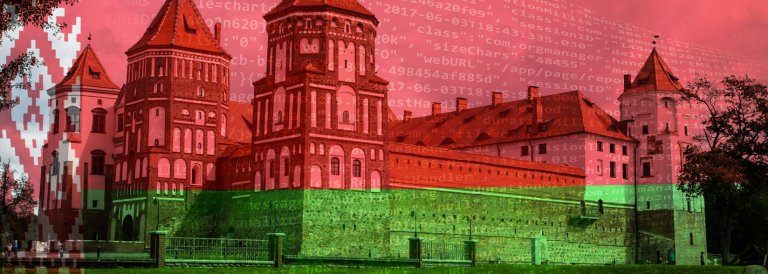

Belarus Adopts New Accounting Framework That Supports Cryptocurrencies

Belarus Adopts New Accounting Framework That Supports Cryptocurrencies Belarus Adopts New Accounting Framework That Supports Cryptocurrencies

National Geographic

Belarus is eyeing its position amongst the most crypto friendly nations in the world by recently announcing the introduction of its new cryptocurrency accounting standards.

According to the recent decree, the national Finance Ministry has developed a new working standard that allows for crypto transactions to be accounted for in an entirely streamlined fashion.

In addition to this, the new ruling also makes it easier for businesses employing virtual currencies to file for their taxes as well as utilize alt-assets in general.

With this move, the small landlocked nation has now joined the ranks of a growing list of European countries that have been actively working to usher in a new era of digital innovation and transparency.

For example, Malta, Estonia, Switzerland have all overhauled their existing economic structures in a bid to incorporate cryptocurrencies and to generate more employment and foreign investments.

The Finer Details

While the new ruling specifies specific measures that can assist the Finance Ministry in recording crypto transactions, the document refrains from explicitly using the term cryptocurrency — instead referring to them as “digital signs” – primarily because virtual assets are still not recognized as legal tender in Belarus.

Some of the other noteworthy points of interest within the decree include:

- Startup companies launching private token-sale and crowdfunding events are required to declare the cost of their tokens in advance to the national financial regulator. However, this rule is only applicable to private players and government institutions are exempt from such undertakings.

- Tokens purchased through ICOs will be deemed as investments. Depending upon the duration of the sale period, the coins should be referred to as “Long-term financial investments” — if the circulation period exceeds a full year.

- All token purchases should be explicitly mentioned in tax files under the credit categories of “Settlements with different debtors and creditors” or “Other income and expenses.”

- For alt-currencies that are bought by traders or online exchanges for future commercial purposes, owners need to account for them as “Goods” in the credit section and “Settlements with suppliers and contractors” within the debit category.

- Lastly, digital coins that are procured through mining activities need to be placed under the “Finished Products” debit account and the “Primary Production” credit tab.

Final Thoughts

In what seems like an exceptionally well thought out move, Belarusian President Alexander Lukashenko appears to be ahead of the digital curve when compared to his Russian, American and Indian counterparts.

Last year, Lukashenko upvoted a crypto bill that will see the development of a Silicon Valley-style economic zone within the nation.

Belarus is now one of the first countries to have established a comprehensive legal framework which facilitates cryptocurrency use within its financial scheme of things. If this move is anything to go by, the crypto train seems to be surging ahead with full steam, and it will only be a matter of time till other European nations follow suit.