Will Bitcoin’s Taproot upgrade cause a “DeFi rain”?

Will Bitcoin’s Taproot upgrade cause a “DeFi rain”? Will Bitcoin’s Taproot upgrade cause a “DeFi rain”?

The Taproot upgrade aims to improve the privacy of transactions and the efficiency of the Bitcoin network.

Photo by Anant Jain on Unsplash

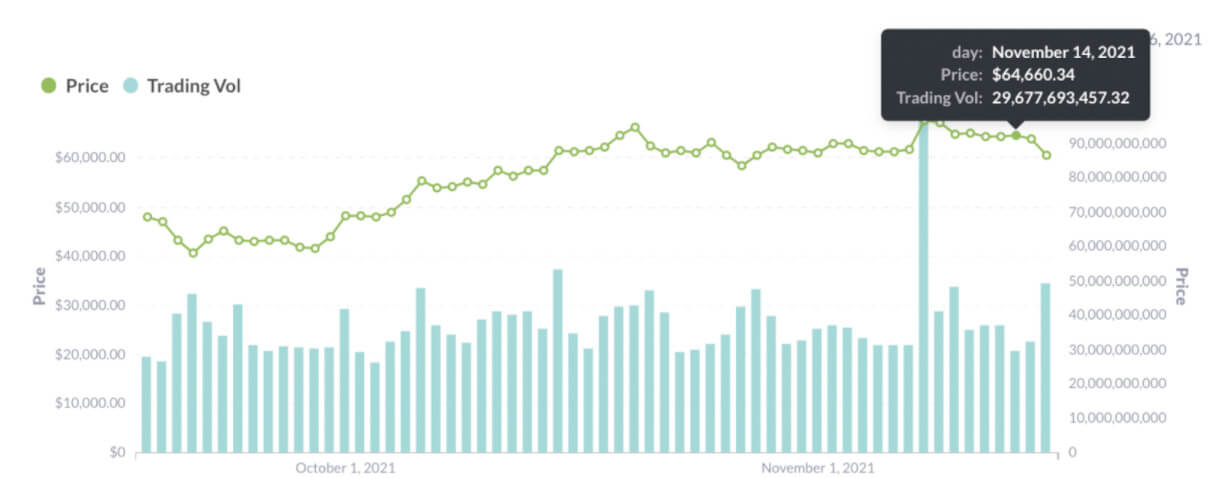

On Nov. 14, the highly anticipated Bitcoin upgrade Taproot was activated on block 709,632 with the aim of kindling a DeFi and dApp ecosystem around the decentralized currency, giving it a more Ethereum-like functionality.

But while Taproot received almost universal support from the Bitcoin community—unlike the divisive 2017 SegWit upgrade—it has not resulted in any significant price or trading volume changes.

While some people are surprised, expecting a greater impact, they shouldn’t be.

Even though the Taproot upgrade is turning Bitcoin towards the future with a series of privacy and efficiency upgrades, the coin will remain a relatively conservative force in crypto primarily as a store of value in the near term.

What is a Taproot Update

The Bitcoin community updates Bitcoin every 4 years with soft forks, where new features are mainly introduced via Bitcoin Improvement Proposals (BIPs).

Unlike the previous upgrades, Taproot is not a single feature enhancement to the Bitcoin network, but rather a larger upgrade containing three improvement proposals (BIP340, BIP341, and BIP342).

Greg Maxwell proposed this upgrade in 2018. Since then, the three BIPs, written by Pieter Wuille, Tim Ruffing, AJ Townes, and Jonas Nick were compiled into Taproot and merged into Bitcoin Core in October 2020.

The Taproot upgrade aims to improve the privacy of transactions and the efficiency of the Bitcoin network.

The proposal’s content:

- BIP340 adds a Schnorr multi-signature approach that is also compatible with previous elliptic curve digital signatures.

- BIP341 proposes a new network payment method called “Pay-to-Taproot” (P2TR), which uses the MAST (Merkle Tree) data structure, using the features of aggregated signatures.

- BIP342 improves the Bitcoin network by adding a new scripting language called Tapescript to help verify Schnorr aggregated signatures and Pay-to-Taproot payment paths, improving the inclusiveness and flexibility of P2TR while providing room for future upgrades to the Bitcoin network in terms of smart contracts.

Impact on Bitcoin

Lower costs

- One of the main advantages of Schnorr signatures is their ability to capture multiple keys and generate unique signatures in complex bitcoin transactions. This means that signatures involving multiple parties can be “aggregated” into a single Schnorr signature.

- It has been hailed as the most significant technical update since Bitcoin Segwit.

- Schnorr signatures will reduce the amount of data needed for multi-signature transactions. As a result, transactions will be less expensive to process, thus reducing the cost of transaction fees.

Better privacy

- The MAST data structure, based on the Schnorr multi-signature approach, can contain complex transaction information. It will allow multi-signature transactions or transactions involving multiple addresses to appear as a single standard transaction.

- Multi-signature transactions will be indistinguishable from simple transactions, meaning that the addresses involved in multi-signature transactions have a higher level of anonymity and privacy.

Smart Contract Support

- Because the Taproot upgrade reduces the output of transactions on the network, it opens up the possibility of deploying complex smart contracts.

- At the same time, Taproot provides an extended toolkit for developers to continue developing on Bitcoin.

In summary: The heart of the Taproot upgrade is the Schnorr signature. It brings a whole new mix of performance, privacy, and even smart-contract possibilities to Bitcoin.

Can Taproot improve BTC’s competitive edge?

While both Bitcoin and the Ethereum network are based on the concept of distributed ledgers and encryption, they are very different in terms of technical specifications.

For example, Bitcoin acts as the digital equivalent of gold and is used to store value. Ether powers applications and makes a profit by supporting the network.

One of the main differences between Bitcoin and Ether is that Ether supports and works with smart contracts and provides developers with a way to create new applications.

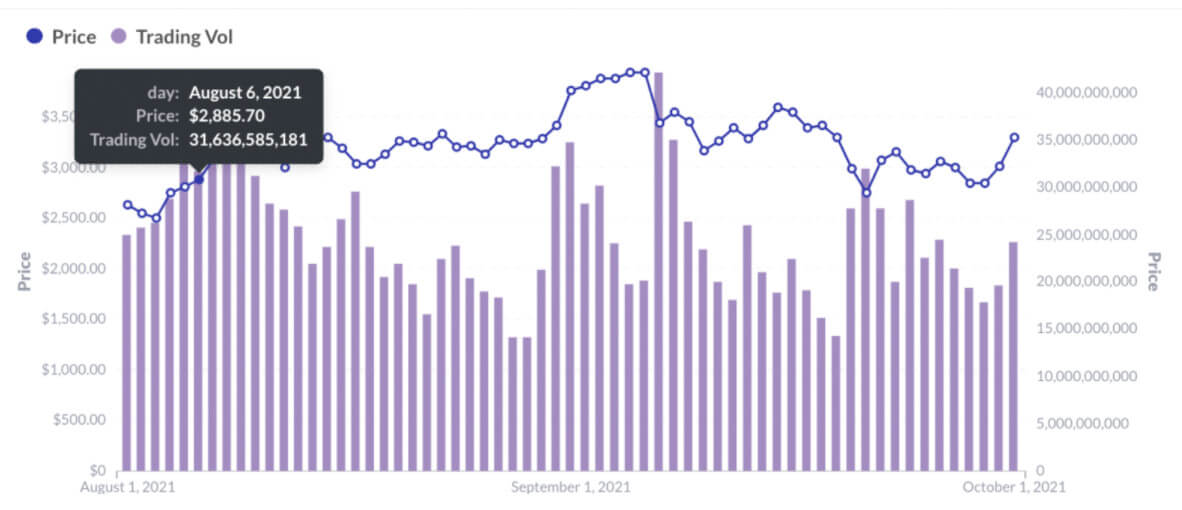

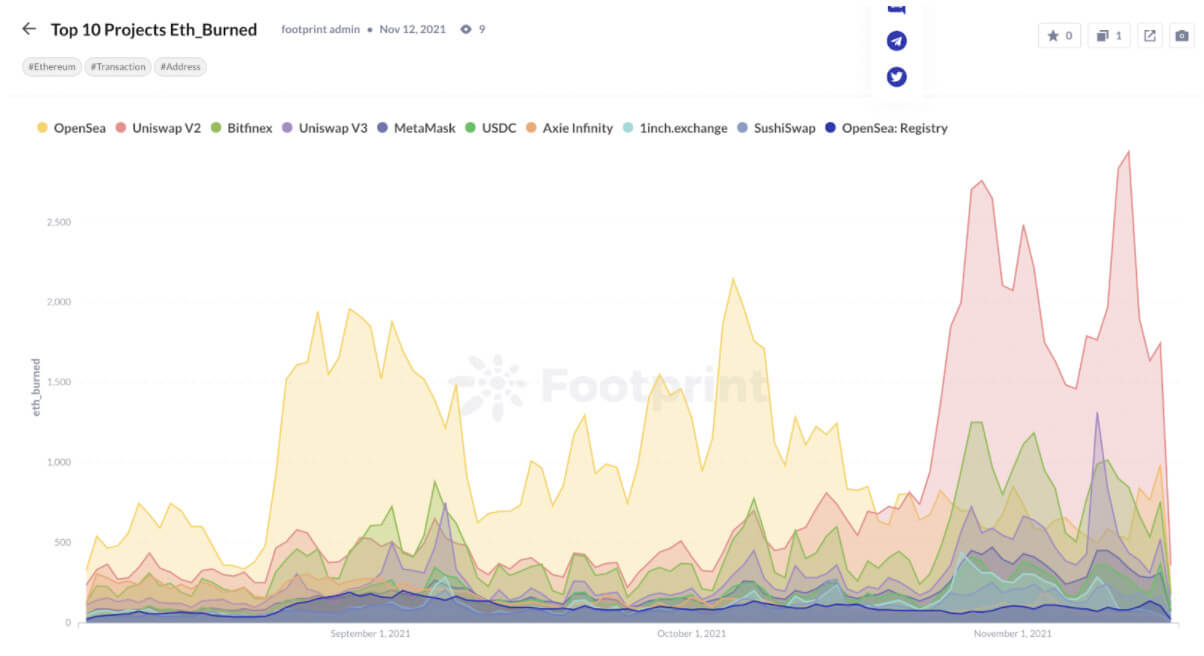

Today, Ether dominates as the preferred blockchain for these applications, also known as dApps, or decentralized applications.

Most decentralized finance and NFT applications are built on the Ethernet network. As the use of Ether in DeFi and NFT has become more widespread, Ether has established itself as a first-mover in the application of cryptography.

While Ethereum has greater transaction volumes, Bitcoin’s cryptocurrency capabilities and superior network security can also attract liquidity that stays in the network for the long term.

Similar to gold, Bitcoin is stable and limited to a mintage of 21 million coins, and its value as digital gold savings is gaining more consensus.

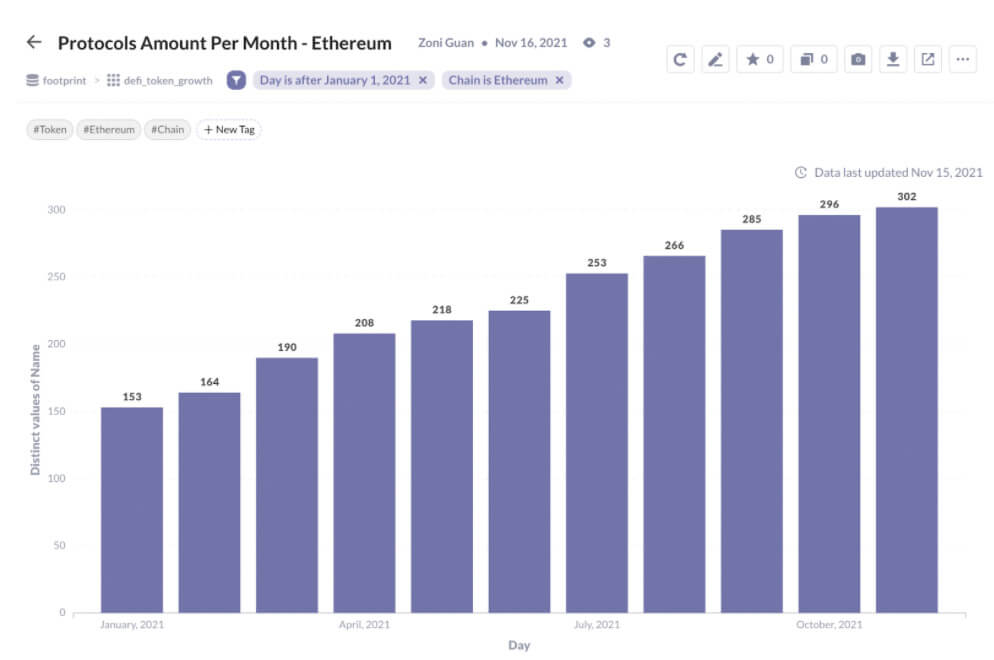

Taproot makes the Bitcoin network more attractive for building DeFi protocols to attract incremental user demand. Many Bitcoin followers see this upgrade as a god-sent for DeFi in the Bitcoin network.

However, many analysts, such as Zoni from Footprint Analytics, are not convinced that Taproot will turn Bitcoin into a smart contract ecosystem.

Positioned as a peer-to-peer electronic cash system, Bitcoin lacks a mature ‘virtual machine’ EVM (smart contract runtime environment) to run smart contracts to support smart contract storage, execution, and verification.

Therefore, it is difficult to attract more dApp or DeFi projects to program and build projects on its chain. There is still a long way to go for Bitcoin to become a programmable platform with a DeFi ecosystem.

It is fair to say that Bitcoin’s development is slow.

One reason for this is its PoW consensus mechanism, which requires up to 50% of Bitcoin nodes’ consensus in every modification. Even with Taproot, it is unlikely that it will catch up with the rapid development of DeFi.

Furthermore, only half of the known Bitcoin nodes have indicated support for the upgrade, with the rest still running old software. That means they haven’t yet implemented Taproot’s new rules.

The actual activations of Taproot, including Schorr, will not get started until next year.

This report was brought to you by Footprint Analytics.

Footprint Analytics is an all-in-one analysis platform to visualize blockchain data and discover insights. It cleans and integrates on-chain data so users of any experience level can quickly start researching tokens, projects and protocols. With over a thousand dashboard templates plus a drag-and-drop interface, anyone can build their own customized charts in minutes. Uncover blockchain data and invest smarter with Footprint.

Farside Investors

Farside Investors

CoinGlass

CoinGlass