Here’s why Cardano (ADA) average transaction fees are up 1,500% in the past year

Here’s why Cardano (ADA) average transaction fees are up 1,500% in the past year Here’s why Cardano (ADA) average transaction fees are up 1,500% in the past year

How does IOHK intend to solve the problem of rising fees on Cardano?

Image by rawpixel.com

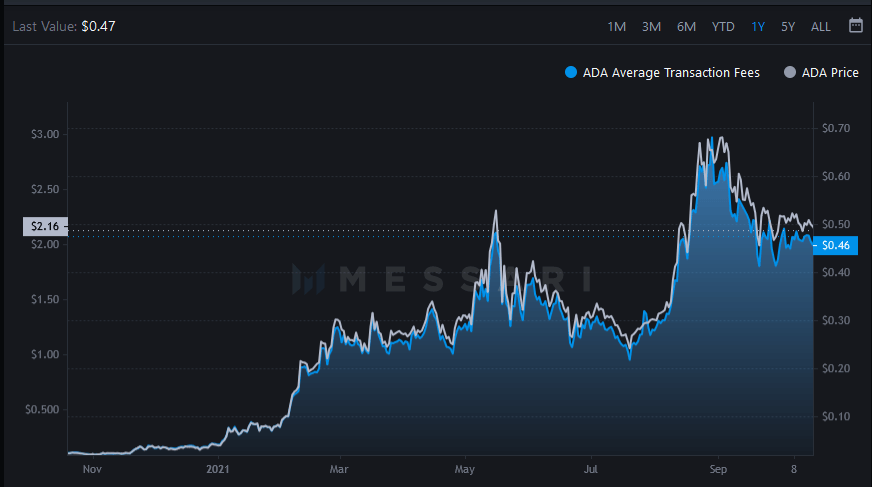

Data from Messari shows, over a year, average transaction fees on the Cardano network have increased from $0.03 to $0.47 – this represents a 1,466% increase.

Transaction fees are calculated in ADA at a mainly fixed or constant rate. Therefore, it’s expected that as the price of ADA increases, so do the transaction fees in dollar terms.

However, if the price of ADA increases in the future, which is expected as the dApp ecosystem fills out, the big fear is that it may become too expensive to transact on Cardano.

How are transaction fees calculated?

For transactions to work on Cardano, users must pay a minimal fee. This incentivizes stake pool operators (SPOs) to keep the network running. And it also increases network safety by making Distributed Denial of Service (DDoS) attacks expensive for attackers to spam the network with dummy transactions.

Minimal fees are calculated using the formula a+b x size. Where “a” = 0.155381 ADA, “b” = 0.000043946 ADA/Byte, and “size” = the size of the transaction in Bytes.

IOHK calculates a 200 Byte transaction, which is typical, coming in with a minimal fee of 0.1641802 ADA, or $0.3497 at today’s price.

0.155381 ADA + 0.000043946 ADA/Byte × 200 Byte = 0.1641702 ADA

In deriving “a” and “b,” IOHK said they considered multiple factors such as cost of memory, average transactions per second, and so on to come up with minimal values. That way, they could achieve the goals of preventing DDoS attacks while also keeping SPOs sufficiently compensated for their efforts and running costs.

“How expensive is one byte of computer memory?

How many transactions will there be on average per second?

How large will a transaction be on average?

How much does it cost to run a full node?”

In other words, IOHK set up the fee system in a delicate balance to take account of network safety and efficiency at the lowest deemed cost.

Is Cardano economically scalable?

The above parameters were set over four years ago. Back then, ADA was priced at around $0.02. However, a spike in the ADA price since then has pushed transaction fees up significantly.

The current average transaction fee of $0.47 may be palatable for many users. But what happens if the price of ADA hits $10? More so, wouldn’t this force users from less developed regions to go elsewhere?

However, IOHK CEO Charles Hoskinson doesn’t see this as a problem. In a recent AMA, Hoskinson addressed this issue by saying thanks to Voltaire and Catalyst, token holders can vote on proposals to lower fees when the time comes.

As such, scalable fees are somewhat indirectly built-in, making this a short-term issue only.