Surge in Bitcoin open interest signals possible increase in volatility

Surge in Bitcoin open interest signals possible increase in volatility Quick Take

- The incessant influx of disheartening news into the Bitcoin ecosystem continues to cast a shadow over the Bitcoin market, pushing its price further into the red.

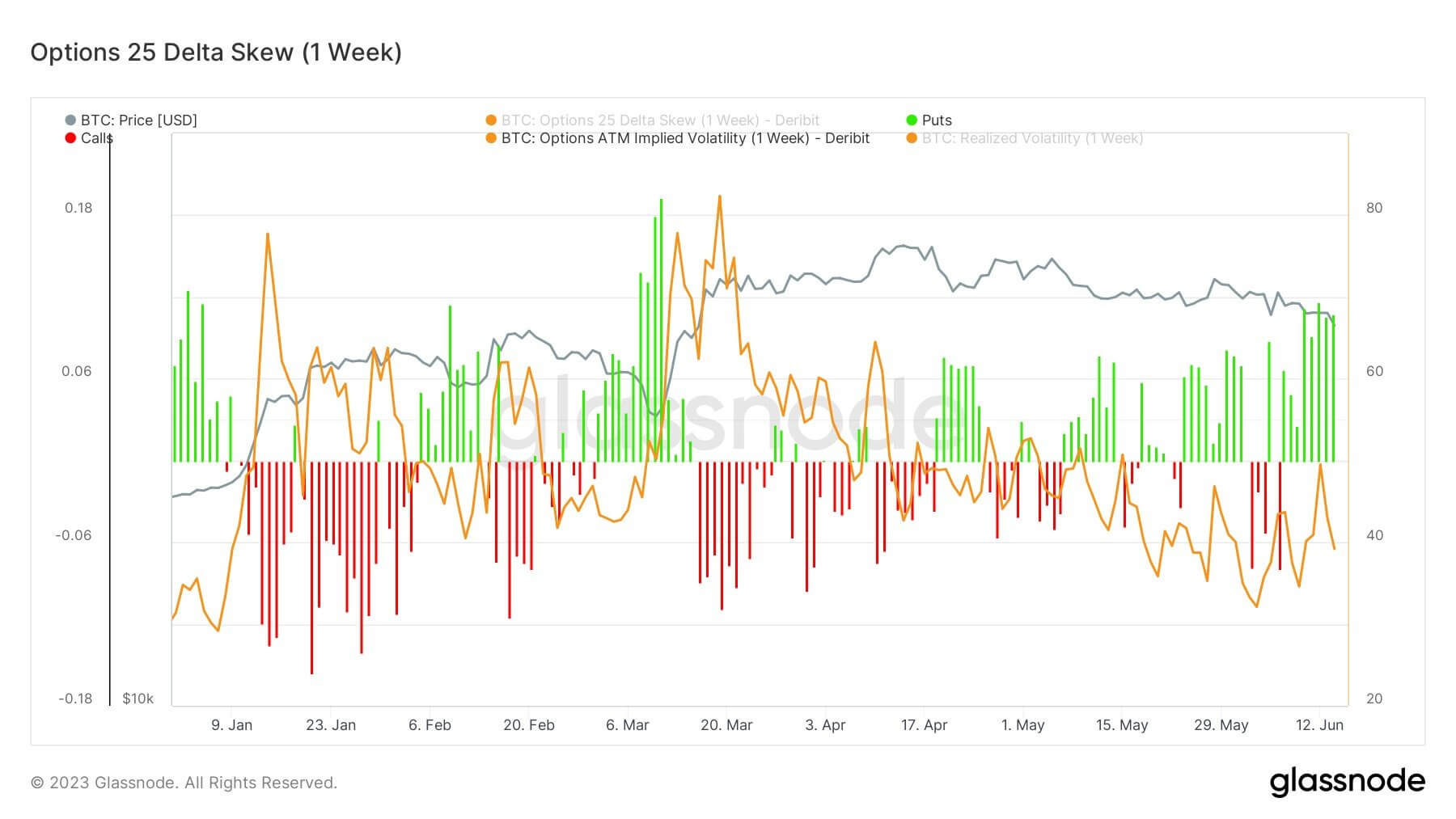

- This downward trajectory is underscored by the options 25 delta skew (1-week), indicating that put options are not only trading at a premium but are also on course to reach their second-highest level this year, thereby reinforcing our bearish outlook

- Meanwhile, Bitcoin’s open interest is on an upward climb, with a significant injection of roughly $450 million, primarily sourced from exchanges such as Binance and Bybit.

- The introduction of new liquidity to the market will likely stoke further volatility.