LUNA rallies as Terra raises $1 billion to create a Bitcoin reserve for UST

LUNA rallies as Terra raises $1 billion to create a Bitcoin reserve for UST LUNA rallies as Terra raises $1 billion to create a Bitcoin reserve for UST

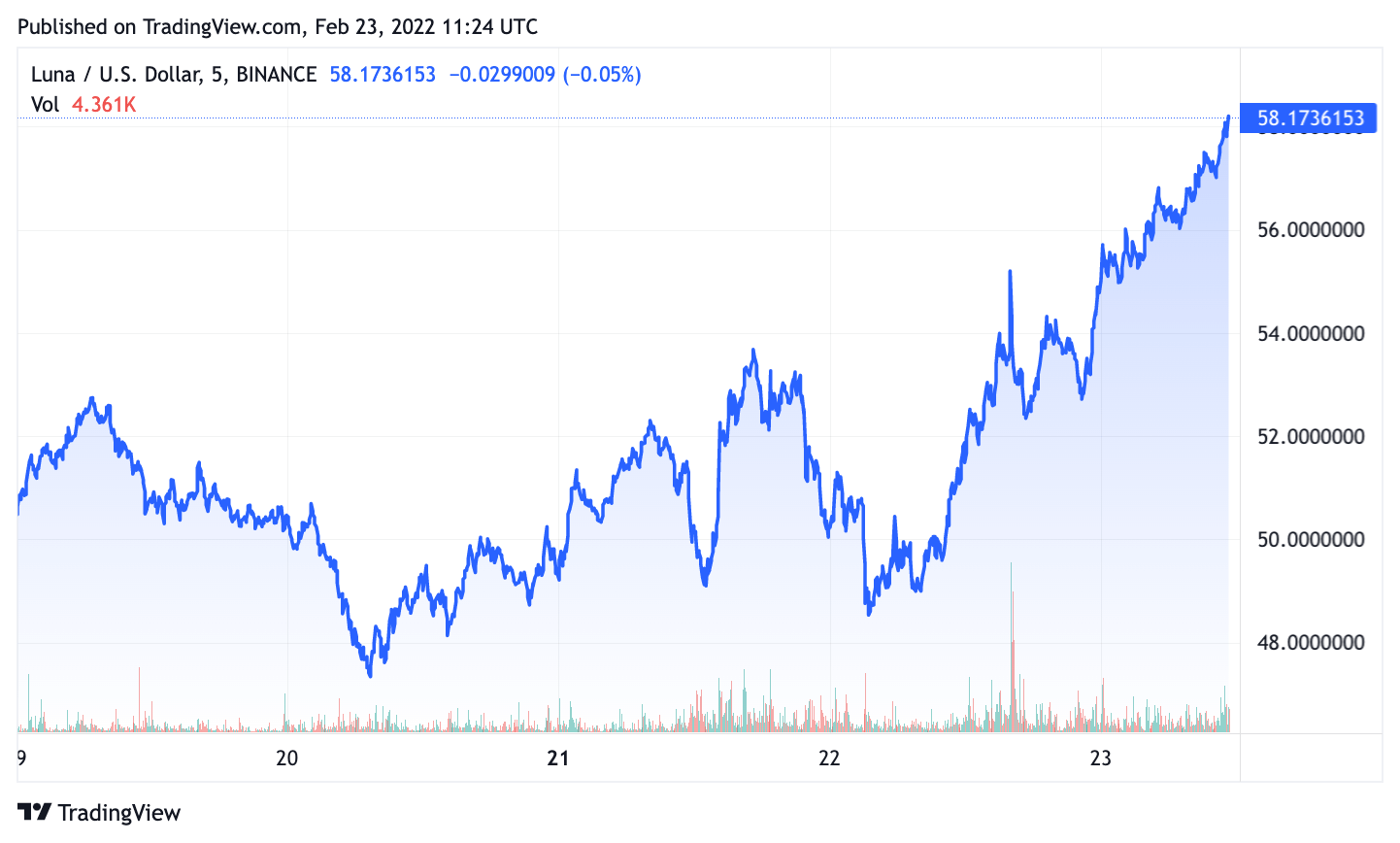

Terra’s native token LUNA is up over 14% following the news of one of the more impressive raises the crypto space has seen to date.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Luna Foundation Guard (LFG) recently completed an over-the-counter sale of LUNA–raising $1 billion from venture capital groups led by Jump Crypto and Three Arrows Capital.

Established in the Republic of Singapore, LFG is a non-profit organization that formed in January to help support the growth of the Terra ecosystem, and the sustainability and stability of its algorithmic stablecoins.

Reserve denominated in Bitcoin to safeguard the UST peg

The $1 billion raised in a recent private sale will go towards forming a decentralized UST Forex reserve denominated in Bitcoin, according to Terra’s announcement on Twitter.

1/ The long awaited [REDACTED] 💎3 is here!

📣 The Luna Foundation Guard (LFG) has closed a $1 billion private token sale to establish a decentralized $UST Forex Reserve denominated in $BTC! 📣

🧵👇

— Terra (UST) 🌍 Powered by LUNA 🌕 (@terra_money) February 22, 2022

Bitcoin-denominated reserve for Terra’s biggest stablecoin will help ensure that the price of UST maintains its peg in selloff scenarios.

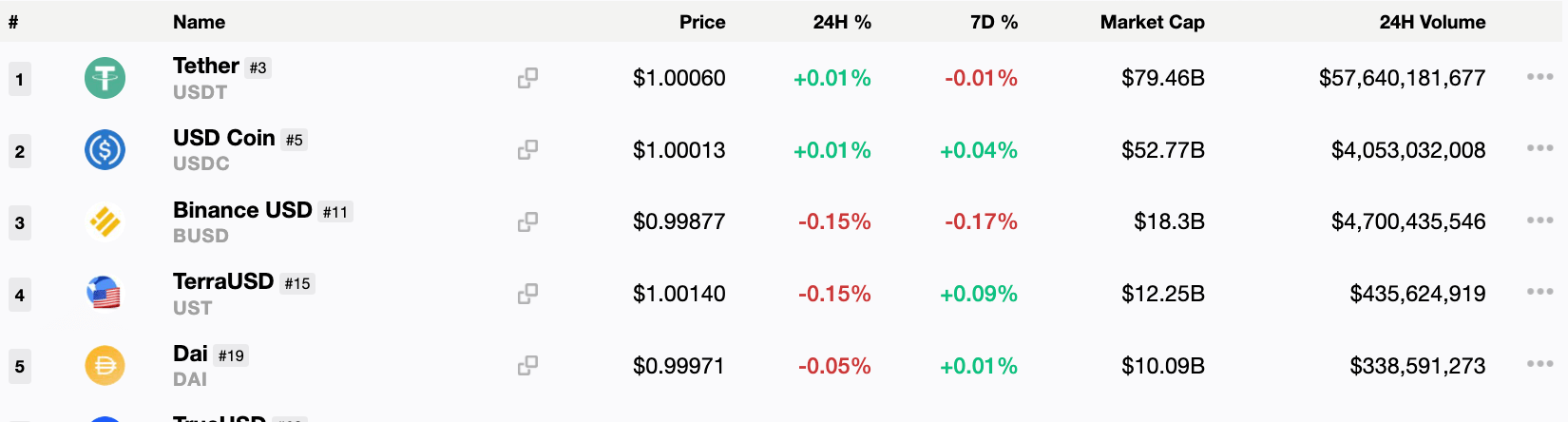

With a $12.25 billion market cap, Terra’s native stablecoin, UST, is currently the fourth-largest out there, and as far as decentralized stablecoins go–it ended the long lasting hegemony of DAI in December last year.

While leveraging Terra’s utility token, LUNA, the algorithmic stablecoin maintains a nearly equal value to the US dollar.

One of the crypto industry’s largest sales ever

As UST rises above its peg, LUNA is bought and burned–causing the native token’s price to appreciate. However, when UST drops below its peg, LUNA is minted and sold–driving the native token’s price down.

According to LFG, “one common criticism of algorithmic stablecoins is their reflexive nature and the hypothetical risk of a ‘bank run’ scenario where demand to sell the stable outstrips supply in a way that causes compounding price decreases in both native tokens.”

This in mind, the reserve created through the $1 billion sale will provide “an additional avenue to maintain the peg in contractionary cycles that reduces the reflexivity of the system.”

The private sale was led by Jump Crypto and Three Arrows Capital, with participation from DeFiance Capital, Republic Capital, GSR, Tribe Capital, to name a few.

With a 24-hour trading volume topping $2.3 billion, LUNA saw its price jump over 14% following the announcement.

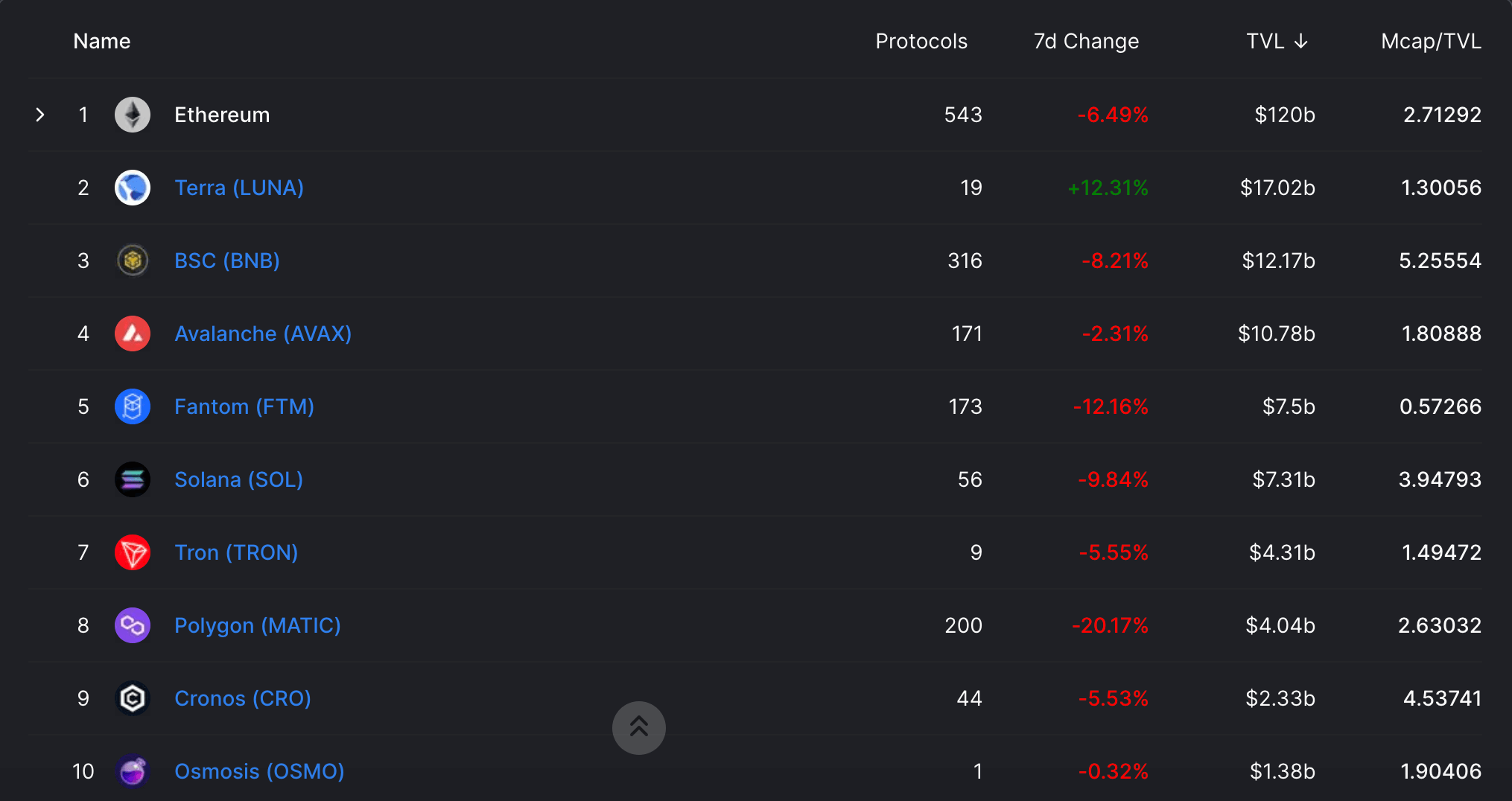

Despite the recent market stall, Terra is making strides and gaining an advantage among major Layer 1 competitors.

The blockchain positioned itself at the very top in the race to dominate the DeFi ecosystem.

Terra’s total value locked (TVL) is up over 12% during the past week, currently topping $17 billion, while other chains are losing steam, according to data provided by DeFi Llama.

Farside Investors

Farside Investors