and the skills required for available jobs. Technological advancements, for example, can render certain jobs obsolete, increasing structural unemployment.

- Cyclical Unemployment: This type of unemployment is directly related to the economic cycle. During recessions, demand for goods and services declines, leading companies to reduce their workforce, thereby increasing unemployment.

- Seasonal Unemployment: This occurs when industries have peak hiring seasons, such as retail during the holidays or agricultural work during harvest periods.

The Unemployment Rate’s Effect on Financial Markets

The unemployment rate has significant implications for financial markets. When unemployment is high, it often signals economic contraction or recession, which can lead to stock market declines. Conversely, a low unemployment rate typically indicates economic expansion, boosting investor confidence and encouraging stock market growth.

Governments and central banks often respond to rising unemployment by implementing policies to stimulate economic growth. For instance, lower interest rates can encourage borrowing and investment, while increased government spending may create jobs and stimulate demand.

Correlation Between the Unemployment Rate and Bitcoin Prices

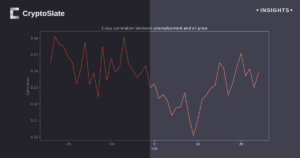

While traditional financial markets are closely tied to macroeconomic indicators like the unemployment rate, Bitcoin and the broader crypto market have demonstrated a more nuanced relationship.

Bitcoin, often referred to as “digital gold,” is decentralized and operates outside the control of governments and central banks, making it more resilient to certain economic factors that affect fiat currencies and traditional assets. However, the unemployment rate can indirectly influence Bitcoin’s price, especially during periods of economic stress.

Flight to Safety

During periods of high unemployment and economic uncertainty, investors often seek assets that they perceive as safe havens. Historically, gold has been a popular choice. However, Bitcoin has increasingly entered the conversation as a digital alternative to gold.

For example, during the COVID-19 pandemic in 2020, unemployment spiked globally, and Bitcoin saw a significant rise in price as some investors turned to crypto as a hedge against economic instability and inflation caused by government stimulus measures.

Risk Appetite and Speculation

On the flip side, Bitcoin is also viewed by many as a speculative asset. During times of economic expansion and low unemployment, when investors have higher risk tolerance, Bitcoin can experience price surges driven by speculation. This was evident during Bitcoin’s meteoric rise in 2017, a period characterized by low unemployment and robust economic growth in many parts of the world.

Institutional Involvement

More recently, institutional investors have started to view Bitcoin as a hedge against broader economic instability, including the potential for rising unemployment. As unemployment trends influence monetary policy (e.g., interest rates and quantitative easing), Bitcoin’s narrative as a store of value becomes increasingly compelling. The correlation between unemployment, inflation fears, and Bitcoin’s price was evident in 2021 when major companies and funds began investing in Bitcoin, partly due to concerns over fiat currency devaluation.

The unemployment rate is a vital economic indicator that reflects the overall health of the labor market and the economy at large. While its direct influence on the price of Bitcoin may not be as strong as it is on traditional financial markets, the unemployment rate’s role in shaping macroeconomic conditions can indirectly affect Bitcoin’s price.

As Bitcoin graduates from a speculative asset to a store of value, its relationship with traditional economic indicators like the unemployment rate may become even more pronounced. Understanding these dynamics is crucial for investors in both traditional markets and the rapidly evolving crypto space.

Farside Investors

Farside Investors

CryptoQuant

CryptoQuant