XRP crowned top-traded altcoin of the year: Kaiko

XRP crowned top-traded altcoin of the year: Kaiko XRP crowned top-traded altcoin of the year: Kaiko

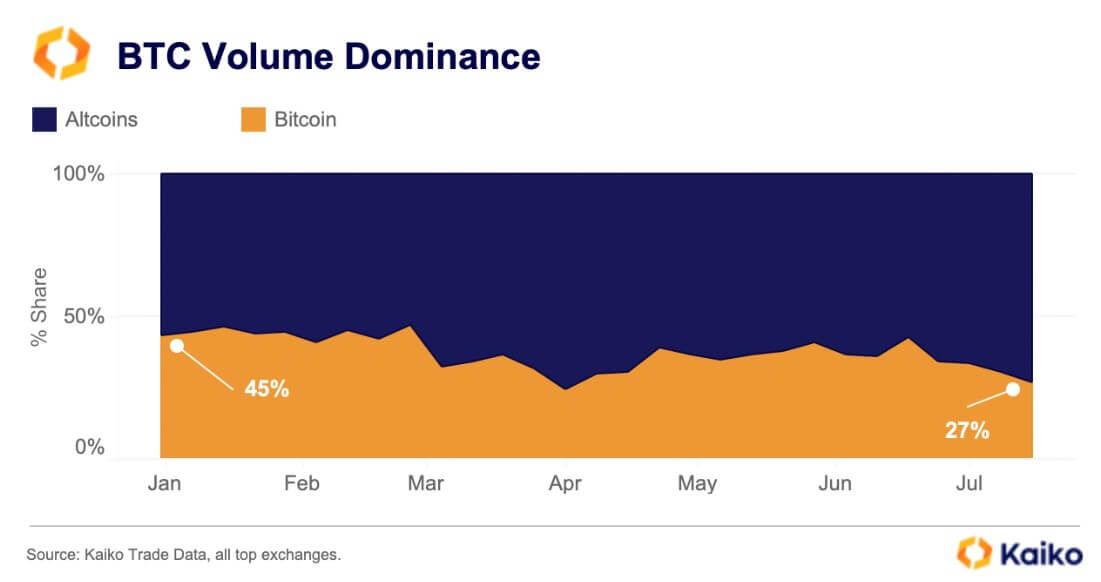

Since the beginning of July, Bitcoin's trading has declined to the lowest levels since April.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

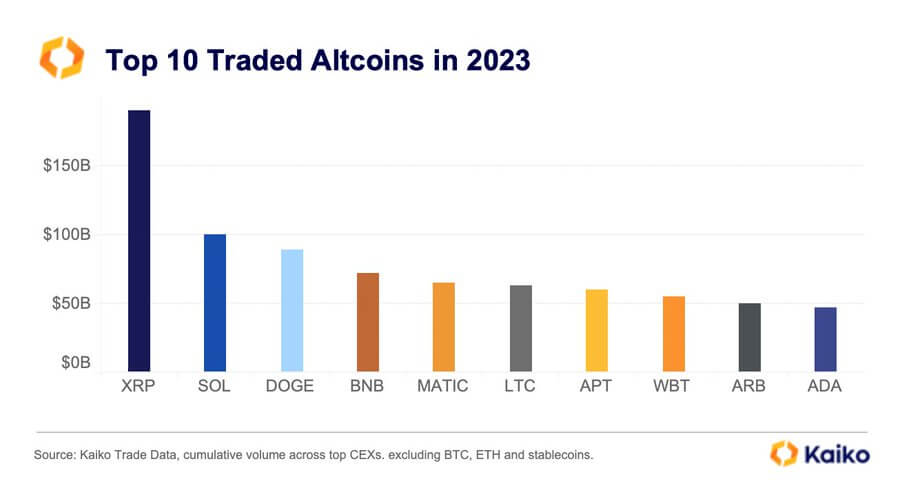

Blockchain analytical firm Kaiko reported that Ripple’s XRP is the top-traded altcoin for this year, with its trading volume exceeding $150 billion.

XRP’s trading volume completely dwarfs that of other altcoins rival significantly, with the closest being Solana’s SOL, recording about $100 billion. Others like Dogecoin (DOGE), Binance Coin (BNB), and Polygon’s MATIC complete the top five, with more than $50 billion traded each.

This increased volume can be attributed to renewed investors’ interest in the cryptocurrency following Ripple’s partial victory against the U.S. Securities and Exchange Commission (SEC).

Crypto market maker Efficient Frontier, citing Kaiko data, noted that the liquidity and trading for XRP majorly improved as Americans could trade the digital asset on major exchanges such as Coinbase following the crypto payment company’s victory.

Bitcoin’s volume suffers

Meanwhile, Bitcoin trading volume slipped 8% since the start of July following the Ripple ruling, according to Kaiko data. Kaiko added that BTC’s current trading volume dominance is at its lowest since April, at 27%.

Kaiko wrote:

“Offshore exchanges have experienced a more extreme drop in BTC trading activity, partially due to a spike in South Korean altcoin volume. Since the start of 2023, BTC dominance has fallen by 20%. On U.S. exchanges.”

On July 17, the blockchain analytical firm pointed out that XRP trades surpassed BTC across 25 tracked centralized exchanges, as investors preferred the altcoin to the flagship digital asset,

XRP Price Performance

While the court ruling positively impacted XRP’s price performance, increasing its value to a yearly high above $0.80, the digital asset has begun to shed some of its gain, losing more than 7% during the past week, as per CryptoSlate’s data.

However, it is still up 43% during the last 30 days, as it was worth $0.47 before the ruling.

Meanwhile, the decline in XRP’s value can be linked to the general market slump as there is increased speculation that the Federal Reserve could raise interest rates by another 25 basis points.