Bitcoin retakes $20,000 fueling speculation of bull market return

Bitcoin retakes $20,000 fueling speculation of bull market return Bitcoin retakes $20,000 fueling speculation of bull market return

A 6% upside swing in the last 24 hours has renewed talk of the end of the bear market market, but on-chain metrics suggest otherwise, at least in the near term.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Having broken through $19,300 resistance at the fourth time of asking, Bitcoin moved higher during the early hours of Tuesday (UTC) to peak at $20,400.

Bull exhaustion sees the $20,170 level providing support in the meantime. However, the significant gains over the past 24 hours have renewed calls for an end to the bear market from some.

Trader and the host of the Wolf of all Streets Podcast, Scott Melker, remarked that today’s Bitcoin price action is highly unusual given that stocks have gone the other way.

Bitcoin up big on a day when stonks are down.

In 2022 that’s like seeing a unicorn riding a three legged elephant through the halls of Valhalla from the window of your billion dollar luxury penthouse on Uranus.

— The Wolf Of All Streets (@scottmelker) September 27, 2022

What’s further perplexing is that this comes at a time when major currencies, including the EUR and GBP, are losing significant ground to the USD.

Although the rally has brought a degree of market optimism, what do on-chain metrics show?

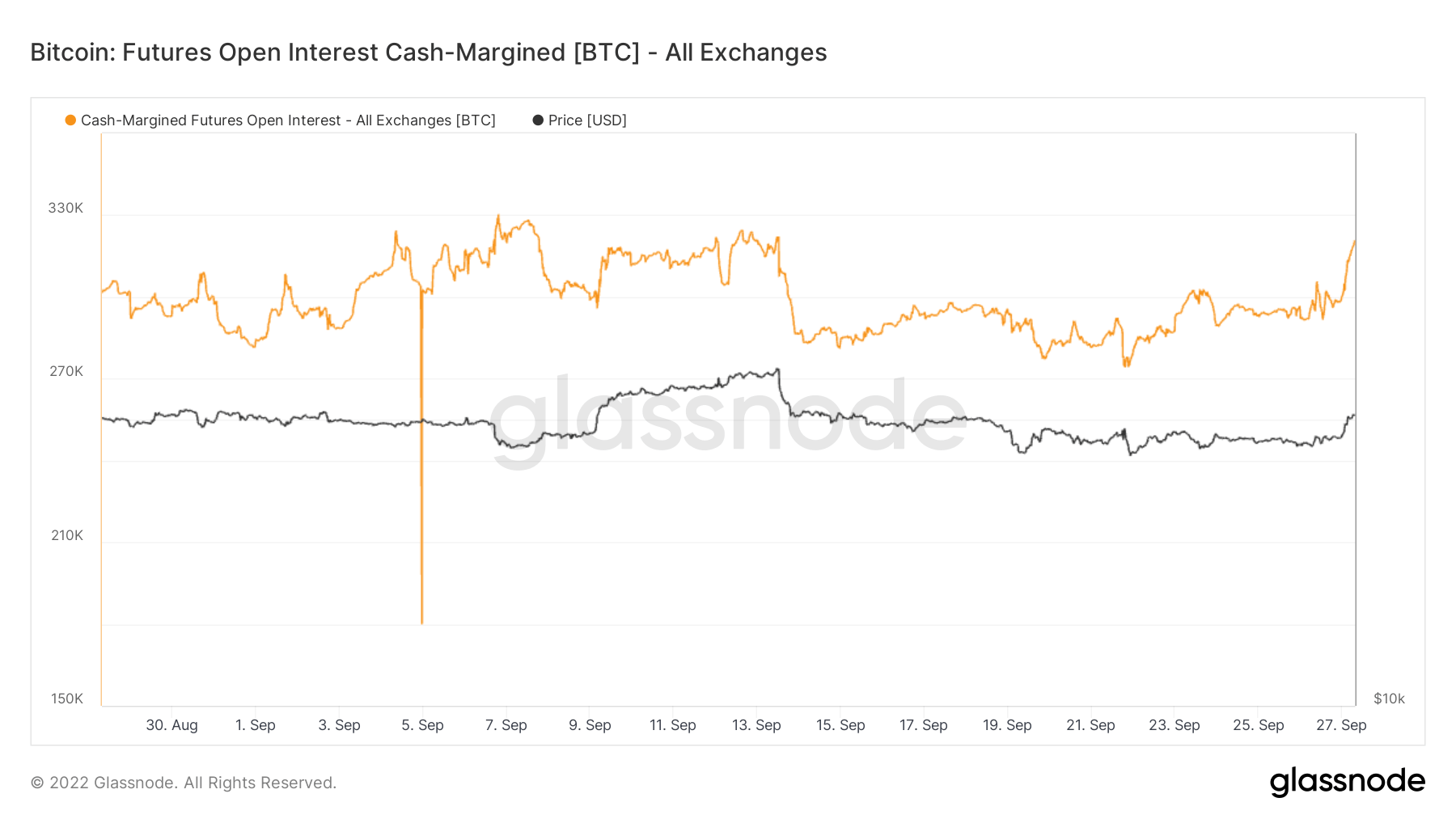

Futures Open Interest

Open interest refers to the number of futures contracts over a particular period. A contract is created when both a buyer and seller agree to it. In general, an increase in open interest and a price increase confirm an upward trend.

The Glassnode chart below shows Futures Open Interest soaring as the Bitcoin price rallied overnight. However, at this time, based on a data point of one day, it is unclear whether the pattern will sustain.

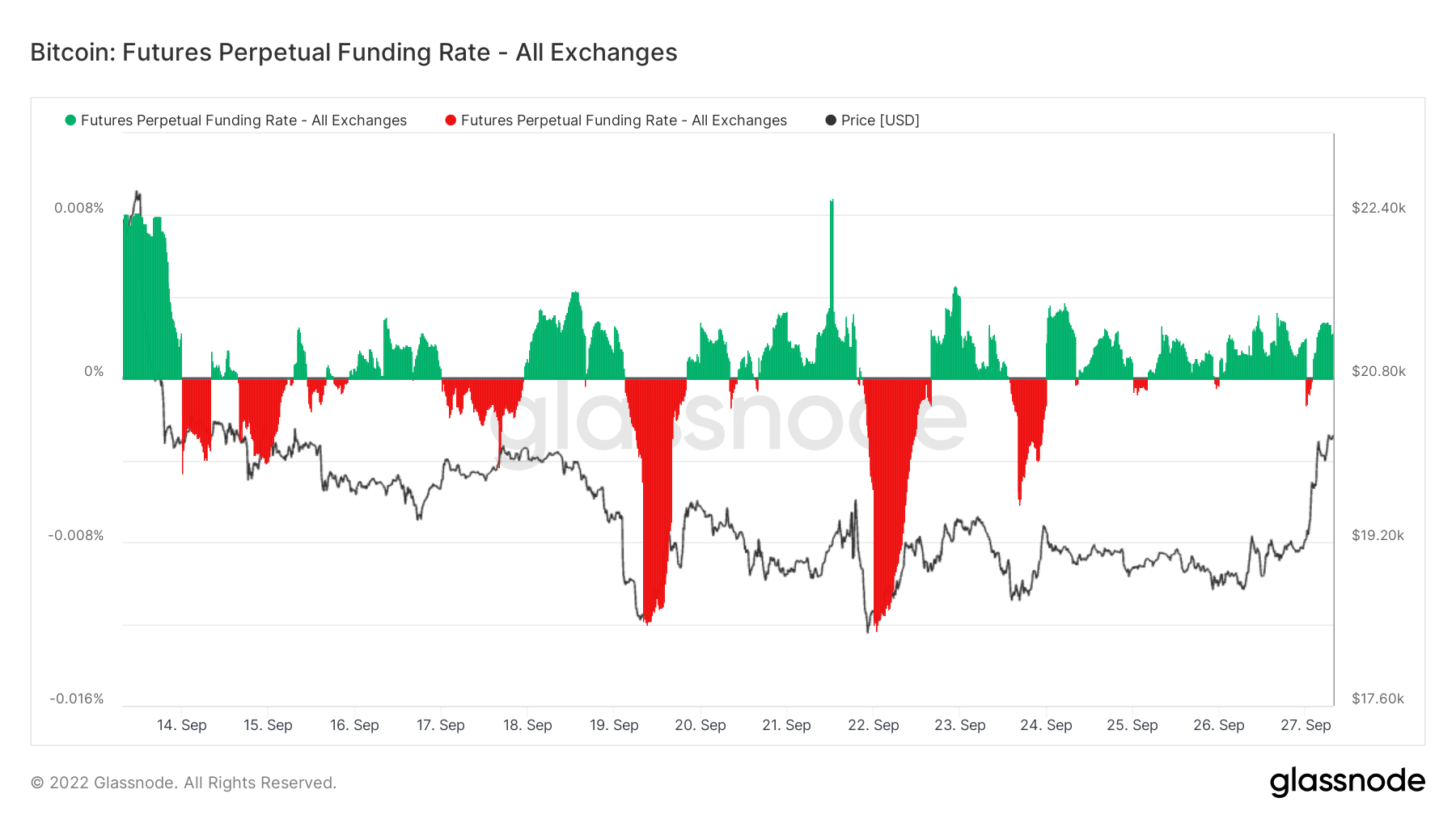

Futures Perpetual Funding Rate

As perpetual contracts can be held indefinitely, the Futures Perpetual Funding Rate refers to a mechanism that keeps perpetual contracts markets tied to the spot market price.

During periods when the funding rate is positive, the price of the perpetual contract is higher than the marked price. Therefore, long traders pay for short positions. In contrast, a negative funding rate shows perpetual contracts are priced below the marked price, and short traders pay for longs.

The chart below shows a surge in futures traders willing to pay a premium for longs. Similar to Futures Open Interest, the lack of data points and relatively muted magnitude of the move call for caution in declaring an end of the bear market.

Can this Bitcoin rally continue?

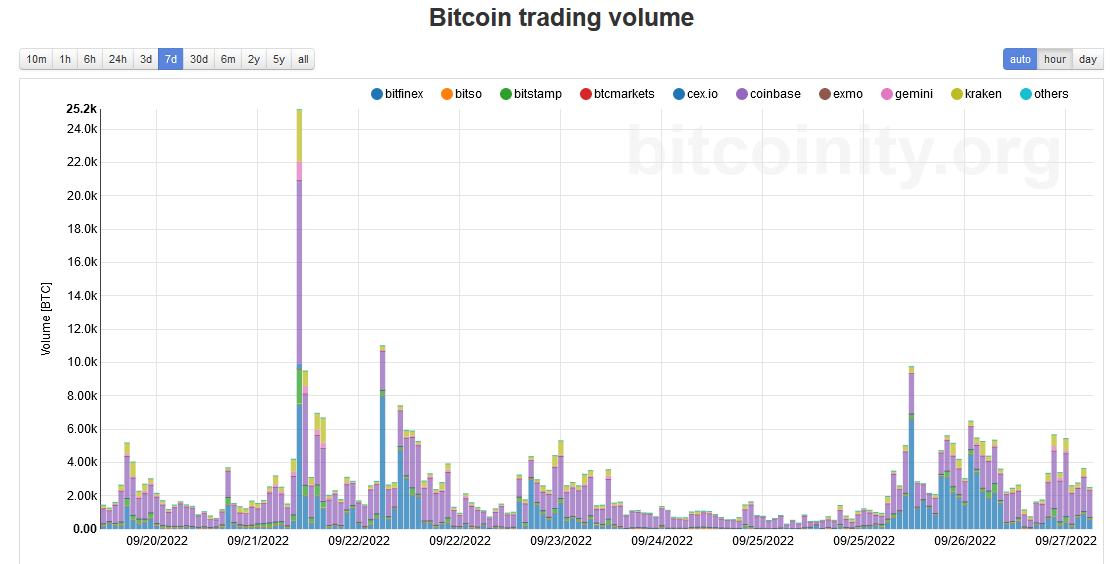

Analysis of spot market volume shows a slight drop-off in volume from the buyers compared to the previous day.

The peak hourly volume was 6,000 as of press time on Sept. 27. This is significantly less than on Sept. 21, when hourly volume hit over 25,000, and BTC peaked at $19,900.

Based on the above, this latest Bitcoin rally was driven by derivatives traders rather than spot buyers.

However, macro factors continue to weigh heavily across all markets. And with spot buyers wary, the bear market is unlikely to end.