Op-ed: Could a spot ETF lead to ‘paper’ Bitcoin controlling the market?

Op-ed: Could a spot ETF lead to ‘paper’ Bitcoin controlling the market? Op-ed: Could a spot ETF lead to ‘paper’ Bitcoin controlling the market?

The double-edged sword of a spot Bitcoin ETF and the looming specter of 'paper Bitcoin' taking over the market.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

The air is thick with speculation. Bitcoin, the flagbearer of the digital currency realm, stands at the precipice of historic transformation.

The game appears to be changing with financial titans like BlackRock, Fidelity, and Ark Invest filing for SEC approval for spot Bitcoin ETFs. But is it all sunshine and rainbows from here?

While approval could trigger a wave of institutional money, there are rising concerns that it could also lead to the emergence of “paper Bitcoin,” potentially steering the Bitcoin market away from its decentralized essence.

The Immediate Upside: An Onramp for Institutional Money

Bitcoin’s volatile past has seen it struggle for mainstream acceptance. However, filing spot Bitcoin ETFs by financial behemoths strongly indicates a more stable future. There’s an optimistic buzz in the market, not just because of these filings but also because these proposals claim to address the SEC’s concerns about fraud and market manipulation.

If the SEC green-lights these ETFs, we are looking at a potential torrent of institutional investment that could lift Bitcoin to staggering new highs.

In terms of market impact, these developments have already set the wheel in motion, with Bitcoin surging over 20%, closing in on the $35,000 mark. With billions in inflows anticipated, there’s chatter about Bitcoin soaring to over $145,000.

The Long-Term Concern: The Rise of “Paper Bitcoin”

However, the creation of spot Bitcoin ETFs also brings the risk of giving birth to “paper Bitcoin”—a representation of actual Bitcoin ownership without requiring physical custody of the digital coins.

This could mark a tectonic shift in how Bitcoin is traded, managed, and understood. Like gold ETFs, often settled in cash and not physical assets, spot Bitcoin ETFs could make it easier for investors to bet on Bitcoin’s price without owning the asset.

If paper Bitcoin gains ground, a gap between actual supply and demand may form, potentially allowing the ETFs to control price discovery and disrupting the decentralized ethos that Bitcoin was built upon. With more people investing in paper Bitcoin rather than the actual asset, there are fears that Bitcoin’s supply could be manipulated to serve the interests of larger financial entities.

However, when reviewing the latest BlackRock filing for its spot Bitcoin application, it does not seem like BlackRock could issue paper Bitcoin without holding the underlying asset.

The prospectus states that the Trust will store actual Bitcoin with a custodian. The bitcoins are held in “cold” (offline) storage and trading accounts. When new shares are issued, they must be backed by a corresponding amount of Bitcoin deposited into the Trust’s accounts.

The prospectus states

“No Shares are issued unless the Bitcoin Custodian or Prime Broker has allocated to the Trust’s account the corresponding amount of bitcoin.”

The value of the shares tracks the price of the actual Bitcoin held by the Trust, based on a Bitcoin pricing index. The Trust must pay expenses and fees, which means it needs to sell some of its Bitcoin holdings periodically. However, the number of shares stays constant, reducing the amount of Bitcoin backing each Share.

So, based on the description in the prospectus, it does not seem feasible for BlackRock to issue these shares without holding the underlying Bitcoin assets to back them. The Shares represent direct ownership interests in the Trust, which directly owns the bitcoins.

The Liquidity Paradox

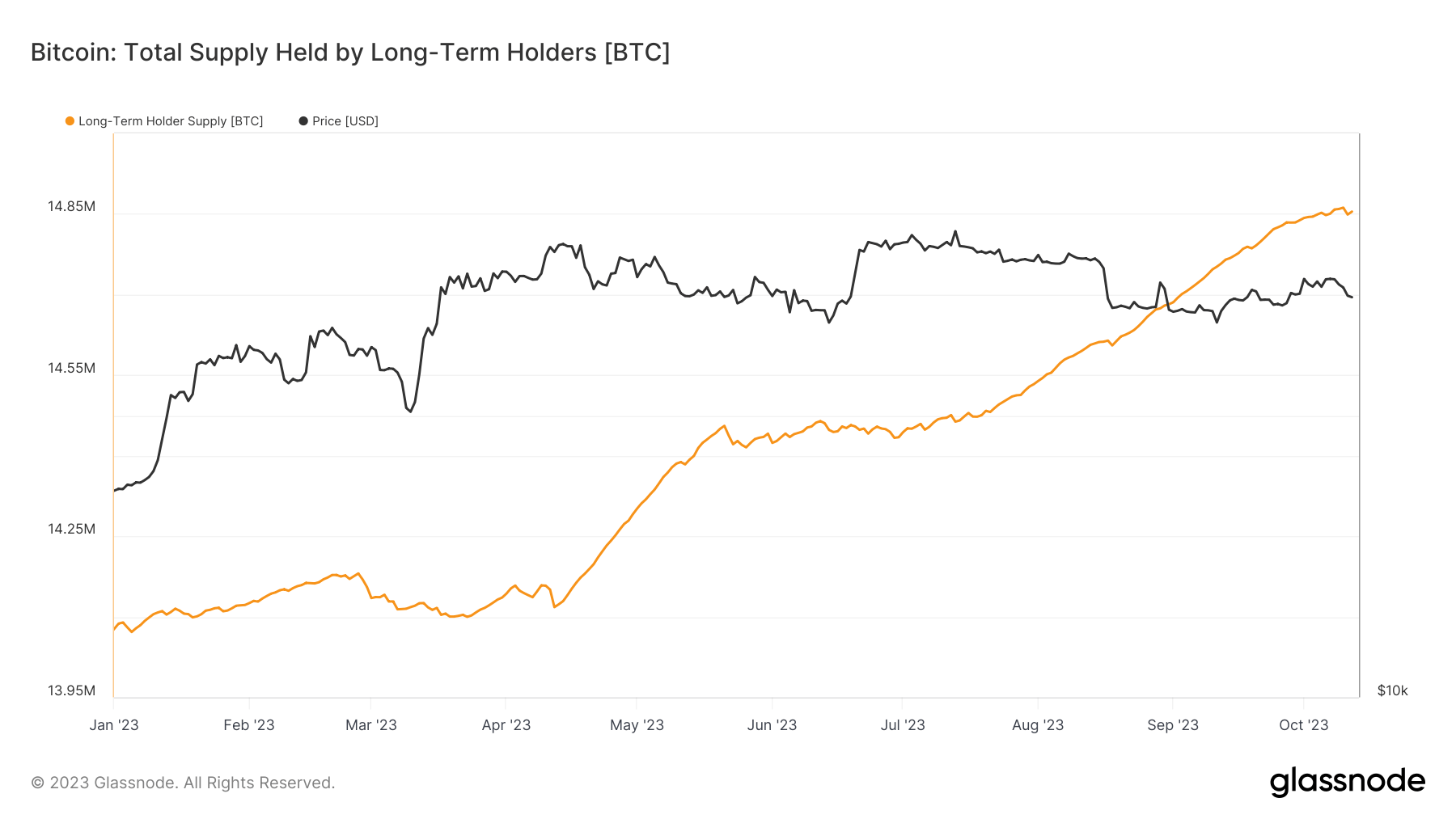

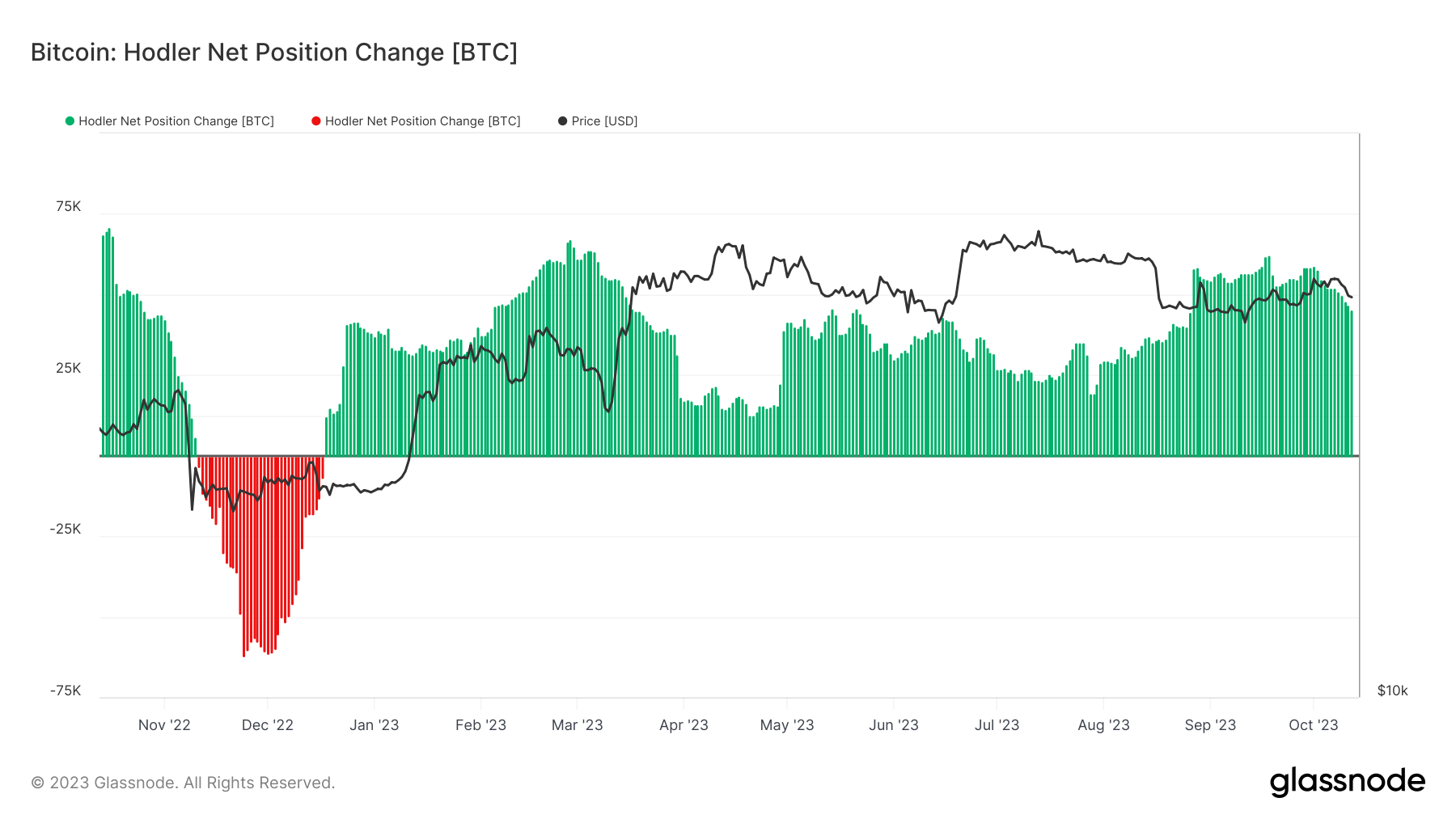

Moreover, while Bitcoin ETFs might promise increased liquidity, let’s not forget that over 76% of existing Bitcoin is held by long-term holders in accounts that have not transacted in over 155 days.

The prevalence of “hodling” suggests a certain resilience but also points to existing liquidity challenges. An influx of paper Bitcoin could exaggerate these liquidity issues, making the market even less accessible for new entrants and existing holders who might want to sell.

This vast reserve of inactive Bitcoin underscores not just the long-term confidence of these holders but also a practical liquidity challenge already in the market.

The phenomenon of “hodling” represents both strength and vulnerability. On the one hand, it signals firm investor conviction in Bitcoin’s future, potentially stabilizing prices and serving as a buffer against market volatility.

On the other hand, it signifies that a significant portion of Bitcoin’s supply is off the market for all intents and purposes. This creates a tight supply environment, making it more challenging for new investors to enter and existing holders to exit without causing significant price fluctuations.

Introduce “paper Bitcoin” into this equation, and the liquidity dynamics could be even more complex. If a large segment of market participation shifts towards trading paper Bitcoin via ETFs, we might find ourselves in a paradoxical situation.

While these ETFs could offer the allure of enhanced liquidity on the surface, they could simultaneously exacerbate the existing liquidity challenges in the actual Bitcoin market.

Why?

Because paper Bitcoin doesn’t immediately necessitate the purchase of real Bitcoin, potentially causing a disconnect between supply and demand metrics. This could create a bifurcated market—liquid on paper but increasingly illiquid in reality—posing challenges for both new entrants seeking to buy and existing holders looking to sell.

Could BlackRock issue ‘paper’ Bitcoin without holding the underlying asset?

In the BlackRock prospectus, I could not identify specifics on the timing lag between share purchases and Bitcoin acquisitions. However, it does suggest that Bitcoin is acquired before shares are issued:

“The Trust issues and redeems Shares only in blocks called “Baskets.”

Only “Authorized Participants” may purchase or redeem Baskets. To create a Basket, an Authorized Participant deposits the corresponding Bitcoin with the Trust in exchange for shares.

This implies BlackRock would need to have custody of sufficient Bitcoin before issuing new shares to an Authorized Participant. The prospectus does not appear to describe a mechanism for issuing shares before acquiring Bitcoin.

However, the prospectus does not provide all operational details. So, while it suggests shares are only issued after getting Bitcoin, it’s possible there could be some short lag in practice.

Thus, while Bitcoin ETFs hold the promise of increased liquidity, the prevailing trend of “hodling” and the potential influx of paper Bitcoin create a nuanced landscape. It could lead to a market that appears liquid but is fraught with underlying challenges, making it both compelling and treacherous for investors.

Lessons from the Gold ETF surge

When we consider the future of Bitcoin ETFs, the trajectory of gold ETFs provides an illuminating case study. Introduced in 2003, gold ETFs revolutionized how investors could access this traditional store of value. They ushered in a plethora of advantages, such as cost efficiency, increased transparency, and enhanced liquidity, effectively democratizing gold investment.

Let’s look at the numbers to understand the impact better. The average daily trading volume for gold in 2023 stands at $139 billion, making it one of the most liquid assets globally, in part thanks to the liquidity and accessibility offered by gold ETFs.

Moreover, gold prices displayed resilience, falling only 3.7% in Q3 2022 but remaining up by 11% over the previous year. These dynamics suggest that ETFs can attract significant investment even when the underlying asset faces market headwinds.

So what could this mean for Bitcoin? If Bitcoin ETFs are approved and manage to replicate even a fraction of gold ETFs’ success, we could witness an inflow of institutional and retail investment on a scale not seen before in the crypto market. Given that gold ETFs have enabled daily trading volumes in the hundreds of billions and Bitcoin currently trades around $23 billion per day, Bitcoin ETFs could similarly become a catalyst for tremendous volume and capital inflow.

However, the key difference here lies in the market cap and existing liquidity. Gold has been traded for centuries and has a market cap in the trillions, while Bitcoin, with its $669.7 billion market cap, is still in its adolescent stage. Yet, this also indicates more room for exponential growth.

Thus, the transformative effect of gold ETFs on their underlying asset offers a tantalizing preview of what could be in store for Bitcoin. While one must exercise caution given the inherent differences and risks between the two assets, the successful path paved by gold ETFs suggests that Bitcoin could be on the cusp of a new era of investment, liquidity, and valuation.

The Halving X-Factor

Adding a layer of complexity is Bitcoin’s impending halving event. With the supply of new Bitcoin set to decrease, an ETF-induced demand surge could send prices skyrocketing. But if that demand is mainly for paper Bitcoin, then the implications for the actual, physical Bitcoin market could be unprecedented and unpredictable.

While the potential approval of spot Bitcoin ETFs opens the door for transformative institutional investment, it also raises legitimate concerns.

The rise of “paper Bitcoin” could shift control of the Bitcoin market away from individual, decentralized actors to more centralized financial entities.

As we stand at this crucial juncture, one thing is sure: the decisions made today will have a far-reaching impact on the Bitcoin landscape of tomorrow.

Therefore, while we may revel in the short-term gains, we must be wary of the long-term implications. After all, in the quest for legitimacy and acceptance, Bitcoin must not lose its soul.