TitanSwap is building the strongest exchange ecosystem for all users

Disclaimer: This is a sponsored press release. Readers should conduct their own research prior to taking any actions related to the content mentioned in this article. Learn more ›

As one of the indispensable foundations in the blockchain industry, the digital currency exchange has always been a battleground for old and new start-ups. Based on statistics, there are already tens of thousands of digital currency exchange in the market, trying to gain more market share. The competition is fierce and it is not easy to stand out. Currently, the most popular exchanges are centralized exchanges and decentralized exchanges.

Centralized exchanges (CEX) enjoy relatively faster transaction speeds, lower user thresholds, and users don’t need to manage secret keys by themselves. Meanwhile, as the users’ cryptocurrency is under the custody of the exchange, there is a risk of the shutdown or vanish of the exchanges, and security incidents such as theft and loss of coins often occur in centralized exchanges.

As for decentralized exchanges (DEX), currently, there are two types of DEXs. The first type is the DEXs matching the orders of buyer and seller, with the operation process taking place on-chain. A typical representative is the EOS decentralized exchange, Newdex. The other type is based on funding pools rather than order books composed of the orders from buyers and sellers, and the operation is more similar to a human-machine transaction. UniSwap is the symbol of this type of DEXs.

In fact, the emergence of UniSwap officially started the trend of decentralized exchanges. As soon as it launched the market, many second-tier exchanges were impacted. Under this shocking influence, a bunch of digital currency projects began to explore their market in Swap, leading to an increasing number of DEXs.

In this competition, who is most likely to be the winner? TitanSwap.

TitanSwap, King of Swag, is gradually implementing its future plan

TitanSwap is a decentralized exchange (DEX) based on AMM mechanism, which greatly simplifies the operation of market makers, and anyone can put liquidity into TITAN Pool and gain profit.

TITAN includes TITAN Swap, TITAN, TITAN Automated Order, TITAN Smart Route, TITAN Address Audit, TITAN Adaptive Bonding Curve, TITAN Layer2 Support, etc.

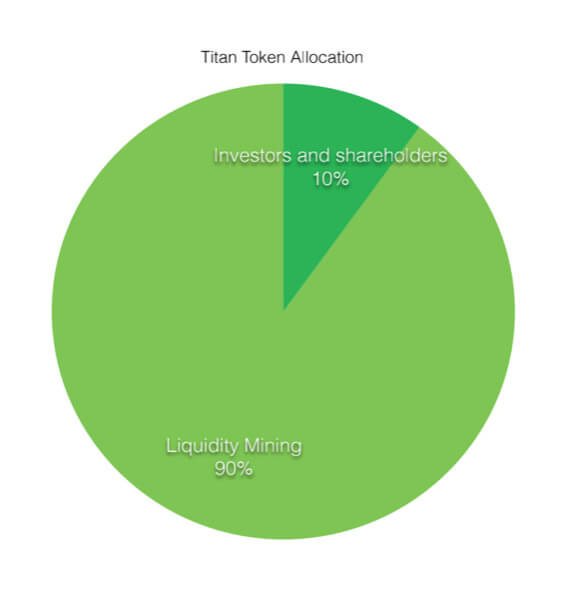

Among them, TITAN is the governance token of TITAN DAO, with the proposal and voting rights to jointly determine the future of TITAN. At the same time, rewards are given to liquidity providers and traders. For example, after users possess TITAN governance tokens, they can enjoy the governance rights:

- Increasing or reducing the transaction fee of TITAN Pool based on the volatility of the trade.

- TITAN time-weighted voting coefficient

- Adjusting the speed of liquidity mining to release TITAN

- Adjusting the TITAN allocation weights between different liquidity pools

- A bonus weighting factor for locked voting

- Minimum collateral requirements to become a brokerage.

Compared with other DEXs, TitanSwap pays more attention to user experience and regards each user as a member of ecological development.

In addition, users can inject liquidity into the Titan Pool liquidity pool and become a liquidity provider, or use TitanSwap to complete transactions and activate the Titan decentralized financial center ecosystem. In this way, users can become a Titan ecological builder and be rewarded.

TITAN Automated Order is an automated order mechanism based on AMM. Under the AMM mechanism, TitanSwap adopts an Adaptive Bonding Curve, differing from other DEXs. Automatically adapt to different bonding curves for different asset types, TitanSwap can achieve a perfect combination of greater liquidity and better price discovery mechanisms, and provide users with the best exchange path: It can be set to automatically execute in the order of the queue when the order reaches the predetermined execution price, and provide automated tools for arbitrageurs and improve the AMM price formation mechanism. It can provide users with smaller slippage, lower costs, and systematically provide greater liquidity for the system.

TITAN Smart Route can realize the automatic selection of multiple main chain liquidity pools, support more trading pairs and ensure less slippage. Its mission in the first phase is to determine the best liquidity pool to use based more on the pairs that the Trader is trading and their order sizes.

In the second phase, enable orders via cross-chain smart routing with the automatic selection of multiple mainnet liquidity pools. A cross-chain asset exchange will be achieved through anchoring the underlying assets of the mainnet on Ethereum.

TITAN Address Audit: As many DEXs currently do not conduct KYC/AML audits on users on the platform, nor have they established an audit mechanism for the tokens traded on the platform, a large number of fraud projects show up on the exchanges, causing huge losses to users. TITAN Address Audit cooperates with CoinGecgo to identify the address of the token contract in the transaction pair to avoid scam coins and help users select the right token.

In the exchange ecosystem, users are the god. Only by providing better services to users, can the ecosystem develop better. The core of TitanSwap is user-orientated, which is to provide customers with the best solution and offer users the best experience.

TitanSwap’s official website has been officially launched, and other products will come to the market one after another. The benefits from TitanSwap are on the way, so stay tuned!

CryptoQuant

CryptoQuant

Farside Investors

Farside Investors