Why one data analyst is wary of any imminent Ethereum rally

Why one data analyst is wary of any imminent Ethereum rally Why one data analyst is wary of any imminent Ethereum rally

Photo by Raychel Sanner on Unsplash

The significant fundamental growth seen by Ethereum over the past couple of months has led to a torrent of calls from investors regarding an imminent rally.

The cryptocurrency’s price, however, has remained stagnant and is showing few signs of being able to break its correlation with Bitcoin and rally independent from the rest of the market.

The growth of the Ethereum-based DeFi sector is one catalyst for a rally that many investors are watching, but one data analyst is wary of this possibility.

He is noting that the amount of capital required to fuel any significant ETH uptrend may prove to be a roadblock for its near-term growth, as the crypto market has not seen any significant inflows of fresh capital in recent times.

Analysts aren’t convinced that Ethereum is ready to rally

There are multiple narratives regarding why Ethereum could be positioned to rally in the near-term, including the potential launch of the ETH2.0 testnet in the coming months, EIP 1559, and the growth of the DeFi sector.

Although all these narratives and the events underpinning them are net-positive for ETH, they have yet to provide it with any upwards momentum.

One factor that may be suppressing the cryptocurrency is the sheer size of its market cap – which is currently sitting at $26.65 billion.

Analysts are noting that the amount of capital required to catalyze any significant Ethereum price gains simply doesn’t exist within the market at the present moment.

While specifically looking towards the narrative regarding DeFi token profits being cycled into ETH as a catalyst for upside, Ari Paul – a managing partner at BlockTower Capital – explained that the decentralized finance sector remains too small to provide ETH with any notable upside.

“Look at the relative dollar amounts. ETH is a $26 billion market cap token. If defi rallies by $2b and some fraction of that gets recycled into ETH, the sale of $1 has a *much* bigger impact on defi than a buy of $1 has on ETH.”

DeFi sector’s limited size leaves room for continued outperformance of ETH

The DeFi sector’s immense growth throughout the past several weeks and months has been driven by an inflow of capital from token investors and protocol users.

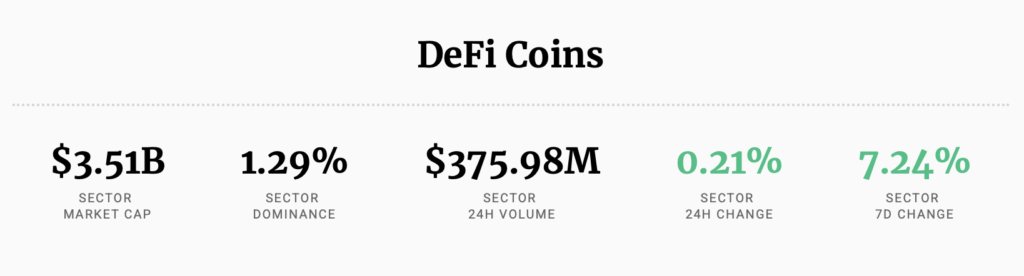

According to CryptoSlate’s proprietary data, the tokens within this fragment of the crypto market currently have an aggregated market capitalization of $3.6 billion.

Because this is only a mere fraction of Ethereum’s market cap, tokens within this sector can continue rallying without there being any substantial capital inflows.

Data analyst Ceteris Paribus spoke about this in a recent tweet, also explaining that Ethereum will need a broad institutional and macro fund participation rate to rally higher.

“We have two very different markets within crypto right now. Has always been true, but have felt it more recently. DeFi can rally without a ton of new money coming in, but BTC/ETH are at the point where they need real, institutional/macro fund flows to take it to the next level.”

Until this trend shifts and the crypto market sees heightened capital inflows, smaller DeFi-related tokens will likely continue outperforming Ethereum.