Binance.US surpasses $10 million in daily trading volume, less than one month after launch

Binance.US surpasses $10 million in daily trading volume, less than one month after launch Binance.US surpasses $10 million in daily trading volume, less than one month after launch

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Catherine Coley, the CEO of Binance.US announced on Twitter that the American subsidiary of Binance surpassed $10 million in daily trading volume for the first time.

Slowly, but surely! It has been a busy first month.

Thank you for trading on https://t.co/NDRVQIXfNf! #AchievementUnlocked #BUIDL #UsersFirst ?? https://t.co/LLewsd3yi2— Catherine Coley (@cryptocoley) October 23, 2019

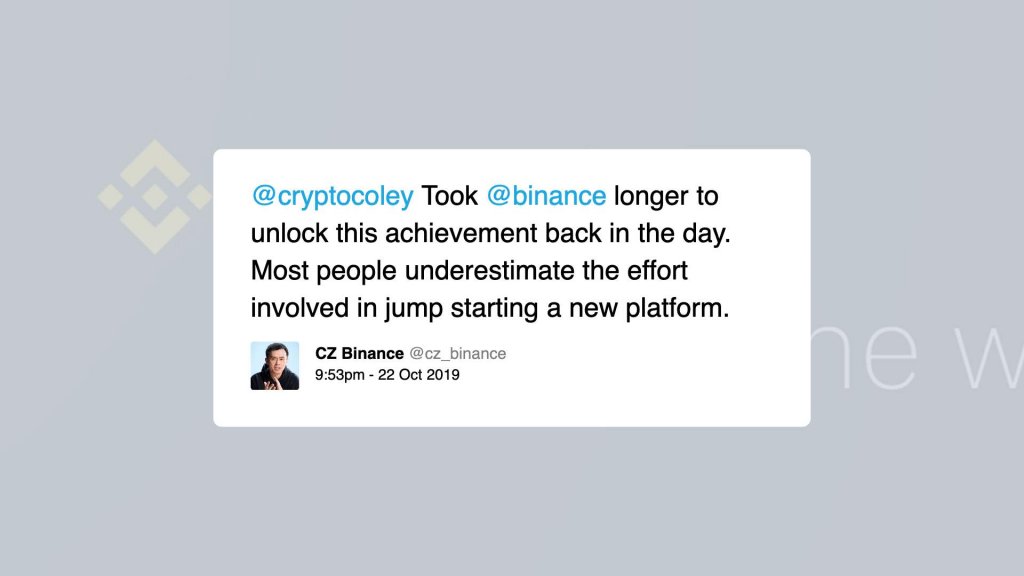

CEO Changpeng Zhao noted that it took Binance.US less time to reach the daily $10 million mark than it took Binance in the beginning.

For comparison, according to CoinMarketCap, Binance completed over $823 million in trading volume today.

Off to a fast start

Since its launch on Sept. 23, Binance.US has added new coins almost every week, including Algorand, Zcash, IOTA, Chainlink and many others.

Binance.US currently offers five BTC trading markets and 19 USD markets.

On Oct. 21, Binance.US announced the addition of IOTA and BUSD. This became the first time IOTA was listed on a fully regulated cryptocurrency exchange in the U.S., according to Dan Simerman, head of financial relations at the IOTA Foundation.

The company said it plans on introducing new cryptocurrencies in batches following the initial launch. The batches, Binance.US said, will be “highly-curated” and meet U.S. regulations and compliance standards based on the Digital Asset Risk Assessment Framework.

Alongside with IOTA, Binance.US also listed BUSD, a fully-regulated and USD-denominated stablecoin. BUSD made headlines in September when it received approval by the New York State Department of Financial Services (NYDFS), becoming one of the few cryptocurrencies that can be sold to New York residents.

Uncertainties in the U.S. market

Despite the rapid expansion of Binance.US, the state of the U.S. cryptocurrency exchange market remains uncertain.

Earlier this week, Poloniex, a cryptocurrency trading platform acquired by Circle for $400 million, said that it is moving out of the U.S. to focus on the global market, possibly due to regulatory roadblocks in the U.S. market.

Messari’s Ryan Selkis said:

“Watching Circle bleed out publicly after trying to bring better compliance to Polo and eventually sell to Justin Sun certainly seems like the adult equivalent of puking in an alley whilst trying (unsuccessfully) to locate your pants after a bad bender.”

Whether the departure of popular cryptocurrency exchanges from the U.S. would benefit existing exchanges like Coinbase, Binance U.S., and Gemini or would signal the start of a more difficult environment for cryptocurrency exchanges remains to be seen.