Privacy is back on the agenda: Monero and Zcash surge on executive order leak

Privacy is back on the agenda: Monero and Zcash surge on executive order leak Privacy is back on the agenda: Monero and Zcash surge on executive order leak

U.S Treasury Secretary Yellen inadvertently leaked details of the forthcoming executive order on digital assets, leading to a spike in Monero and Zcash. What does this tell us?

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

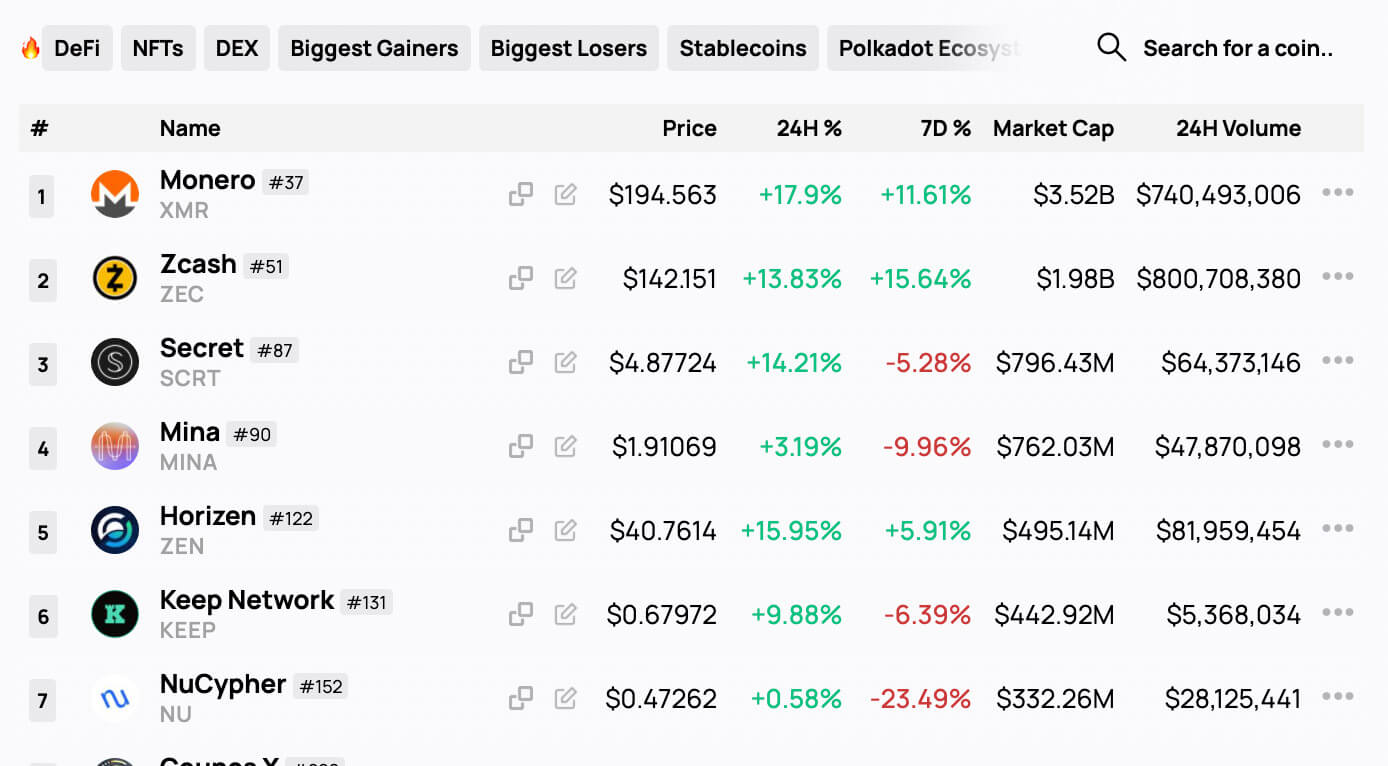

Privacy coins have surged, with Monero posting +18% gains over the last 24-hours to lead the top-100. Similarly, Zcash posted an impressive performance, coming second ahead of Secret.

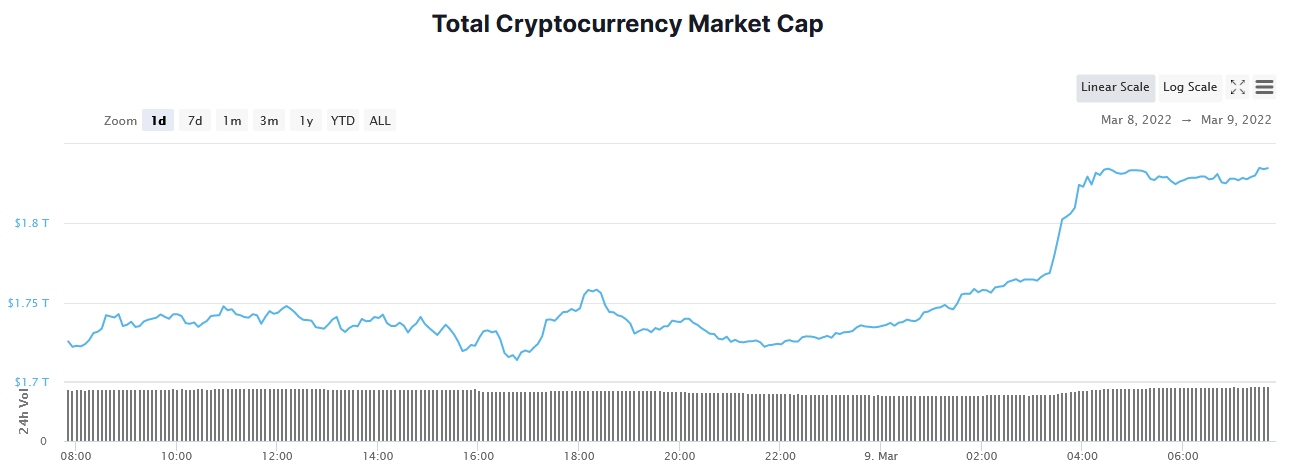

The last 24-hours have seen $108 billion of inflows into crypto markets. The chart below shows a gradual uptick from 22:00 (GMT) Tuesday, followed by a sharp rise around 03:00 (GMT). A plateau of activity since then puts the total market valuation at $1.835 trillion presently.

Analysts have attributed this to a U.S Treasury leak ahead of President Biden’s executive order on digital assets, which is expected to be signed later on Wednesday. However, Treasury Secretary Janet Yellen prematurely posted a statement on the executive order, which has since been taken down.

Although crypto markets responded favorably to the leak, as evidenced by Monero’s rare pack leading position, the privacy-minded take a different view.

Monero spikes on Yellen leak

Yellen’s leak reveals the Biden Administration intends to take a “coordinated and comprehensive approach to digital asset policy.” It continued by saying the policy will “support responsible innovation,” resulting in significant benefits for all.

However, it also mentioned “preventing threats” to the financial system, which leaves readers wondering what the Biden Administration deems a threat.

“It will also address risks related to illicit financing, protecting consumers and investors, and preventing threats to the financial system and broader economy.”

Authorities often use terms such as “illicit financing” and “terrorist financing,” in context with cryptocurrency, to enact unjust policy. For example, before Russia’s u-turn on banning Bitcoin, the Russian central bank used similar language in early February.

Spikes in Monero and ZCash today indicate suspicions over the executive order, and where it may lead as far as government overreach is concerned.

Robert Kiyosaki thinks its bye bye Bitcoin

The Russia-Ukraine conflict has seen an outpouring of pressure to hurt every day Russian people, many of which don’t support the war. Some international companies have bowed to the pressure, with McDonald’s, Starbucks, and Coke Cola announcing their withdrawal from Russia.

Crypto exchanges have also come under pressure to act. Although Binance has (so far) ruled out a blanket ban on Russian addresses, Coinbase yesterday enforced a ban on 25,000 accounts to “comply with sanctions.”

With a crypto framework in place via the executive order, it would become increasingly difficult to avoid the prying eyes of the government. On that, Rich Dad Poor Dad author Robert Kiyosaki posted a grave prediction that this will lead to cryptocurrency seizures and forced adoption of a central bank digital currency.

“BYE-BYE BITCOIN: Prediction. Biden to sign EXECUTIVE ORDER regulating Cryptos. NEXT: Fed Crypto. NEXT: all crypto currencies seized & folded into GOVERNMENT crypto. “Let’s Go Brandon” you criminal. You commie.”

While Kiyosaki’s view seems extreme, based on Executive Order 6102, enacted in 1933, which confiscated gold from U.S citizens, he may have a point.