Keep it vs. leave it: Why Binance delisting leveraged crypto assets has users divided

Keep it vs. leave it: Why Binance delisting leveraged crypto assets has users divided Keep it vs. leave it: Why Binance delisting leveraged crypto assets has users divided

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Binance, the world’s largest crypto exchange, has decided to delist leverage crypto tokens from its platform. The decision led to mixed reactions from users; some supportive and others wanting the leverage tokens to remain on Binance.

What are leveraged crypto tokens and why is Binance delisting them?

On futures exchanges like Binance Futures, FTX, Bybit, and BitMEX, users can trade cryptocurrencies such as Bitcoin and Ethereum with leverage of up to 125x.

That means, with $100, a user could trade up to $12,500 in capital, essentially using debt to trade in a more risky environment.

Spot exchanges, however, merely allow users to buy or sell crypto assets; users cannot borrow capital or use leverage to place additional risk for higher reward.

Leveraged crypto tokens supplement the benefit of a futures contract and high leverage trading. It allows users to buy a leveraged version of a crypto asset, and when the price goes up or down, the return is amplified by 3x leverage.

For example, the native cryptocurrency of Binance is called Binance Coin (BNB). If the price of Binance Coin rises from $12 to $13.2, it increased by 10 percent and the investor would net a 10 percent return.

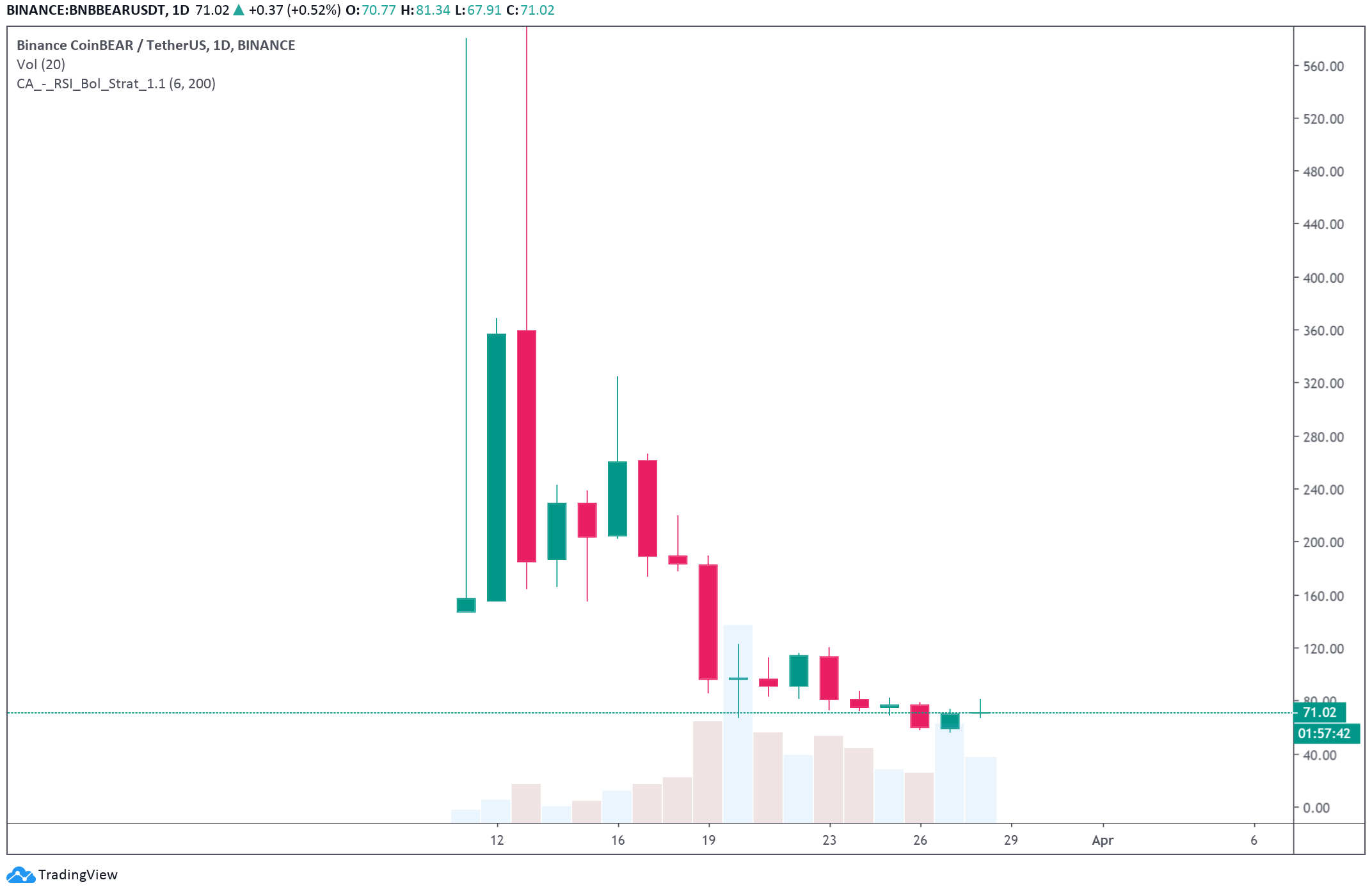

A leveraged BNB token, which on Binance was called BNBBEAR and BNBBULL, multiplies the returns by three times. That means, if the price of BNB increased by 10 percent, the net loss or net gain from the trade would be multiplied by three times when trading the leveraged token.

On March 29, Binance CEO Changpeng Zhao said that Binance will be delisting leveraged crypto tokens because many users still do not fully understand the tokens.

Zhao emphasized that the leveraged crypto tokens brought significant volume to Binance and it would be “bad for business to delist them,” but the company made the decision to protect its users.

He said:

“Protecting users comes first. Seeing from comments in earlier posts, I expect some complaints still. If you dislike our decision for this delisting, check back on the prices of these tokens in a month time, and let us know if you still complain then.”

Users respond with mixed reactions

On Twitter, where Zhao made the announcement, Zhao’s tweet was flooded with comments from users who called for the leveraged crypto tokens to relisted on Binance once again.

Given their high volume, leveraged crypto tokens had many active users trading them on a daily basis.

One trader wrote:

“Most of the people will continue to have problem with whatever is done. Leveraged tokens were pretty nice for those who like limited leverage, no liquidation and were true traders. I still believe people can be educated about it. It’s not for everyone though.. maybe a different tab?”

To it, Zhao said that the team will explore more innovative solutions but in the immediate future, the company finalized the decision to delist the tokens.

The delisting of leveraged tokens could directly translate to a higher daily volume on FTX, a cryptocurrency exchange invested by Binance that created the leveraged tokens.

CoinGecko

CoinGecko