3 key reasons Yearn.finance (YFI) fell 20% in a steep correction

3 key reasons Yearn.finance (YFI) fell 20% in a steep correction 3 key reasons Yearn.finance (YFI) fell 20% in a steep correction

Photo by Greg Rosenke on Unsplash

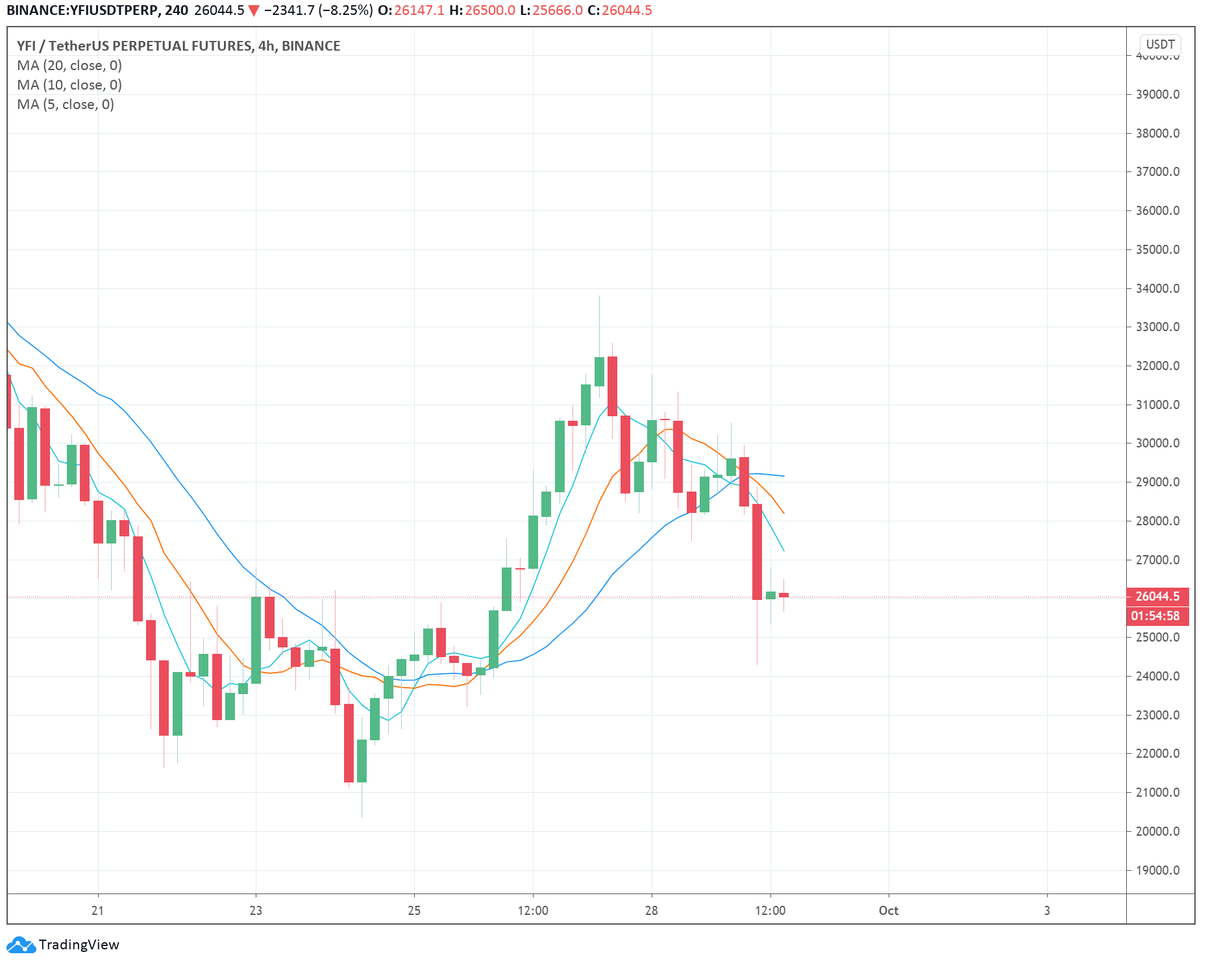

Yearn.finance (YFI), the decentralized finance (DeFi) giant popular for its vaults, fell by 20% within nine hours.

Three key factors contributed to the pullback: the Eminence exploit, Bitcoin price drop, and overall market weakness.

Eminence exploit causes controversy

On September 29, users began to stake millions of dollars in a new DeFi project called Eminence. The project was not ready or publicly launched, as YFI creator Andre Cronje said.

Nonetheless, the smart contract of Eminence saw an inflow of around $15 million overnight. Cronje and other YFI developers working on Eminence did not expect the smart contract to see such large inflows.

Typically, Cronje deploys a staging contract or a prototype on Ethereum and continues building on top of it over time. Hence, Eminence was not ready nor was it presented as it a finished product. Cronje said:

“1. Yesterday we finished the concept behind our new economy for a gaming multiverse. Eminence. As per my usual methodology, I deployed our staging contracts on ETH so we can continue developing on it. 2. Eminence is at least ~3+ weeks still away. These contracts, nor the ecosystem are final, yesterday alone you will notice I deployed 2 separate batches of the contracts, this is my usual ‘test in prod’ process.”

Since the project was still a nascent development phase, naturally, there were exploits for hackers to target.

Unknown individuals conducted a “very simple” exploit, according to Cronje. They minted lots of EMN, burned them for other currencies, and then sold them for EMN. $15 million were stolen from the exploit, and $8 million were sent to Cronje’s deployer account. Cronje explained:

“The exploit itself was a very simple one, mint a lot of EMN at the tight curve, burn the EMN for one of the other currencies, sell the currency for EMN.”

Because of the link between EMN and Cronje, who created YFI, it could have amplified the selling pressure on YFI. The two projects are not related to one another but it might have caused the market sentiment to rattle.

Bitcoin saw a steep rejection, amplifying YFI pullback

The drop of YFI also coincided with the decline in the price of Bitcoin. As the price of Yearn.finance dropped, Bitcoin rejected from the $11,000 resistance level.

Within hours, BTC declined from above $10,900 to $10,600, leading the DeFi market and Ethereum to correct. The Bitcoin pullback followed a red weekly close, indicating a sluggish short-term price trend.

Sharp BTC pullback led Ethereum to drop, causing DeFi to lag

As BTC fell, the price of Ethereum declined sharply from $364 to $350. In technical terms, the near-term range of ETH is between $350 and $373, with the latter presenting a heavy resistance area.

Overnight, Ethereum dropped to the bottom of the range within a short period. For DeFi tokens and small-cap cryptocurrencies that largely follow the trend of ETH, a short-term pullback was unavoidable.