A big Bitfinex Bitcoin whale is anticipating a severe correction, will he be right?

A big Bitfinex Bitcoin whale is anticipating a severe correction, will he be right? A big Bitfinex Bitcoin whale is anticipating a severe correction, will he be right?

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

A Bitcoin whale on Bitfinex who identifies as Joe007 has been consistent in calling for a steep correction in the market since the $9,000s. The individual explained the current bull market has been highly manipulated by other whales, and a pullback is unavoidable.

Profitable for six consecutive months

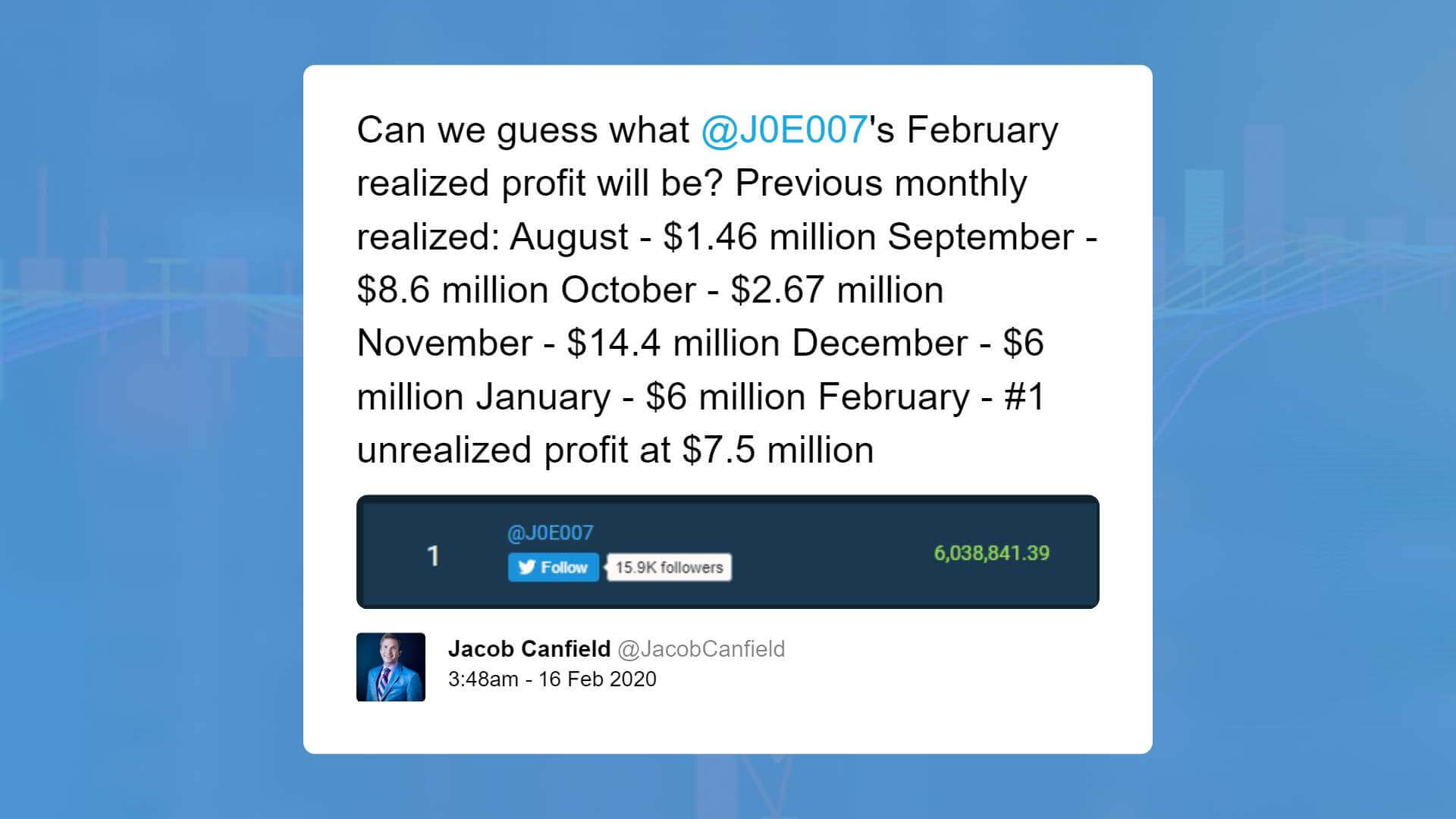

According to cryptocurrency trader Jacob Canfield, Joe007 has been profitable for six straight months from August 2019 to January 2020.

On average, the trader recorded $6.52 million in profit on a monthly basis for the past half-year.

Throughout February, Joe007 has been consistent in describing the Bitcoin rally from the $9,000s to $10,500 as a case of manipulation in the form of spoof orders.

In margin trading, spoof orders refer to fake buy orders placed to encourage other investors to place long contracts to bump up the price of Bitcoin. With the recent upsurge being driven primarily by highly leveraged longs, the whale said that the move is “irresponsible,” and an inevitable pullback will arrive.

Joe007 said:

“You can push the price only so long with fantom money. At some point, people would want to cash out their mad gainz only to find no one on the other side of the market. That would be the show.”

Whales tend to trade on Bitfinex over other platforms because the exchange offers only up to 3.3x leverage. Compared to BitMEX or Binance’s 100 to 125x, the low leverage of 3.3x does not appeal to most individual investors with low capital.

As such, traders on Bitfinex tend to trade with a longer-term strategy, as the low leverage significantly reduces the likelihood of any liquidation.

So far, 16 days into February, Joe007 is up to $6.7 million in a short position. If the Bitcoin price stays below $10,000 for the rest of the month, it would result in seven consecutive profitable months for the investor.

With the market sentiment becoming increasingly optimistic day by day, the question is whether the rally, which was initially kickstarted with manipulation through spoof orders, can evolve into an organic upsurge in the short to medium-term.

Is the Bitcoin rally organic?

In response to a question from the community on the possibility of the rally becoming organic as the price increases, Joe007 simply said: “Let’s wait and see.”

Some pieces of data such as on-chain investor activity from Adaptive Fund’s Willy Woo show that the demand and interest from retail investors have increased in the past month. The upcoming Bitcoin reward halving in late April has been considered as a major variable for the price trend of the dominant cryptocurrency by traders.

One trader known as Satoshi Flipper said:

“BTC halving is in 2.5 months. Don’t be ignorant and pretend it doesn’t matter and/or should be ignored when you’re analyzing.”

Bitcoin Market Data

At the time of press 1:10 am UTC on Feb. 17, 2020, Bitcoin is ranked #1 by market cap and the price is down 0.14% over the past 24 hours. Bitcoin has a market capitalization of $180.39 billion with a 24-hour trading volume of $43.17 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 1:10 am UTC on Feb. 17, 2020, the total crypto market is valued at at $286.08 billion with a 24-hour volume of $174.09 billion. Bitcoin dominance is currently at 63.12%. Learn more about the crypto market ›