Spot Bitcoin ETFs narrow gap to Net Asset Value, signaling market maturity

Spot Bitcoin ETFs narrow gap to Net Asset Value, signaling market maturity Quick Take

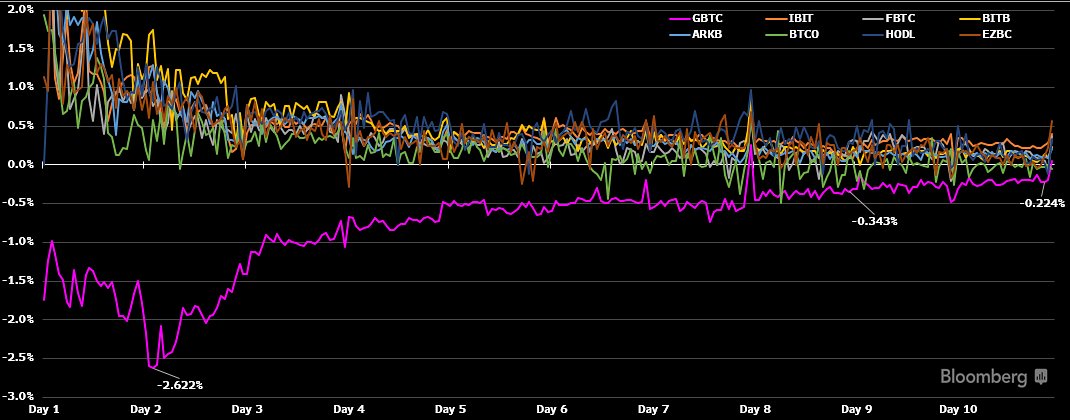

The Bitcoin Exchange-Traded Funds (ETFs) have passed through 11 trading days, revealing interesting dynamics about their performance against the Net Asset Value (NAV).

An ETF’s ideal situation is for its market price to equal the NAV per share. The Grayscale Bitcoin Trust (GBTC), for example, once traded at a hefty 50% discount. However, following its ETF conversion, the discount has impressively tightened to a marginal -0.22% after day ten, a considerable movement from day two (-2.6%,) according to ETF analyst James Seyffart.

In contrast, the majority of the newborn nine ETFs commenced with over a 2% premium, but by day ten, they were trading around 0% – 0.5%, according to James Seyffart.

The arbitrage bandwidth between every spot ETF is calculated as “the highest premium (or discount) minus the lowest discount (or premium) at 15-minute intervals throughout the trading day”, according to James Seyffart.

Strikingly, from a momentarily high of 8% on day one, it’s now trading at a more restrained 0.35%. The shrinking of these premiums and discounts bodes well for investors, suggesting a healthier market environment. This convergence towards the NAV fosters confidence, limits arbitrage opportunities, mitigates market risk, and ultimately facilitates fair pricing.