$1.6 billion liquidated after Bitcoin briefly falls under $54,000

$1.6 billion liquidated after Bitcoin briefly falls under $54,000 $1.6 billion liquidated after Bitcoin briefly falls under $54,000

The asset fell over $3,000 overnight as crypto markets saw a huge sell-off. And it’s down by -10% of its all-time high.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Bitcoin fell to under $54,000 in the morning hours amidst a broader sell-off in the crypto market. The asset later recovered slightly and traded over $54,700 at press time.

Bitcoin….gone

Data from markets tool Bybt showed over $1.6 billion worth of crypto positions were ‘liquidated’ as a result of the price plunge, with $953 million worth of Bitcoin positions and $255 million worth of Ethereum positions erased in the price carnage.

234,825 traders were liquidated for a total of $1.62 billion over the past 24 hours

Chart: @bybt_com pic.twitter.com/brbUaQ0PZy

— Bloqport (@Bloqport) March 23, 2021

Traders borrow money from exchanges (a process called margin trading) to place bigger bets on their directional positions. The exchanges charge fees in return and automatically close out positions if the market moves against the direction that the trader placed his trade, in a process known as “liquidation.”

Over 234,000 traders were liquidated this morning, Bybt showed, with the single largest liquidation order coming from crypto exchange Huobi—a Bitcoin position worth over $10 million. Bitfinex saw the biggest liquidations with over $747 million in positions liquidated.

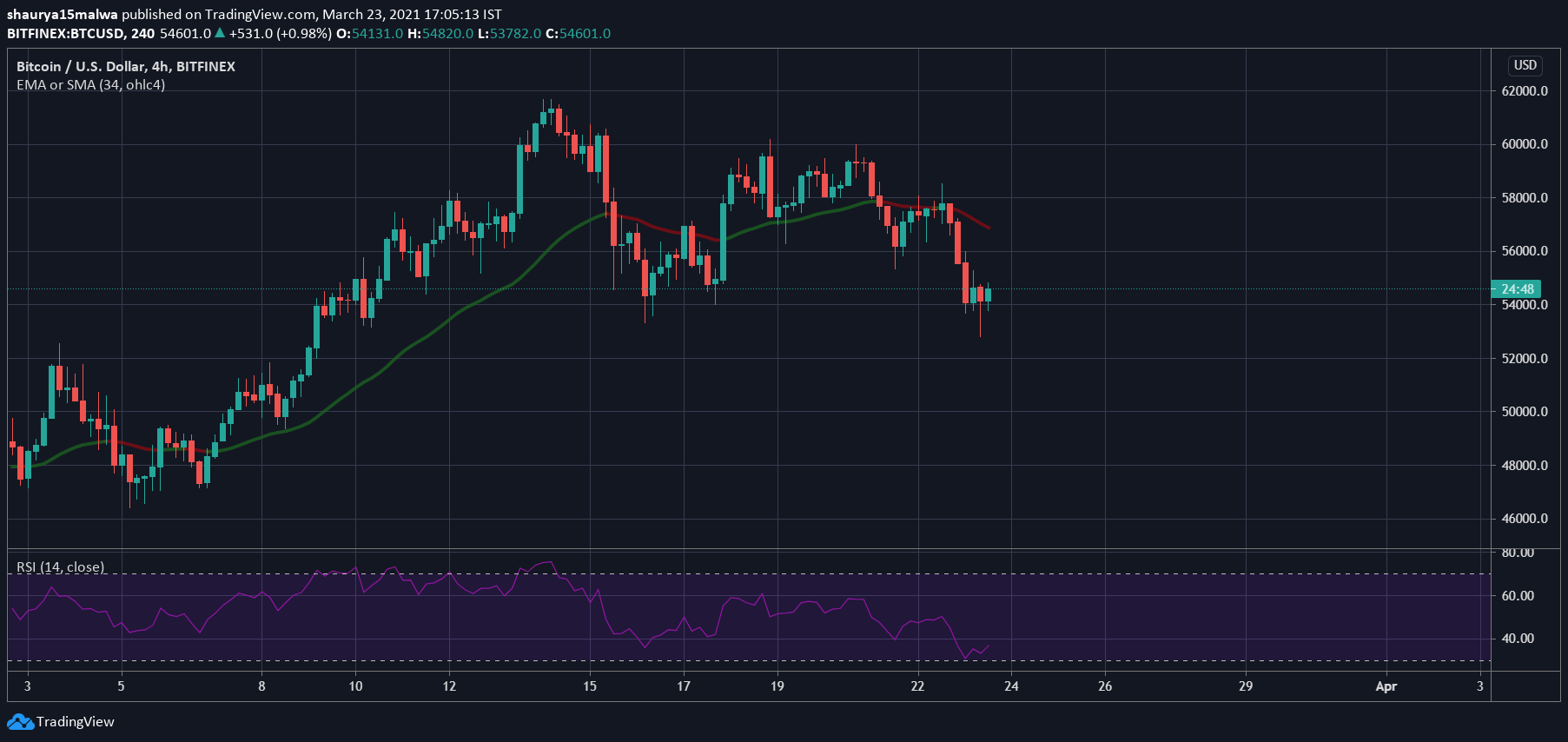

The market has since steadied. As the below image shows, Bitcoin is currently sitting on support after bouncing from the $54,000 level. The RSI indicator shows the asset is currently “oversold,” meaning the downward price action could be overextended.

What does on-chain data say?

On-chain data from analytics tool IntoTheBlock show a “mostly bearish” sign for the asset, with three metrics flashing a “red” sign and just two showing a “green” signal. Bitcoin’s net network growth, a tool that calculates momentum, shows bearish growth at -0.46% alongside the falling “large money transactions” at -0.76%.

Accumulation metrics remain “neutral,” meaning large holders are either dumping their Bitcoin or hoarding more of the asset depending on the entry/exit strategy. Over $11 billion have, in addition, left crypto exchanges in the past week while $12 billion has flowed in.

Meanwhile, there could be a further drop ahead. Rafael Schultze-Kraft, the co-founder of markets tool Glassnode, said he wouldn’t be surprised if the market were to dip further.

“Not much Bitcoin realized between here and $51k. Would not be surprised if we dipped a bit more. Strongest on-chain support currently at $47,400,” he tweeted.

Not much #Bitcoin realized between here and $51k. Would not be surprised if we dipped a bit more.

Strongest on-chain support currently at $47,400.https://t.co/3GFPTQPp6F pic.twitter.com/NLBQvEIGfB

— Rafael Schultze-Kraft (@n3ocortex) March 22, 2021

Bitcoin investors are arguably not going to like that.