Why the US Q1 GDP came in hot at 2.0%

Why the US Q1 GDP came in hot at 2.0% Quick Take

- The first quarter of the year witnessed the U.S. GDP outperforming expectations by landing at a 2.0% growth rate, surpassing the anticipated forecast of 1.4%.

- The impressive performance runs in tandem with the recent U.S. initial jobless claims data, which reported 239,000 compared to the projected 265,000.

- These core economic indicators have influenced the U.S. bond market, instigating a rise in yields across the yield curve.

- As a reaction to these data points and shifting bond yields, market sentiment is increasingly skewed toward the anticipation of tighter monetary policy.

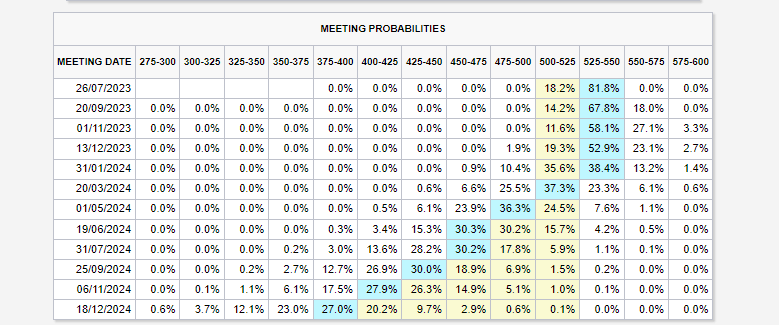

- Specifically, market participants are now pricing in an 82% probability of a 25 basis point rate hike at the next Federal Reserve meeting.

- Should this expectation come to fruition, it would bring the federal funds rate to a range of 5.25-5.50%, reflecting the central bank’s response to stronger economic growth and employment data.