Nexus Mutual surpasses 1% of total DeFi TVL as insurance market heats up

Nexus Mutual surpasses 1% of total DeFi TVL as insurance market heats up Nexus Mutual surpasses 1% of total DeFi TVL as insurance market heats up

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

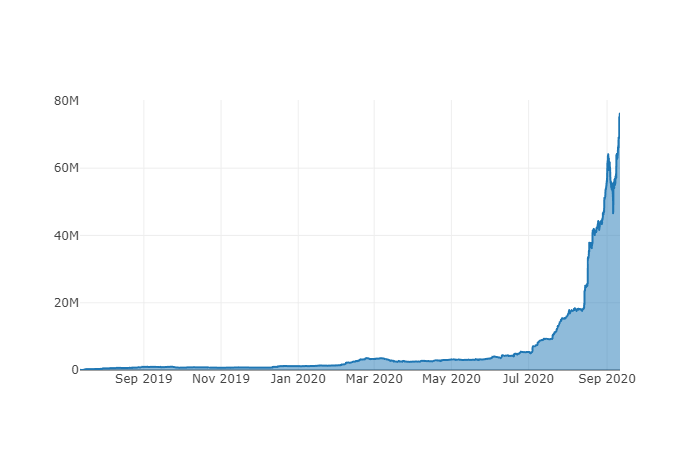

Nexus Mutual, the insurance coverage provider for decentralized finance (DeFi) protocols, surpassed $74 million in active coverage. It now covers for 206,763 ETH, which is around 1% of the total DeFi market.

Richard Chen, a partner at 1Confirmation, wrote:

“Nexus Mutual just crossed 1% of TVL in DeFi covered! Great achievement but still long ways to go.”

Although its TVL remains relatively low compared to major DeFi protocols, it is one of the two major insurance underwriters.

Why industry executives are optimistic about Nexus Mutual (NXM) and DeFi insurance

DeFi insurance is still a nascent market, and whether Nexus Mutual would succeed is still uncertain. But industry executives are optimistic about NXM and DeFi insurance as a whole.

According to Yan Liberman, the co-founder of Delphi Digital, the target market of DeFi insurance is still mostly untapped.

There is significant growth potential in the DeFi sector, especially for early key players, including Nexus Mutual and Yearn.finance’s Yinsure.finance. Liberman noted:

“Projects will often use their supply side to incentivize an environment where demand side can grow. Nexus is dealing with the opposite. It has immediate product market fit, evidenced by growth in coverage and how quickly excess capacity for cover is usually purchased. Even with all the recent growth in cover, the target market is still largely unaddressed.”

One of the skepticisms towards the growth trajectory of Nexus Mutual is it’s Know Your Customer (KYC)-enabled platform. To purchase NXM and gain active coverage, users need to undergo KYC.

Due to the KYC, major exchanges, including Binance, listed Wrapped NXM (WNXM) that does not require KYC to hold.

But Liberman stated that NXM has significant accessibility with its integration with Yearn.finance. Recently, Yearn.finance selected NXM as its insurance underwriter.

Within several months since its launch, Yearn.finance has quickly evolved into a DeFi giant. Its valuation hovers at $1 billion after the Coinbase listing on September 10.

Based on the accessibility of NXM and its coverage of Yearn.finance, Liberman noted that NXM has strong potential. He added:

“On the demand side, product market fit is and always will be a primary driver, but accessibility is also important. That’s why the recent integration with Yearn will be huge. $YFI enables users to purchase NXM underwritten insurance without KYC.”

DeFi market is still growing

Following the listings of Yearn.finance’s native token YFI by Coinbase and Binance, the awareness of DeFi has started to increase.

But as CryptoSlate previously reported, the DeFi sector is primarily used by native cryptocurrency users. It remains untouched by casual and mainstream users.

Over the longer term, especially as ETH 2.0 launches, the DeFi market has room to rapidly expand. Infrastructure is being built by organizations backed by major crypto companies, exchanges, and investment firms.