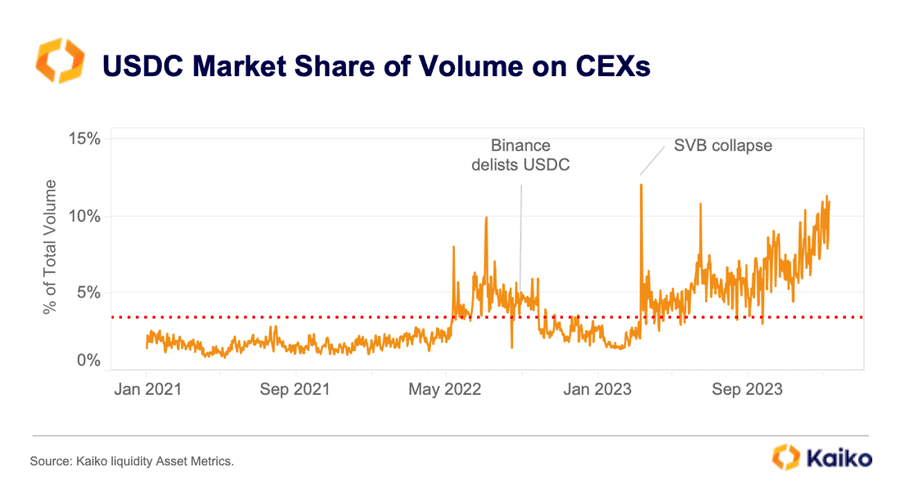

USDC doubles market share on centralized crypto trading platforms to over 10%

USDC doubles market share on centralized crypto trading platforms to over 10% USDC doubles market share on centralized crypto trading platforms to over 10%

USDC has enjoyed enormous adoption across different trading platforms despite the significant headwinds.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

USD Coin (USDC), the second-largest stablecoin by market capitalization, has seen its market share on centralized crypto trading platforms grow significantly during the past months.

Data from Paris-based crypto intelligence platform Kaiko showed that USDC’s market share doubled to over 10% from around 5% in September 2023, mainly due to the rising volumes recorded on Bybit.

Why USDC’s market share is growing

Bybit has emerged as the largest market for USDC, likely due to its introduction of a zero-fee trading incentive for its USDC trading pairs in February last year.

Binance’s relisting of the USDC stablecoin, following the legal troubles that emerged with Binance USD (BUSD), also potentially played a role in helping to improve USDC’s market share during the period.

Coinbase, the largest crypto trading platform in the U.S., also progressively increased the interest rates on USDC, starting from 2% and incrementally moving it to 6% throughout last year. This greatly incentivized users of the platform to hold the stablecoin.

Also, Circle, the stablecoin issuer, has notable partnerships with major financial institutions like Japanese financial giant SBI Holdings and licensing in major jurisdictions like Singapore, which further helps to boost USDC’s circulation and presence.

USDC’s supply

Despite these improved numbers, USDC’s current circulating supply remains drastically below its all-time high of $45 billion.

Circle attributed this decline to several factors, including “rising interest rates, regulatory crackdowns, bankruptcies, and outright fraud.”

In addition, USDC faced significant headwinds last year after one of its banking partners, Silicon Valley Bank, collapsed. This resulted in USDC briefly losing its peg and a massive outflow from the digital asset.

Meanwhile, Circle recently revealed its intention to go public again through an initial public offering (IPO) filed with the U.S. Securities and Exchange Commission.