Bitcoin sees “healthy change” in open interest as high-leverage positions get flushed out

Bitcoin sees “healthy change” in open interest as high-leverage positions get flushed out Bitcoin sees “healthy change” in open interest as high-leverage positions get flushed out

Photo by Karl Lee on Unsplash

Bitcoin has seen some turbulence in recent times as buyers and sellers both attempt to gain control of the cryptocurrency’s mid-term trend.

It does appear that bulls have the upper hand, however, as one on-chain indicator is suggesting that it is on the cusp of seeing a major upswing in the days and weeks ahead.

This bright outlook from a price-perspective comes as the cryptocurrency flashes signs of growing fundamental strength, as seen while looking towards its “healthy change” in open interest.

Much of Bitcoin’s previous volatility can be attributed to the immense presence of high-leveraged positions within the market, which act as fuel for the cryptocurrency to see large – and unsustainable – price movements.

The existence of these positions can be largely gauged while looking towards the cryptocurrency’s open interest.

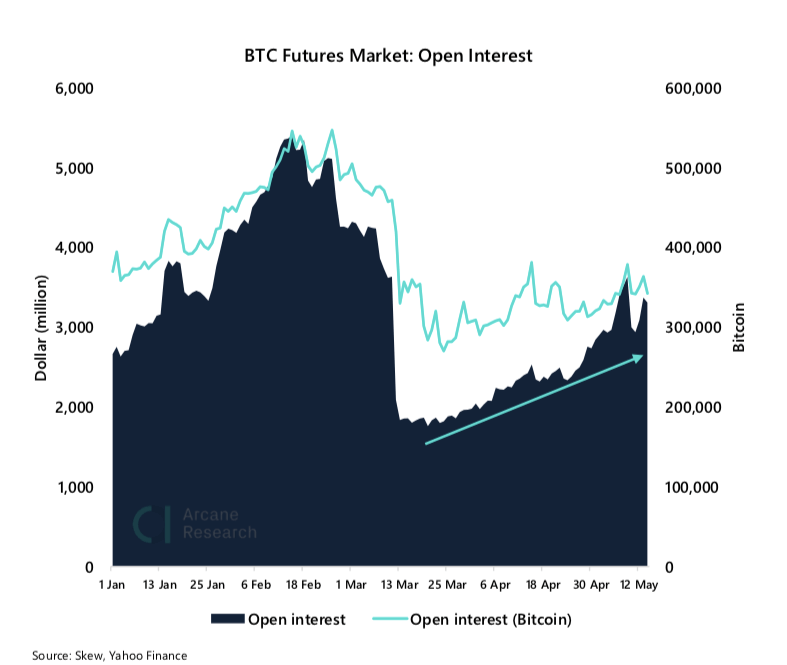

According to a recently released analysis from Arcane Research, growth in Bitcoin futures open interest seems to suggest that traders are relying less heavily on leverage in order to profit from BTC’s volatility.

“The lower BTC denominated open interest in the futures market may be viewed as a healthy indicator in terms of the current speculative environment. It signals fewer leveraged positions, meaning that the market is less vulnerable for violent liquidation loops like those seen in March.”

The divergence between futures open interest and that seen on margin trading platforms like BitMEX does indicate that market participants are keen on gaining exposure to the crypto’s long-term price action rather than attempting to capitalize on short-term movements.

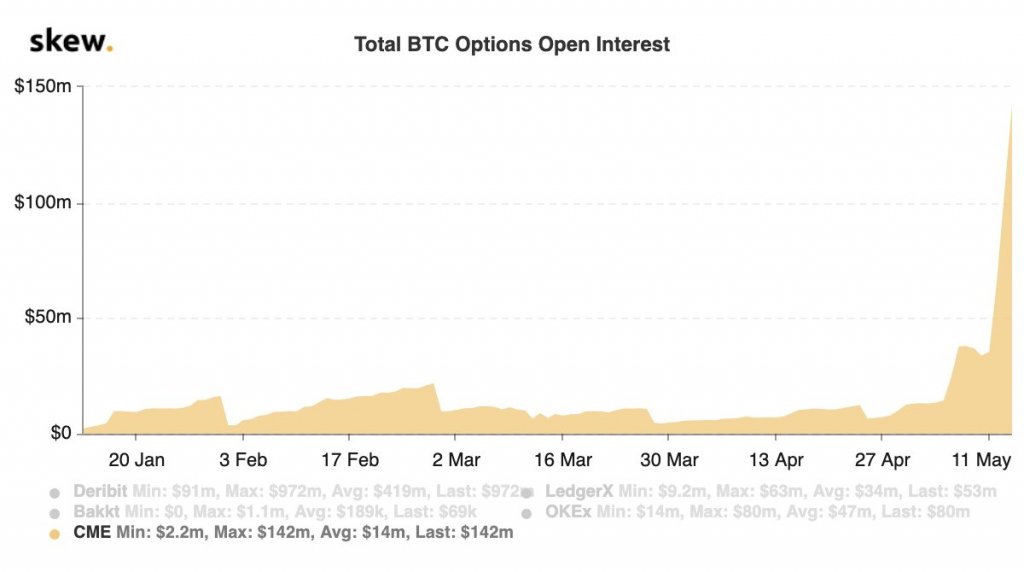

Open interest for Bitcoin options has also seen a massive rise in recent times, now being 10x larger than that seen last month according to data from Skew.

“CME Bitcoin options open interest is up 10x this month.”

Bitcoin’s momentum in Network Value to Transaction (NVT) Ratio

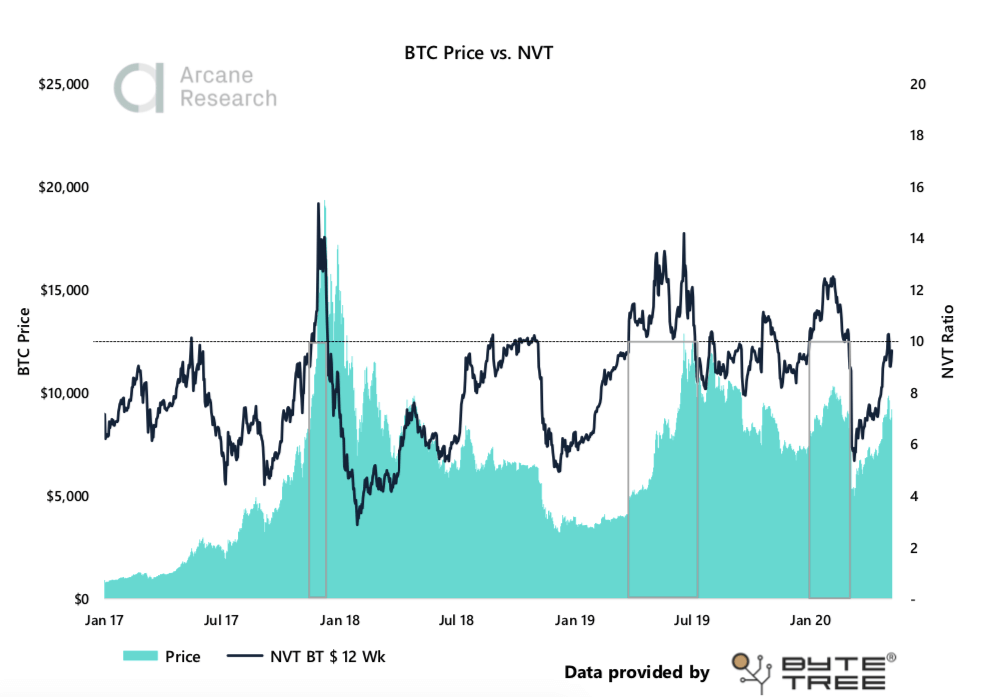

Arcane Research also notes that the cryptocurrency could soon see some immense momentum based on its Network Value to Transaction (NVT) ratio.

This indicator measures the price of Bitcoin against the value being transferred on the BTC network.

They note that this indicator’s value recently pushed above 10, which is historically a sign of an imminent period of fast price growth.

“Based on the last three years, an NVT ratio surpassing 10 could indicate a period of strong and fast price growth. This was seen both on 2017, 2019 and 2020. Network traffic must increase in order for price to continue rising. Fortunately, network traffic in USD terms is rising sharply.”

The confluence of these factors could provide Bitcoin with some serious strength in the days and weeks ahead.

![Skew [acquired by Coinbase]](https://cryptoslate.com/wp-content/themes/cryptoslate-2020/imgresize/timthumb.php?src=https://cryptoslate.com/wp-content/uploads/2019/11/skew-logo.jpg&w=16&h=16&q=75)

![Skew [acquired by Coinbase]](https://cryptoslate.com/wp-content/themes/cryptoslate-2020/imgresize/timthumb.php?src=https://cryptoslate.com/wp-content/uploads/2019/11/skew-logo.jpg&w=100&h=100&q=75)