This $22 billion fund manager says buy Gold, Bitcoin as bond markets fail as a hedge after U.S. Quant Easing

This $22 billion fund manager says buy Gold, Bitcoin as bond markets fail as a hedge after U.S. Quant Easing This $22 billion fund manager says buy Gold, Bitcoin as bond markets fail as a hedge after U.S. Quant Easing

Image by MichaelWuensch from Pixabay

The ongoing COVID-19-pandemic has served as a defining point of modern financial markets.

The U.S. and global indices are close to all-time highs, after an initial dip in March, even as virus casualties, global unrest, and unemployment linger on. To combat, some billionaire fund managers like Paul Tudor Jones have called out the instability in global markets and purchased Bitcoin futures as a hedge against possible hyperinflation.

Now, a $22 billion rated fund manager is starting to recommend cryptocurrencies as a hedge alongside gold, for numerous reasons apart from currency risk.

No government bonds, buy Bitcoin

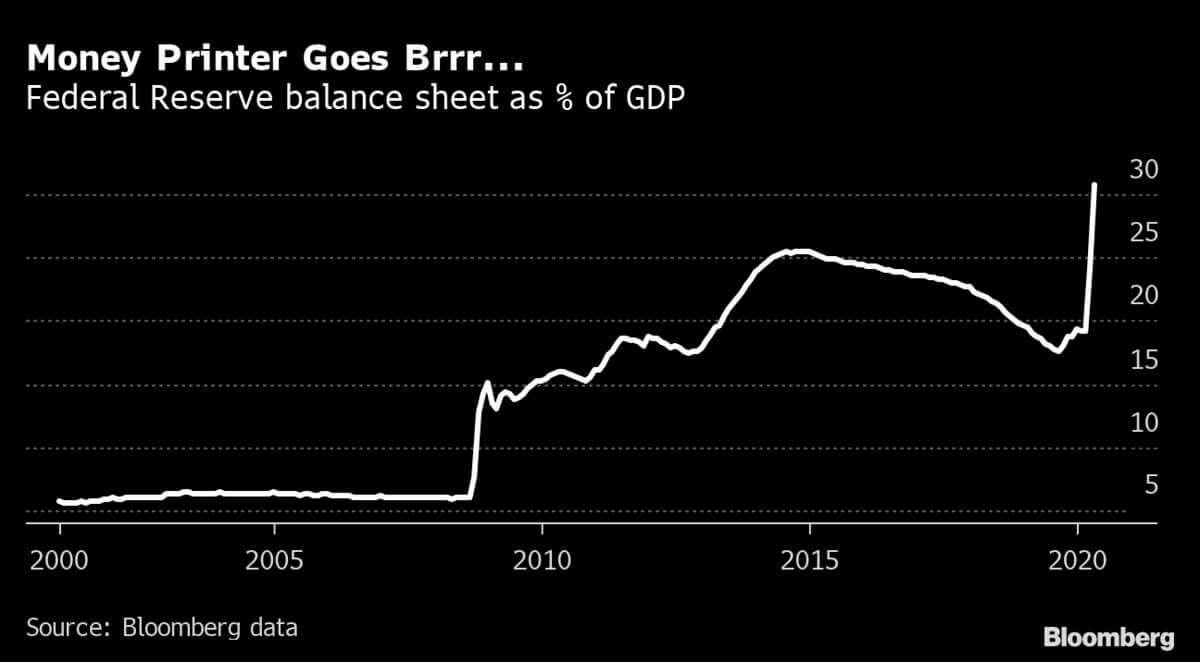

Paul Britton, CEO of Capstone Advisors in New York, believes the decades-old strategy of holding government bonds to balance equity risk may have run its course. His main reason; the U.S. Federal Reserve lowered interest rates to zero, allowing many to access technically “free” money to eventually purchase equities and pump markets.

The change has huge implications. Fiat currencies like the U.S. dollar have been exposed to inflation and long-term risk. Reports also suggest equity markets are now dominated by retail traders instead of hedge funds and banks, causing dislocation in prices and a deviation from fundamentally-derived intrinsic value.

Some institutions have already started storing Bitcoin and Ether, presumably for risk protection:

Pension funds, family offices, advisers & hedge funds…these are the institutions

And the institutions are here:

– 27% own crypto (in the U.S.)

– 45% own crypto (in Europe)Of these:

– 25% own Bitcoin

– 11% own EtherI expect them to double down in the coming months

— Ryan Sean Adams – rsa.eth ? (@RyanSAdams) June 9, 2020

However, with no access to cutting-edge risk tools that institutional investors apply, retail traders have been left “defenseless,” having little apart from equity options on IB or Robinhood to protect against risk. Hedge funds are facing trouble as well — the lack of positive government bond yields has made prosperous environments a distant dream.

Britton states the old 60/40 portfolio approach — one that includes treasury bonds to serve as insurance against equity risk — has plunged into “double jeopardy.” Dying or negative yield, has left equities as the only source of capital gains. And the latter is now under risk as well.

With the lack of diversification, Britton has some advice for retail and institutional investors alike; purchase gold, cryptocurrencies, and remain in cash. He noted:

“Asset allocators will have to think about alternatives to bonds, including cash, gold, cryptocurrencies, and explicit volatility strategies — such as put options directly hedging equities — with which they may be less familiar.”

Bitcoin volatility remains a con

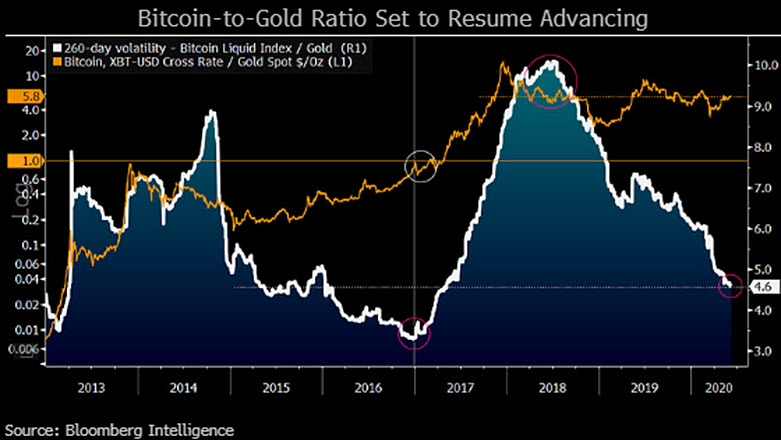

Britton notes there are pros and cons to purchasing cryptocurrencies, presumably large-cap ones like Ether and Bitcoin, to serve as an effective hedge.

For one, Bitcoin’s notorious volatility has left many-a fund in the lurch. Massive price drops for Bitcoin on “Black Thursday” caused some crypto investors to lose up to 98.5 percent of their initial principal.

Last week, as CryptoSlate reported, the former governor of China’s central bank voiced a similar opinion. She noted Bitcoin was a “commercial success” for blockchain technology, but its volatility had possibly “failed it” as a currency.

Meanwhile, the volatility hasn’t put off all investors. Paul Tudor Jones II, the famed billionaire fund manager, invested over $70 million in Bitcoin futures last month. Others, like Jim Simons’ of the famed Renaissance Technologies, are also reportedly eyeing the crypto market to capture and profit from volatility.

One part of the allure towards Bitcoin comes from reaping crazy, once-in-a-lifetime type returns. The other, however, is a bit more sinister. As Jones puts it, crypto provides a definite hedge against the “massively” inflated equity and currency market.