The stock market is outperforming Bitcoin over the past year: Why this may soon change

The stock market is outperforming Bitcoin over the past year: Why this may soon change The stock market is outperforming Bitcoin over the past year: Why this may soon change

Photo by Roberto Júnior on Unsplash

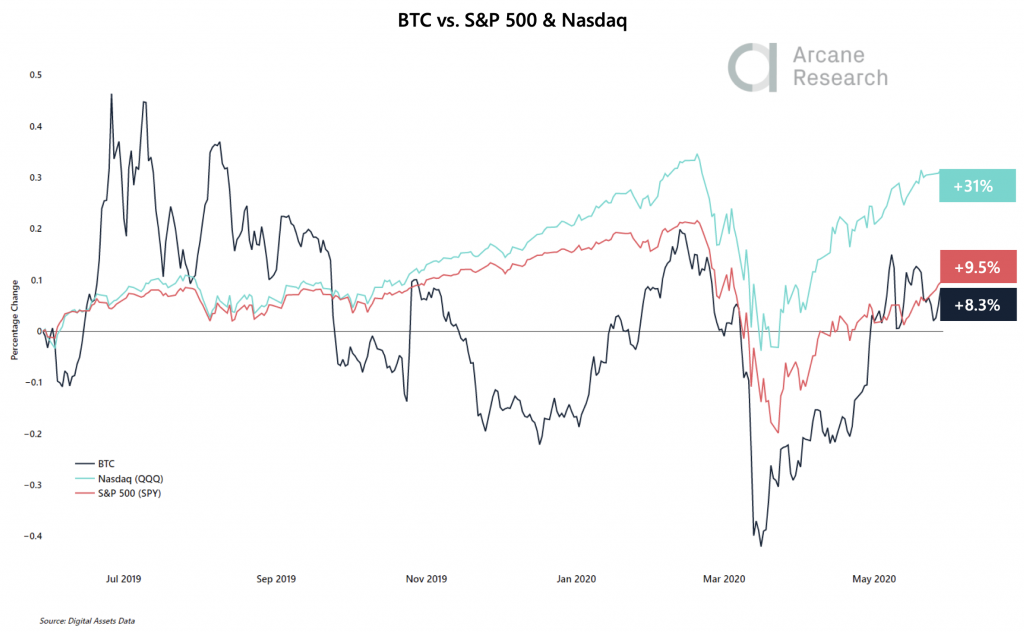

Despite Bitcoin’s strong performance against a backdrop of global turbulence in recent times, it is important to note that the stock market is still outperforming the benchmark cryptocurrency over a one-year period.

There is a strong chance that this trend will soon come to a harsh end, however, as economic and social unrest in the US could lead equities to see further downside in the weeks ahead.

This could allow Bitcoin to gain further ground against the traditional markets in the days and weeks ahead.

Stock market outperforms Bitcoin over one-year period

Despite Bitcoin’s strong performance over the past three months, it has failed to garner any macro-uptrend over a year-long or multi-year long time frame.

This grows clear while looking towards the benchmark cryptocurrency’s price action seen throughout the past 12 months.

One year ago, Bitcoin was trading around $8,600. This means that over a year-long period it has gained 10 percent.

This is in contrast to the S&P 500, which has climbed 13 percent from where it was trading at on June 1st of 2019.

Arcane Research spoke about this trend in a recently released report, explaining that the cryptocurrency’s volatility has also far outweighed that of the stock market. This could make BTC a less attractive investment proposition.

“The stock market has performed better than bitcoin over the last 12 months. In addition, the volatility has been much higher for bitcoin.”

They do further go on to add that a high Sharpe Ratio – which is a measurement of an asset’s average return minus its risk-free return – does make it an attractive addition to investors’ portfolios.

“The uncorrelated property of bitcoin is one of its main advantages as an investment. Combining a high Sharpe Ratio with being uncorrelated, bitcoin is a unique addition to every investment portfolio.”

Here’s why BTC’s underperformance may soon shift

Bitcoin has just recently began trading like a safe haven asset, as it was previously showing high levels of correlation with the global markets.

Bitcoin could now benefit from future stock market declines, and the ongoing pandemic coupled with mounting social unrest in the United States could mean that intense bear-favoring volatility is imminent.

Furthermore, imminent inflation induced by the widespread money printing seen throughout the past few months could further bolster the benchmark cryptocurrency, shining a spotlight in its fixed scarcity.

The confluence of these factors could put a firm end to Bitcoin’s macro underperformance of the traditional markets.

Bitcoin Market Data

At the time of press 9:30 pm UTC on Jun. 2, 2020, Bitcoin is ranked #1 by market cap and the price is down 1.01% over the past 24 hours. Bitcoin has a market capitalization of $175.04 billion with a 24-hour trading volume of $45.19 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 9:30 pm UTC on Jun. 2, 2020, the total crypto market is valued at at $268.99 billion with a 24-hour volume of $145.22 billion. Bitcoin dominance is currently at 65.06%. Learn more about the crypto market ›

CryptoQuant

CryptoQuant