Short-term holder activity sparks Bitcoin FOMO rally signs

Short-term holder activity sparks Bitcoin FOMO rally signs Quick Take

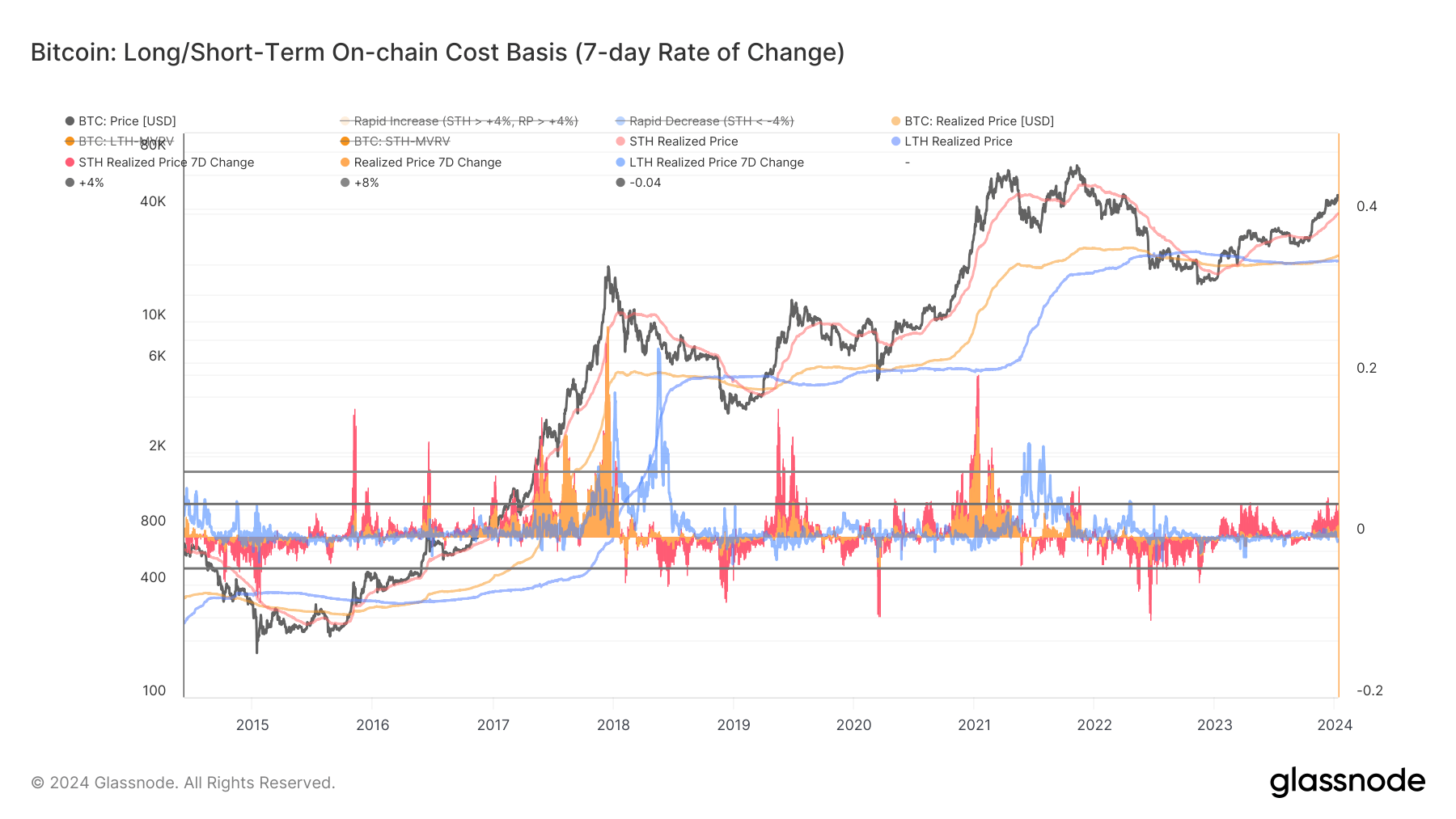

Recent analysis of on-chain cohorts illuminates substantial movement in the Bitcoin market. For instance, the Short-Term Holder Realized Price (STH RP), reflecting the average on-chain acquisition cost for coins moved within the last 155 days, has seen a significant uptick. It rose 3.5% in the past seven days, reaching $37,500, indicating the potential onset of a Fear Of Missing Out (FOMO) driven rally.

This rise has positioned the STH RP roughly 20% below the current price, suggesting heightened trading activity among short-term holders. In contrast, the Long-Term Holder Realized Price (LTH RP), which represents the average on-chain acquisition price for coins dormant within the last 155 days, remains relatively stable at $20,900.

As the realized price, which is the aggregate price of the last spent on-chain coins, is at $22,300, a noticeable divergence persists between the realized price and the LTH RP. This divergence underlines an active exchange of coins at higher prices, reinforcing the view that the market trends toward bullishness.