Stablecoin volume outpaces Mastercard, PayPal as digital payments wars loom

Stablecoin volume outpaces Mastercard, PayPal as digital payments wars loom Stablecoin volume outpaces Mastercard, PayPal as digital payments wars loom

Stablecoins surpass Mastercard, PayPal in transaction volumes with a potential to reshape the financial landscape.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

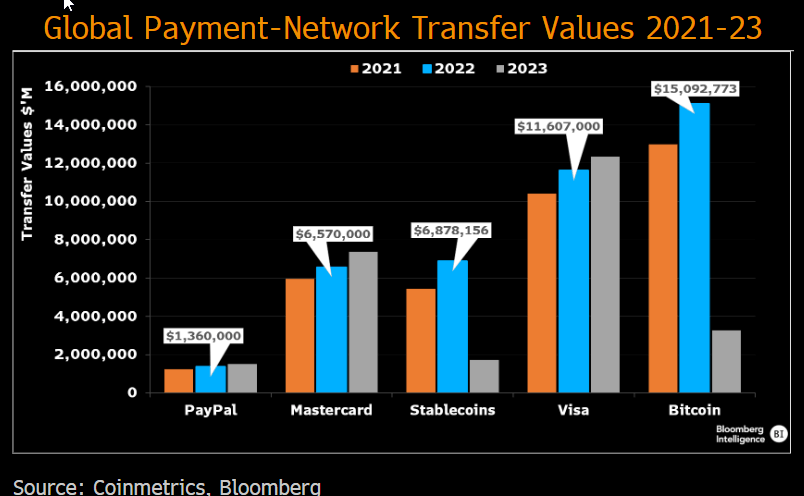

Fiat-backed stablecoins have eclipsed Mastercard and PayPal in moving more value across their networks in 2022, according to a Bloomberg Intelligence note on Aug. 25.

According to Bloomberg Intelligence crypto market analyst Jamie Coutts, stablecoins on several Layer-1 networks transacted $6.87 trillion in 2022, surpassing the transaction volumes of Mastercard and PayPal.

However, stablecoins still lagged behind the Visa network, which processed nearly double the volume at $11.6 trillion.

Notably, the bear market of 2023 has not been so kind to the stablecoin market as it fell behind Mastercard year-to-date.

Coutts suggests that stablecoins’ adoption growth, which has outpaced Bitcoin and Ethereum in the past two years, is set to accelerate due to network effects and significant improvements in blockchain scaling.

These factors are laying the foundation for increased global adoption of stablecoins. However, it’s also worth noting that stablecoin volumes have significantly declined in 2023, primarily due to the cyclicality of crypto asset prices and an unfavorable US regulatory environment.

Despite these challenges, the role of stablecoins in the digital money evolution is indisputable. Coutts projects that the number of stablecoin users might even overtake Bitcoin in the next three to five years.

This potential growth is attributed to the network effects of payment integration with merchant companies like PayPal, Visa, and Shopify, along with product innovations like real-world assets generating yield for stablecoins.

Furthermore, advancements in blockchain scaling are laying the necessary infrastructure for the mainstream adoption of stablecoins. The crypto industry is undergoing rapid changes, with Layer-2 networks experiencing a significant increase in active addresses, thus suggesting that the Ethereum network might be undervalued.

Therefore, Coutts argues that stablecoins have cemented their place in the digital age, proving their worth despite a challenging crypto market. As the crypto ecosystem continues its expansion, the influence of stablecoins is expected to grow, potentially reshaping the digital financial landscape in the coming years.

Digital payment wars.

The news comes alongside the decision to shutter Mastercard services for Binance on Aug. 24, removing pre-paid card services to LatAm and Middle East customers.

In February, reports from Reuters circulated that Visa and Mastercard would pause future crypto ventures until the regulatory climate had improved. Visa disputed the claims at the time.

Recent research data suggests Visa is actively working on crypto products, such as exploring leveraging account abstraction on Ethereum to allow Visa card payments for gas fees.

Further, Bloomberg reported in February that another key legacy payment provider, PayPal, was also pulling back on crypto. However, PayPal’s stablecoin was released less than six months later.

In August, PayPal launched its PYUSD stablecoin with plans to push on to DeFi, and a collaboration with Ledger is already live.

Meanwhile, Mastercard appears to be now focusing its crypto efforts on CBDCs over improving digital asset payment rails.

With stablecoins overtaking Mastercard and PayPal in 2022 and the launch of PayPal’s own stablecoin, the future of digital payments looks set to involve a war of attention between legacy payment providers and the new wave of digital disruptors.