Mati Greenspan discusses DeFi casinos, the Bitcoin bull case, and how global banks are “bleeding”

Mati Greenspan discusses DeFi casinos, the Bitcoin bull case, and how global banks are “bleeding” Mati Greenspan discusses DeFi casinos, the Bitcoin bull case, and how global banks are “bleeding”

In a recent interview with community-driven crypto edutainment channel Cryptonites, cryptocurrency investor and Quantum Economics founder Mati Greenspan shared his thoughts on the current trends and topics of discussion in the crypto market, such as the rise of DeFi, the rise of Bitcoin, and even some important takeaways for budding crypto traders. Greenspan’s an equity […]

In a recent interview with community-driven crypto edutainment channel Cryptonites, cryptocurrency investor and Quantum Economics founder Mati Greenspan shared his thoughts on the current trends and topics of discussion in the crypto market, such as the rise of DeFi, the rise of Bitcoin, and even some important takeaways for budding crypto traders.

Greenspan’s an equity and crypto market veteran known for his previous work with multi-asset broker eToro — where his insights and calls on the Bitcoin market reached unprecedented popularity within the crypto community and provided valuable information for those taking their first steps in the burgeoning market.

And in case you were wondering: Greenspan opened his first paper trading account at the ripe age of 13 — while trying to figure out the price movements of gold and commodities.

Should Bitcoin traders use technicals or fundamentals?

As a user of both technical and fundamental analysis for making trades, Greenspan said that setting a time horizon was the most important for any trader. Greenspan said:

“Some may use trendlines and pivot points to analyze the market and place trades, while others may concentrate on important news events like the upcoming US presidential elections to determine how their investments work out.”

And while both are correct methods, they work better in different timelines (technical for the short term, fundamental for long term), the veteran analyst further added.

However, these could be invalidated based on sudden new developments, Greenspan noted, such as how news of the COVID-19 caused a 45% percent in the crypto market earlier this year — an event now called “Black Thursday.”

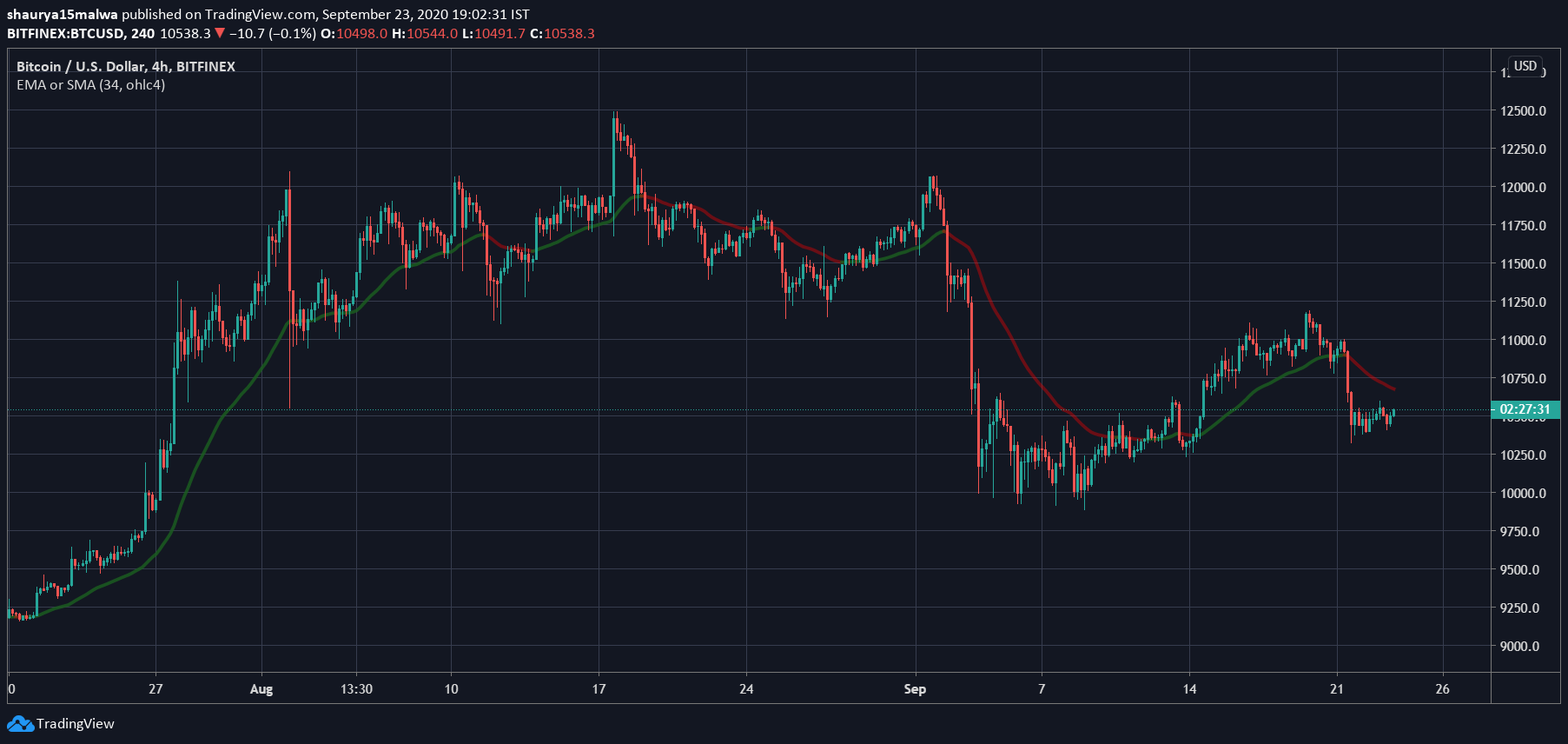

Bitcoin — correlated to stonks but why?

Greenspan then spoke on the apparent correlation the Bitcoin market seems to exhibits with traditional asset classes, such as the S&P 500 Index or gold. (The three have largely been “one big trade,” as crypto fund manager Travis Kling pointed out in a tweet earlier this month).

It's all one trade. pic.twitter.com/0yvnAqDPqv

— Travis Kling (@Travis_Kling) September 1, 2020

Greenspan stated, “In the aftermath of COVID-19, Bitcoin has a higher tendency to be correlated to the stock market. However, that just on a day-to-day basis…driven by the money injected by the US federal market reserve in the US stock market.” He added:

“A lot of money has hence ended up in the crypto market because it’s part of the global economy. And therefore, whatever happens in the macroeconomy has a huge effect on the crypto market.”

“A bandage on a severed arm”

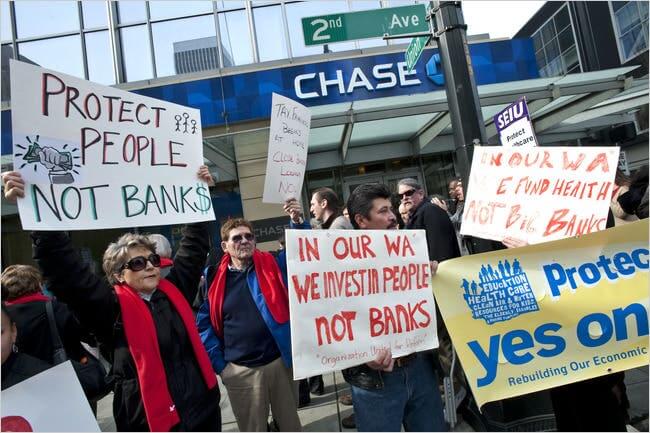

Cryptonites asked Greenspan about his views on the global banking system, which has poured trillions of dollars under “quantitative easing” policies to revive the stock market, oft to benefit the few and make the rich ever richer.

Greenspan used a phrase made famous by Morgan Creek Digital founder Anthony Pompliano, “long Bitcoin, short the bankers,” to explain his long-term sentiment and bullishness on the Bitcoin in the face of quantitative easing.

“The banking system has been failing since the financial crisis. They took the money but there isn’t any way to fix that problem. It’s like a bandage on a severed arm. They (the banks) are bleeding out.”

“The tech revolution is coming, and it’s going to destroy them completely,” Greenspan added.

Banking has been in a bit of a rut lately. Reports from last week showed banks laundered up to $1 trillion in illicit, even terrorist-backed, money in the past years — a development that can potentially reduce long-term trust in the financial system.

This has led to calls for the use of technology more significantly in the financial markets, especially to cut out fraud, manage risk, and bring down money laundering via fiat.

DeFi: The casino that rekts

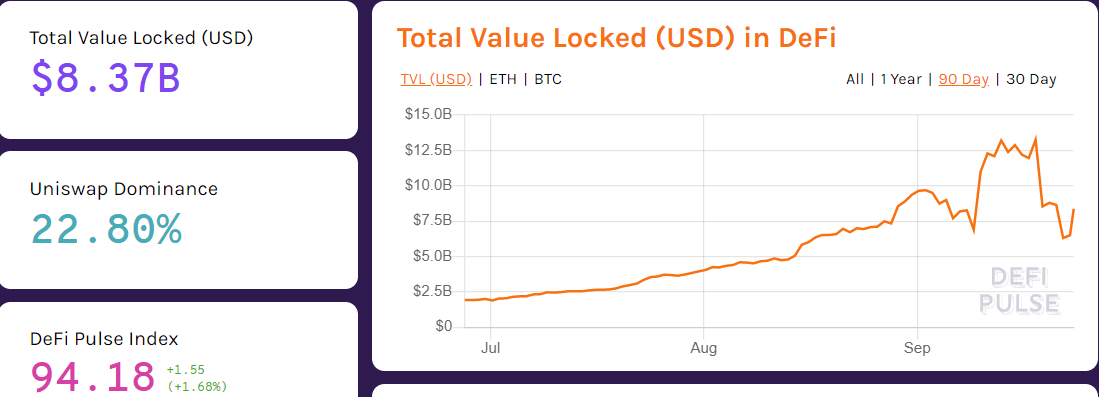

Cryptonites also asked Greenspan his thoughts on DeFi investing, especially considering the enormous daily market volume that projects like Uniswap have enjoyed in recent months, which has transpassed even the volume on CEXs like Coinbase.

But for a trader like Greenspan, the all-in or nothing risk profile of DeFi tokens isn’t worth his while. “I view these projects largely as gambling, and I couldn’t believe the amount of money thrown at these unaudited contracts at all,” he stated.

Greenspan also criticized how billion-dollar DeFi valuations were calculated, “How is the money counted? Are you counting? This $8 billion figure, is it maybe 1 billion that’s been leveraged eight times? I have no idea.”

Leverage and closing thoughts

As a piece of advice for budding traders, Greenspan said one must stay away from high leverage in crypto trading, “If you’re going above 10, it means that you’re going to lose your money.”

“Almost definitely. I know that there are plenty of cowboys out there and plenty of success stories of people who never saw retracement in the market. But for the most part, stay away from leverage in general,” he ended.

CoinGlass

CoinGlass