Ripple (XRP), Dogecoin (DOGE) drop 10% as cryptos plunge

Ripple (XRP), Dogecoin (DOGE) drop 10% as cryptos plunge Ripple (XRP), Dogecoin (DOGE) drop 10% as cryptos plunge

The market dropped ahead of a massive options expiry on Friday, with several large-caps falling 10%.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Top cryptos fell by over 5% today as the broader market saw a hit ahead of a $2 billion Bitcoin options expiry on Friday, data from multiple sources shows.

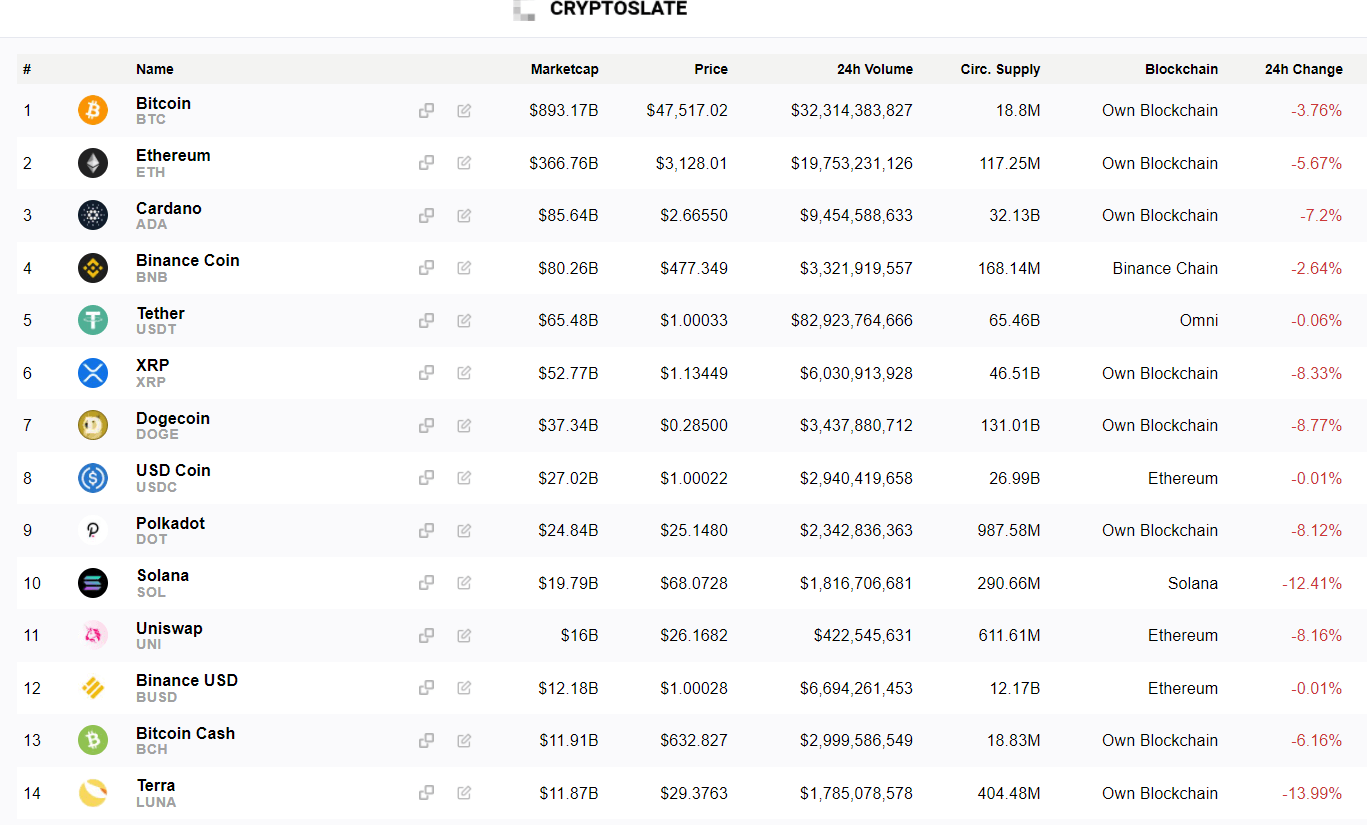

Leading the red charts were Ripple (XRP), Dogecoin (DOGE), and Solana (SOL), with each falling by over 10% and losing billions of dollars from their respective market caps in mere minutes.

As per data on CryptoSlate, the crypto market lost -4.8% off its $2.1 trillion market cap this morning. Bitcoin (-3%) and Ethereum (-4%) saw relatively lesser drawdowns compared to the likes of more popular alts, such as Cardano (-7%), Polkadot (-8%), and Solana (-13%).

Liquidations reach $589 million

Liquidation data on on-chain research tool Bybt showed over $589 million worth of crypto positions were lost to exchanges as the market moved against what most traders had bet on.

‘Liquidations,’ for the uninitiated, occur when leveraged positions are automatically closed out by exchanges/brokerages as a “safety mechanism.” Futures and margin traders—who borrow capital from exchanges (usually in multiples) to place bigger bets—put up a small collateral amount before placing a trade.

Bitcoin traders took on a majority of all liquidations over the past day, with $200 million worth of trading positions getting obliterated. Ethereum traders were next with $113 million in liquidations, with Ripple (XRP), Cardano (ADA), and Dogecoin (DOGE) traders taking on $49 million, $28 million, and $24 million worth of damages.

86%—or $511 million of all liquidations—of all traders were those of a ‘long’ position, meaning betting on higher asset prices.