Bitcoin supply absorption by various cohorts suggests impending halving event not fully priced in

Bitcoin supply absorption by various cohorts suggests impending halving event not fully priced in Quick Take

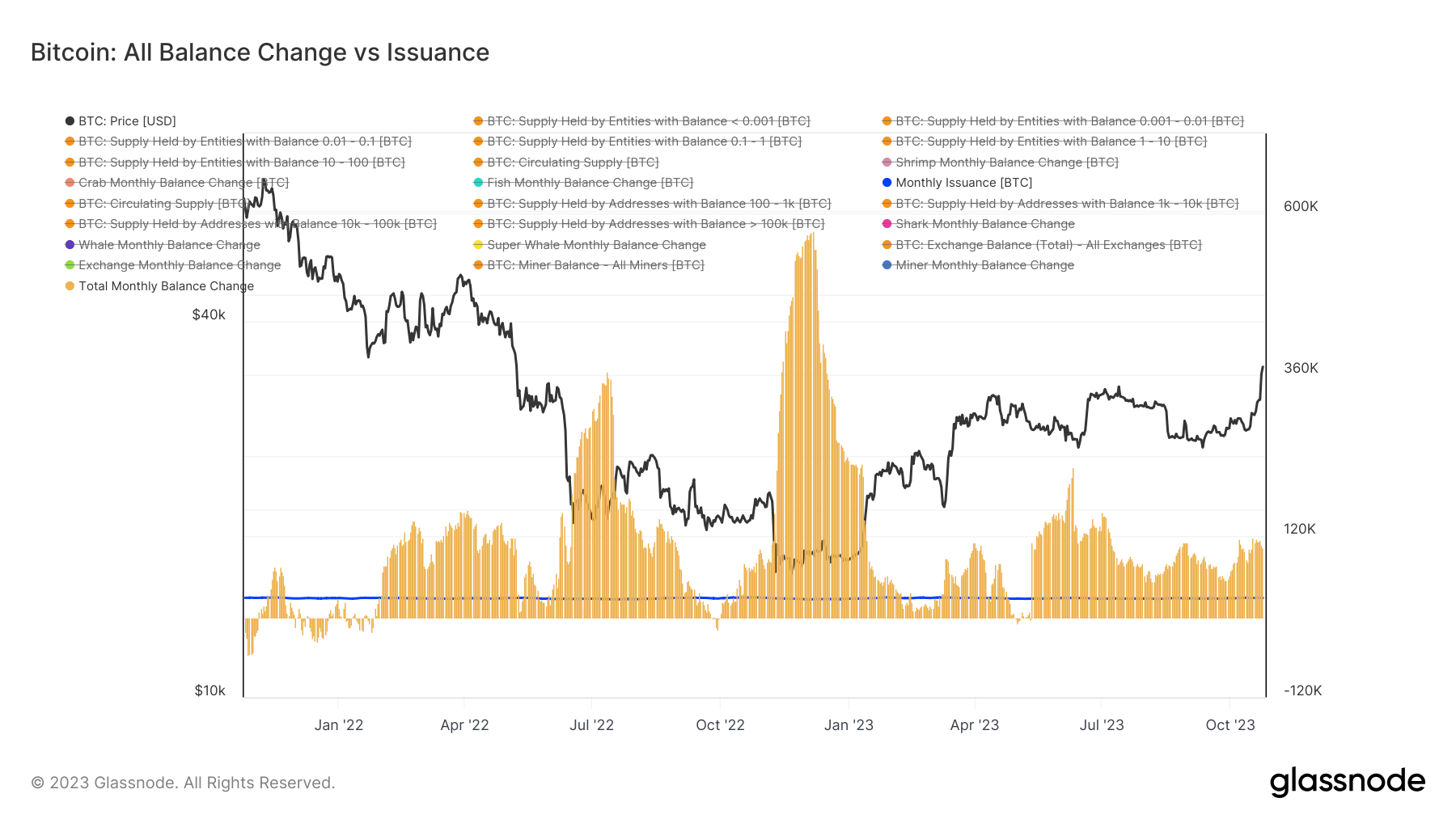

A deep dive into Bitcoin’s issuance reveals a fascinating trend as the next Bitcoin halving event approaches.

The current monthly issuance of Bitcoin stands at 27,000 BTC, calculated from 900 Bitcoin mined each day over 30 days. An analysis of various cohorts, along with exchanges and miners, unveils a significant absorption of this supply.

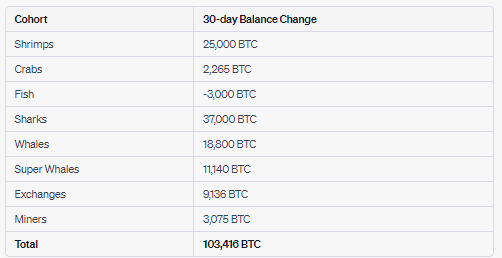

Indeed, the balance of the 27,000 BTC is being consumed overwhelmingly. The past month’s data shows ‘Shrimps’ accumulating 25,000 BTC and ‘Crabs’ by 2,265 BTC,

‘Fish’ decreased by 3,000 BTC, ‘Sharks’ by 37,000 BTC, ‘Whales’ by 18,800 BTC, and ‘Super Whales’ by 11,140 BTC.

Meanwhile, exchanges saw a balance decrease of 9,136 BTC, seen as a bullish sign, and miners increased their balance by 3,075 BTC. In total, these cohorts absorbed roughly 103,000 BTC.

With the impending halving event, the monthly Bitcoin supply will drop to 13,500 BTC. Assuming constant demand, this reduction in supply could trigger a bullish turn in the market—an event that may not yet be fully priced in.